760CG Series Grid Virginia Department of Taxation Tax Virginia Form

What is the 760CG Series Grid Virginia Department Of Taxation Tax Virginia?

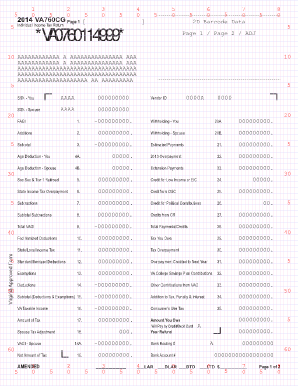

The 760CG Series Grid is a specific tax form utilized by residents of Virginia to report their income and calculate their tax liabilities. This form is part of the Virginia Department of Taxation's suite of tax documents and is essential for ensuring compliance with state tax laws. It is designed to accommodate various income types and deductions, allowing taxpayers to accurately reflect their financial situation.

How to use the 760CG Series Grid Virginia Department Of Taxation Tax Virginia

Using the 760CG Series Grid involves several steps to ensure accurate completion. Taxpayers should first gather all necessary documentation, including W-2 forms, 1099s, and any relevant receipts for deductions. Once the information is compiled, individuals can fill out the form, ensuring that all sections are completed accurately. After filling out the form, it can be submitted electronically or via mail to the Virginia Department of Taxation.

Steps to complete the 760CG Series Grid Virginia Department Of Taxation Tax Virginia

Completing the 760CG Series Grid requires careful attention to detail. Here are the essential steps:

- Gather all required documents, including income statements and deduction receipts.

- Access the 760CG Series Grid form through the Virginia Department of Taxation website or obtain a physical copy.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form electronically or by mail, following the specific submission guidelines provided by the Virginia Department of Taxation.

Key elements of the 760CG Series Grid Virginia Department Of Taxation Tax Virginia

The 760CG Series Grid includes several key elements that taxpayers must understand. These elements typically include personal identification information, income reporting sections, and areas designated for deductions and credits. Additionally, the form may require taxpayers to provide details about their filing status, which can significantly impact tax calculations. Understanding these components is crucial for accurate tax reporting.

Legal use of the 760CG Series Grid Virginia Department Of Taxation Tax Virginia

The 760CG Series Grid is legally binding when completed and submitted according to Virginia tax laws. To ensure its validity, taxpayers must comply with all relevant regulations regarding electronic signatures and document submission. The form must be signed by the taxpayer or their authorized representative to be considered legally executed. Adhering to these legal requirements helps prevent issues with the Virginia Department of Taxation.

Filing Deadlines / Important Dates

Filing deadlines for the 760CG Series Grid are crucial for compliance. Typically, individual income tax returns in Virginia are due on May 1st of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, as well as deadlines for estimated tax payments throughout the year.

Quick guide on how to complete 760cg series grid virginia department of taxation tax virginia

Complete 760CG Series Grid Virginia Department Of Taxation Tax Virginia effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed papers, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to generate, adjust, and eSign your files rapidly without delays. Manage 760CG Series Grid Virginia Department Of Taxation Tax Virginia on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign 760CG Series Grid Virginia Department Of Taxation Tax Virginia without hassle

- Find 760CG Series Grid Virginia Department Of Taxation Tax Virginia and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight pertinent sections of your files or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searches, or mistakes that require reprinting forms. airSlate SignNow meets your needs in document management with just a few clicks from any device of your choice. Adjust and eSign 760CG Series Grid Virginia Department Of Taxation Tax Virginia and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 760cg series grid virginia department of taxation tax virginia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 760CG Series Grid Virginia Department Of Taxation Tax Virginia?

The 760CG Series Grid Virginia Department Of Taxation Tax Virginia is a form used by taxpayers in Virginia to report changes in their tax liability. This form is crucial for ensuring compliance with state tax regulations and can affect your overall tax return outcome.

-

How can airSlate SignNow help with the 760CG Series Grid Virginia Department Of Taxation Tax Virginia?

airSlate SignNow streamlines the process of filling out and submitting the 760CG Series Grid Virginia Department Of Taxation Tax Virginia. Our platform allows you to easily eSign and share the document, ensuring that your tax submissions are completed accurately and efficiently.

-

What are the pricing options for using airSlate SignNow for the 760CG Series Grid Virginia Department Of Taxation Tax Virginia?

airSlate SignNow offers a variety of pricing plans tailored to fit different business needs, making it a cost-effective solution for managing the 760CG Series Grid Virginia Department Of Taxation Tax Virginia. Our plans include features that help businesses optimize their document workflows, ensuring great value for your money.

-

What features does airSlate SignNow offer for the 760CG Series Grid Virginia Department Of Taxation Tax Virginia?

With airSlate SignNow, users can take advantage of features like easy document sharing, customizable templates, secure eSigning, and real-time tracking specifically for the 760CG Series Grid Virginia Department Of Taxation Tax Virginia. These features enhance the efficiency and professionalism of your tax dealings.

-

Are there any benefits to using airSlate SignNow for the 760CG Series Grid Virginia Department Of Taxation Tax Virginia?

Using airSlate SignNow for the 760CG Series Grid Virginia Department Of Taxation Tax Virginia brings numerous benefits, including improved accuracy, faster processing times, and enhanced compliance. By digitizing the signing process, you can eliminate paperwork and reduce the likelihood of errors.

-

Can airSlate SignNow integrate with other software for tax filing in Virginia?

Yes, airSlate SignNow offers seamless integrations with various software tools that assist in tax filing, including those specific to Virginia. This ensures that you can efficiently manage the necessary documentation while keeping everything synchronized across your tools, including the 760CG Series Grid Virginia Department Of Taxation Tax Virginia.

-

Is airSlate SignNow secure for submitting the 760CG Series Grid Virginia Department Of Taxation Tax Virginia?

Absolutely. airSlate SignNow prioritizes security and compliance, providing a secure platform for eSigning and managing the 760CG Series Grid Virginia Department Of Taxation Tax Virginia. Our system employs industry-leading encryption and security standards to keep your sensitive information safe.

Get more for 760CG Series Grid Virginia Department Of Taxation Tax Virginia

Find out other 760CG Series Grid Virginia Department Of Taxation Tax Virginia

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple