Form 1 ES Estimated Tax Payment Voucher 2024-2026

Understanding the Form 1 ES Estimated Tax Payment Voucher

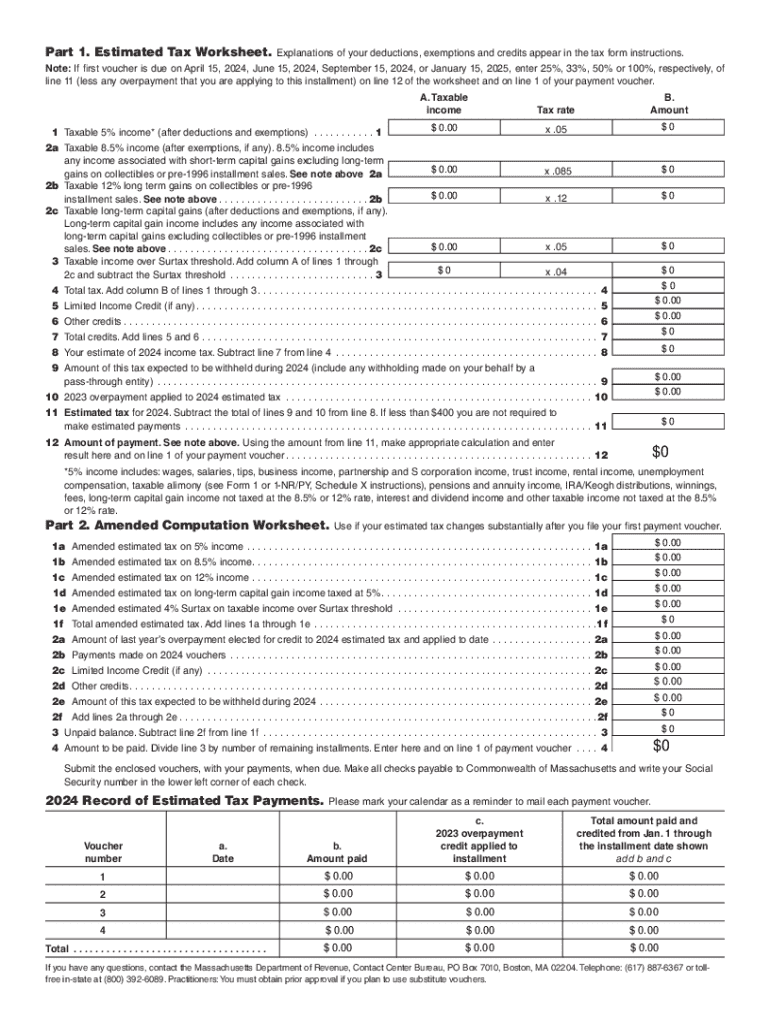

The Form 1 ES Estimated Tax Payment Voucher is a crucial document for individuals in Massachusetts who need to make estimated tax payments. This form is specifically designed for taxpayers who expect to owe at least $1,000 in tax for the year and whose withholding and refundable credits will be less than the smaller of 90% of the current year's tax or 100% of the prior year's tax. It helps ensure that taxpayers meet their tax obligations throughout the year, avoiding penalties and interest that may arise from underpayment.

How to Complete the Form 1 ES Estimated Tax Payment Voucher

Completing the Form 1 ES involves several steps. First, gather your financial information, including your expected income, deductions, and credits for the year. Next, calculate your estimated tax liability using the Massachusetts tax rate. Once you have determined your estimated tax, fill out the form with your personal details, including your name, address, and Social Security number. Indicate the payment amount and select the appropriate payment period. Finally, review the form for accuracy before submitting it.

Obtaining the Form 1 ES Estimated Tax Payment Voucher

Taxpayers can easily obtain the Form 1 ES from the Massachusetts Department of Revenue website. The form is available for download in PDF format, allowing individuals to print it out for completion. Additionally, physical copies may be available at local tax offices or public libraries. It is essential to ensure you are using the correct version of the form for the current tax year to avoid any complications.

Filing Deadlines for the Form 1 ES Estimated Tax Payment Voucher

Timely filing of the Form 1 ES is important to avoid penalties. Estimated tax payments are typically due on the fifteenth day of April, June, September, and January of the following year. Taxpayers should mark these dates on their calendars to ensure they submit their payments on time. If a payment deadline falls on a weekend or holiday, it is usually extended to the next business day.

Submission Methods for the Form 1 ES Estimated Tax Payment Voucher

Taxpayers have several options for submitting the Form 1 ES. Payments can be made online through the Massachusetts Department of Revenue's ePayment system, which provides a secure and convenient way to settle tax obligations. Alternatively, individuals can mail their completed forms along with a check or money order to the appropriate tax office. In-person submissions may also be possible at designated tax offices, allowing for immediate confirmation of receipt.

Key Elements of the Form 1 ES Estimated Tax Payment Voucher

Understanding the key elements of the Form 1 ES is vital for accurate completion. The form includes sections for taxpayer identification, payment details, and the tax year. It also requires taxpayers to specify the amount being paid and the payment period. Additional instructions are provided to guide users through the process, ensuring clarity and compliance with state tax regulations.

Quick guide on how to complete form 1 es estimated tax payment voucher

Prepare Form 1 ES Estimated Tax Payment Voucher effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally-friendly substitute for conventional printed and signed papers, as you can search for the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents promptly without delays. Manage Form 1 ES Estimated Tax Payment Voucher on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

How to modify and eSign Form 1 ES Estimated Tax Payment Voucher with ease

- Find Form 1 ES Estimated Tax Payment Voucher and click Get Form to initiate.

- Utilize the tools available to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to finalize your changes.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate the creation of new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Edit and eSign Form 1 ES Estimated Tax Payment Voucher to ensure excellent communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1 es estimated tax payment voucher

Create this form in 5 minutes!

How to create an eSignature for the form 1 es estimated tax payment voucher

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Massachusetts estimated income tax?

Massachusetts estimated income tax refers to the tax payments that individuals and businesses must make throughout the year based on their expected income. This system helps taxpayers avoid a large tax bill at the end of the year. Understanding how to calculate and pay your Massachusetts estimated income tax is crucial for effective financial planning.

-

How can airSlate SignNow help with Massachusetts estimated income tax documents?

airSlate SignNow simplifies the process of sending and eSigning documents related to Massachusetts estimated income tax. With our platform, you can easily create, send, and manage tax-related documents securely and efficiently. This ensures that you stay organized and compliant with state tax regulations.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing Massachusetts estimated income tax documents. These tools help streamline the workflow, making it easier to handle tax-related paperwork. Additionally, our platform ensures that all documents are legally binding and securely stored.

-

Is airSlate SignNow cost-effective for small businesses handling Massachusetts estimated income tax?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing Massachusetts estimated income tax. Our pricing plans are designed to fit various budgets, allowing businesses to access essential eSigning features without breaking the bank. This affordability makes it easier for small businesses to stay compliant with tax obligations.

-

Can I integrate airSlate SignNow with other accounting software for Massachusetts estimated income tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your Massachusetts estimated income tax documents. This integration allows for a smooth transfer of data, ensuring that your tax calculations and document submissions are accurate and efficient. You can connect with popular platforms to enhance your workflow.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including those for Massachusetts estimated income tax, offers numerous benefits. You gain access to a user-friendly interface, enhanced security features, and the ability to track document status in real-time. These advantages help ensure that your tax documents are processed quickly and securely.

-

How does airSlate SignNow ensure the security of my Massachusetts estimated income tax documents?

airSlate SignNow prioritizes the security of your Massachusetts estimated income tax documents through advanced encryption and secure cloud storage. Our platform complies with industry standards to protect sensitive information, ensuring that your documents are safe from unauthorized access. You can confidently manage your tax documents knowing they are secure.

Get more for Form 1 ES Estimated Tax Payment Voucher

- Oregon petition custody form

- Parte motion order form

- Respondent affidavit form

- Petitioners affidavit in support of motion for order of default oregon form

- General judgment of custody parenting timesupport order oregon form

- Petitioners respondents certificate of mailing of judgment and decree oregon form

- Oregon parte form

- Certificate of mailing judgment regarding custody visitation and support order regarding jurisdiction oregon form

Find out other Form 1 ES Estimated Tax Payment Voucher

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later