Printable Salvation Army Donation Receipt Form

What is the printable Salvation Army donation receipt?

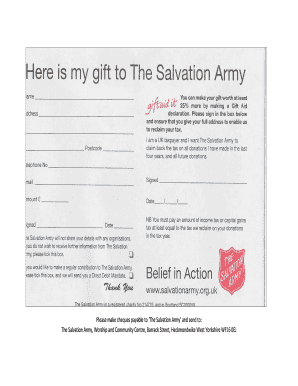

The printable Salvation Army donation receipt is an official document provided by the Salvation Army to acknowledge donations made by individuals or organizations. This receipt serves as proof of charitable contributions, which can be essential for tax purposes. It typically includes details such as the donor's name, the date of the donation, a description of the items donated, and the estimated value of those items. This document is crucial for individuals who wish to claim tax deductions for their charitable contributions on their federal tax returns.

How to use the printable Salvation Army donation receipt

Using the printable Salvation Army donation receipt is straightforward. Once you have made a donation, you can fill out the receipt with the necessary details. This includes your name, the date of the donation, and a list of the items donated along with their estimated values. After completing the receipt, keep a copy for your records and provide the original to the Salvation Army. This ensures that both you and the organization have documentation of the transaction, which is important for tax reporting and compliance.

Steps to complete the printable Salvation Army donation receipt

Completing the printable Salvation Army donation receipt involves several simple steps:

- Download the Salvation Army donation receipt template from the official website or obtain a physical copy at a local Salvation Army location.

- Fill in your name and address at the top of the receipt.

- Enter the date of your donation.

- List the items you donated, providing a brief description and estimated value for each item.

- Sign and date the receipt to confirm the information is accurate.

After completing these steps, ensure you keep a copy for your records while providing the original to the Salvation Army.

Legal use of the printable Salvation Army donation receipt

The printable Salvation Army donation receipt is legally recognized as a valid document for tax purposes. To ensure its legal standing, it must include specific information, such as the donor's name, the date of the donation, and a detailed description of the items donated. According to IRS guidelines, taxpayers must retain this receipt when claiming charitable deductions. It is advisable to keep a copy of the receipt for at least three years after filing your tax return, as this is the period during which the IRS may audit your claims.

Key elements of the printable Salvation Army donation receipt

Several key elements must be present on the printable Salvation Army donation receipt to ensure its validity:

- Donor Information: The name and address of the donor.

- Date of Donation: The date when the donation was made.

- Description of Donated Items: A clear list of items donated, including their condition.

- Estimated Value: The fair market value of each item donated.

- Signature: The donor's signature, affirming the accuracy of the information provided.

IRS guidelines for donation receipts

The IRS has specific guidelines regarding donation receipts that must be followed to ensure compliance when claiming tax deductions. According to IRS Publication 526, any donation valued at more than $250 requires a written acknowledgment from the charity, which is fulfilled by the Salvation Army donation receipt. The receipt must include the charity's name, the date of the donation, and a description of the items donated. For non-cash contributions, the donor should also provide an estimate of the fair market value of the items. Following these guidelines helps ensure that your charitable contributions are properly documented and eligible for tax deductions.

Quick guide on how to complete printable salvation army donation receipt

Complete Printable Salvation Army Donation Receipt effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, alter, and eSign your documents swiftly without delays. Handle Printable Salvation Army Donation Receipt on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to alter and eSign Printable Salvation Army Donation Receipt with ease

- Obtain Printable Salvation Army Donation Receipt and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow caters to your requirements in document management in just a few clicks from a device of your choice. Edit and eSign Printable Salvation Army Donation Receipt and maintain excellent communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable salvation army donation receipt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Salvation Army donation receipt template?

A Salvation Army donation receipt template is a pre-designed document that provides a formal acknowledgment of donations made to the Salvation Army. This template can include details such as the donor's name, donation amount, and the date of the donation, making it an essential item for tax purposes.

-

How can I create a Salvation Army donation receipt template using airSlate SignNow?

You can create a Salvation Army donation receipt template by using airSlate SignNow's intuitive document editor. Simply choose a pre-existing template or design one from scratch, add the necessary fields, and customize it to fit your needs. Once completed, you can easily share and eSign the document with your donors.

-

Are there any costs associated with using the Salvation Army donation receipt template on airSlate SignNow?

airSlate SignNow offers various pricing plans, which can include access to the Salvation Army donation receipt template. Depending on the features and document usage you require, you're able to select a plan that aligns with your budget and business needs, ensuring cost-effectiveness.

-

What are the benefits of using a Salvation Army donation receipt template?

Using a Salvation Army donation receipt template streamlines the donation acknowledgment process for your organization. It ensures consistency, accuracy, and saves time, allowing you to focus on more important tasks while providing a professional touch to your donor communications.

-

Can I integrate the Salvation Army donation receipt template with other applications or systems?

Yes, airSlate SignNow supports integrations with various third-party applications, allowing you to link your Salvation Army donation receipt template with existing systems such as CRMs and accounting software. This integration helps to automate record-keeping and enhance efficiency in managing donor information.

-

Is the Salvation Army donation receipt template customizable?

Absolutely! The Salvation Army donation receipt template in airSlate SignNow is fully customizable. You can modify text, add your organization’s logo, and adjust formatting to align with your brand's identity, ensuring every receipt reflects your unique style.

-

What features are included with the Salvation Army donation receipt template?

The Salvation Army donation receipt template comes with essential features such as fields for donor information, donation details, and automated signatures. Additionally, it provides tracking and management tools to monitor sent receipts, ensuring you maintain clear and organized records.

Get more for Printable Salvation Army Donation Receipt

- Cebu pacific proforma affidavit

- Diets on any 3 sunseed sunsations natural form

- Form of local enabling agreement david w hall davidwhall

- Red elephant menu form

- Student exploration moonrise moonset and phases form

- Mvd 438 a salvage vehicle dealer license application txdmv form

- Business rescue plan och 31 march 2016 optimumcoalbusinessrescue co form

- Cemetery bylaws for emmanuel lutheran church west columbia form

Find out other Printable Salvation Army Donation Receipt

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document