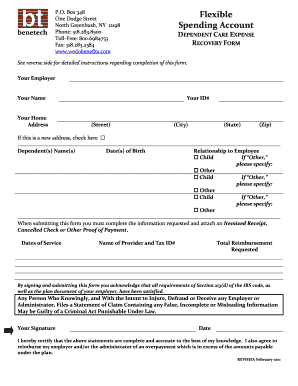

Benetech Flexible Spending Account Form

What is the Benetech Flexible Spending Account

The Benetech Flexible Spending Account (FSA) is a pre-tax benefit account that allows employees to set aside money for eligible healthcare expenses. This account helps individuals save on taxes while managing out-of-pocket healthcare costs. Contributions to the FSA are deducted from an employee's paycheck before taxes are applied, effectively reducing taxable income. Eligible expenses typically include co-pays, prescription medications, and certain medical supplies.

How to use the Benetech Flexible Spending Account

Using the Benetech Flexible Spending Account is straightforward. Once you have set up your account and made contributions, you can access funds to pay for eligible medical expenses. To use the account:

- Keep receipts for all eligible expenses.

- Submit claims for reimbursement through your employer's designated process.

- Use a Benetech FSA debit card, if available, to pay for eligible expenses directly.

It is important to familiarize yourself with the list of eligible expenses to maximize the benefits of your FSA.

Steps to complete the Benetech Flexible Spending Account

Completing the Benetech Flexible Spending Account involves several key steps:

- Review your employer's FSA plan details and contribution limits.

- Decide how much to contribute based on expected medical expenses.

- Complete any required enrollment forms provided by your employer.

- Submit the forms by the specified deadline to ensure your account is activated.

Following these steps ensures that you can effectively utilize your Benetech FSA for eligible expenses.

Legal use of the Benetech Flexible Spending Account

The legal use of the Benetech Flexible Spending Account is governed by Internal Revenue Service (IRS) regulations. To ensure compliance:

- Only use funds for qualified medical expenses as defined by the IRS.

- Keep detailed records and receipts for all transactions.

- Be aware of the “use-it-or-lose-it” rule, which states that any unspent funds may be forfeited at the end of the plan year.

Understanding these legal aspects helps in maintaining compliance and maximizing the benefits of your FSA.

Eligibility Criteria

Eligibility for the Benetech Flexible Spending Account typically includes:

- Being an employee of a company that offers an FSA plan.

- Meeting any specific enrollment criteria set by the employer.

- Complying with IRS regulations regarding FSA participation.

It is advisable to check with your employer for any additional eligibility requirements specific to your workplace.

Required Documents

To successfully set up and use the Benetech Flexible Spending Account, you may need to provide certain documents, including:

- Proof of employment, such as a pay stub or employment verification letter.

- Completed enrollment forms as required by your employer.

- Receipts for eligible medical expenses when submitting claims.

Having these documents ready can streamline the process of managing your FSA.

Quick guide on how to complete benetech flexible spending account

Complete Benetech Flexible Spending Account effortlessly on any device

Online document management has gained traction with businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed papers, allowing you to access the appropriate form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Benetech Flexible Spending Account on any platform using airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The easiest way to modify and eSign Benetech Flexible Spending Account without hassle

- Locate Benetech Flexible Spending Account and click Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Benetech Flexible Spending Account and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the benetech flexible spending account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Benetech flexible spending account?

A Benetech flexible spending account is a tax-advantaged financial account that allows employees to set aside pre-tax dollars for eligible out-of-pocket health expenses. This helps to lower taxable income while providing funds for essential medical services and products. By utilizing a Benetech flexible spending account, employees can manage their healthcare costs more effectively.

-

How can I set up a Benetech flexible spending account?

Setting up a Benetech flexible spending account typically involves enrolling through your employer during the open enrollment period. You will need to decide how much to contribute based on anticipated medical expenses. After setup, you can start using the funds for eligible expenses as defined by IRS guidelines.

-

What are the benefits of using a Benetech flexible spending account?

The benefits of using a Benetech flexible spending account include tax savings, increased cash flow for healthcare costs, and greater control over personal healthcare spending. These accounts can also reduce your overall medical expenses by allowing you to pay for them with pre-tax dollars, thus maximizing your budget for health-related needs.

-

Are there any fees associated with a Benetech flexible spending account?

Typically, there are no fees directly associated with maintaining a Benetech flexible spending account. However, it's important to check with your employer for any administrative fees that might apply. Understanding any potential costs upfront ensures that you can fully benefit from your flexible spending account.

-

Can I use my Benetech flexible spending account for dependent care expenses?

Yes, a Benetech flexible spending account can often be used for dependent care expenses, allowing you to set aside pre-tax dollars for childcare or care for eligible dependents. It’s essential to verify your employer’s specific plan details regarding eligible expenses related to dependent care. This flexibility enhances your ability to manage both healthcare and family care costs.

-

What types of expenses are covered by a Benetech flexible spending account?

A Benetech flexible spending account covers a wide range of qualified medical expenses, including co-pays, deductibles, prescription medications, and some over-the-counter products. It’s important to familiarize yourself with the list of eligible expenses provided by your employer to maximize the benefits of your account. Remember that any funds not used within the plan year may be forfeited.

-

How does a Benetech flexible spending account integrate with your existing benefits?

A Benetech flexible spending account integrates seamlessly with most employer-sponsored health benefit plans, allowing you to maximize your tax savings and healthcare spending. Typically, your employer will provide tools and resources to help you manage your account alongside other benefits. Checking how it fits within your total benefits package is crucial for effective planning.

Get more for Benetech Flexible Spending Account

- Pptc 057 form

- What does a cpap prescription look like form

- Navy federal unauthorized debit form

- Dennys direct deposit form

- Dot vision waiver requirements form

- Consent form for oral surgery

- Request for information customers with allergy qatar airways

- Sbti near term target submission form and guidance

Find out other Benetech Flexible Spending Account

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast