Roc 1 Form

What is the Roc 1?

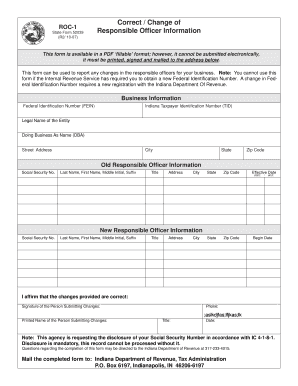

The Roc 1 form, also known as the Indiana Roc 1, is a crucial document used primarily for reporting specific information related to businesses in Indiana. This form is essential for various purposes, including compliance with state regulations and tax reporting. Understanding its function and significance is vital for individuals and organizations operating within the state.

How to use the Roc 1

Using the Roc 1 form involves several steps to ensure accurate completion and submission. First, gather all necessary information, such as business details and financial data. Next, fill out the form carefully, ensuring that all required fields are completed. Once filled, the form can be submitted electronically or via traditional mail, depending on the specific guidelines provided by the state. Utilizing a reliable electronic signature solution can enhance the process, ensuring that the form is signed and submitted securely.

Steps to complete the Roc 1

Completing the Roc 1 form requires careful attention to detail. Follow these steps:

- Gather relevant business information, including your business name, address, and identification numbers.

- Review the form to understand the required sections and any specific instructions.

- Fill in the form accurately, ensuring all information is current and correct.

- Double-check for any errors or omissions before submission.

- Submit the completed form through the designated method, ensuring you retain a copy for your records.

Legal use of the Roc 1

The legal use of the Roc 1 form is governed by state regulations, which outline its requirements and implications. When completed correctly, the form serves as a legally binding document, affirming the accuracy of the information provided. Compliance with all relevant laws, including eSignature regulations, is essential to ensure that the form holds legal weight in any proceedings or audits.

Key elements of the Roc 1

Several key elements must be included in the Roc 1 form for it to be valid:

- Business Identification: Accurate identification of the business, including name and address.

- Financial Information: Detailed financial data relevant to the reporting requirements.

- Signature: A valid signature, which can be achieved through electronic means for enhanced security.

- Submission Date: The date of submission, which is important for compliance with deadlines.

Form Submission Methods

The Roc 1 form can be submitted through various methods, depending on the preferences of the business and the requirements set by the state. Common submission methods include:

- Online Submission: Many businesses opt to submit the Roc 1 electronically, which can streamline the process and ensure faster processing times.

- Mail: The form can also be printed and mailed to the appropriate state office, though this may take longer for processing.

- In-Person: Some businesses may choose to submit the form in person, allowing for immediate confirmation of receipt.

Quick guide on how to complete roc 1

Complete Roc 1 effortlessly on any device

Online document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and efficiently. Manage Roc 1 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Roc 1 effortlessly

- Find Roc 1 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form: by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Roc 1 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the roc 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is roc 1 indiana and how does it relate to airSlate SignNow?

Roc 1 Indiana refers to a pivotal aspect of airSlate SignNow's services in Indiana. It helps businesses streamline their document signing processes efficiently. The platform offers a comprehensive solution that empowers users to manage eSignatures with ease in Indiana.

-

How much does it cost to use airSlate SignNow with roc 1 indiana?

Pricing for airSlate SignNow varies based on the features you choose, but it's designed to be cost-effective. For users in Indiana looking to utilize the roc 1 indiana solution, there are different subscription plans that cater to various business sizes and needs. You can find detailed pricing on the airSlate SignNow website.

-

What features does airSlate SignNow offer for roc 1 indiana users?

AirSlate SignNow offers a range of features for roc 1 indiana users, including customizable templates, real-time collaboration, and secure cloud storage. These features enable Indiana businesses to manage their eSignatures efficiently and enhance overall productivity. It's tailored to meet the needs of diverse industries.

-

What are the benefits of using airSlate SignNow in Indiana?

Using airSlate SignNow in Indiana provides multiple benefits, including increased efficiency in document handling and improved compliance with eSignature laws in the state. The roc 1 indiana solution allows businesses to save time and reduce costs associated with traditional document signing. It ultimately leads to a smoother workflow.

-

Can airSlate SignNow integrate with other business applications in Indiana?

Yes, airSlate SignNow offers robust integrations with various business applications, enhancing its utility for roc 1 indiana users. This allows businesses in Indiana to connect their existing tools and streamline operations further. Integration options include CRMs, document management systems, and more.

-

Is airSlate SignNow secure for handling sensitive documents in Indiana?

Absolutely, airSlate SignNow prioritizes security, making it suitable for handling sensitive documents in Indiana. With features like end-to-end encryption and secure cloud storage, the roc 1 indiana solution ensures that your documents remain confidential and secure throughout the signing process.

-

How user-friendly is the airSlate SignNow platform for new users in Indiana?

AirSlate SignNow is designed to be user-friendly, making it easy for new users in Indiana to navigate the platform. The interface is intuitive, allowing for a smooth onboarding experience, particularly for those utilizing the roc 1 indiana solution. Training resources are also available to assist users.

Get more for Roc 1

Find out other Roc 1

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile