1083 Form

What is the 1083 Form

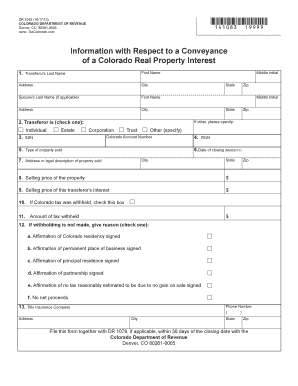

The 1083 form, also known as the Colorado Form DR 1083, is a tax document used primarily for reporting specific tax-related information to the state of Colorado. This form is essential for individuals and businesses that need to comply with state tax regulations. It serves various purposes, including reporting income, calculating tax liabilities, and claiming certain deductions or credits. Understanding the 1083 form is crucial for ensuring accurate tax reporting and compliance with state laws.

How to use the 1083 Form

Using the 1083 form involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully read the instructions accompanying the form to understand what information is required. Fill out the form accurately, ensuring that all entries are correct and complete. After completing the form, review it for any errors before submitting it to the appropriate state tax authority.

Steps to complete the 1083 Form

Completing the 1083 form can be broken down into a series of clear steps:

- Gather necessary financial documents, such as W-2s and 1099s.

- Review the instructions provided with the form to ensure compliance.

- Fill out the form, including all required fields, such as personal information and income details.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the 1083 Form

The legal use of the 1083 form is governed by state tax laws and regulations. To be legally binding, the form must be completed accurately and submitted within the specified deadlines. Failure to comply with these regulations can result in penalties or legal repercussions. It is essential to use the form in accordance with the guidelines set forth by the Colorado Department of Revenue to ensure its validity.

Filing Deadlines / Important Dates

Filing deadlines for the 1083 form are crucial for compliance. Typically, the form must be submitted by April fifteenth of the tax year. However, it is important to check for any updates or changes to deadlines, as they can vary based on specific circumstances, such as extensions or changes in tax law. Staying informed about these dates helps avoid penalties and ensures timely processing of tax returns.

Form Submission Methods (Online / Mail / In-Person)

The 1083 form can be submitted through various methods, allowing taxpayers flexibility in how they file. Common submission methods include:

- Online submission through the Colorado Department of Revenue's e-filing system.

- Mailing a physical copy of the completed form to the designated tax office.

- In-person submission at local tax offices, where assistance may also be available.

Who Issues the Form

The 1083 form is issued by the Colorado Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The department provides the necessary forms, instructions, and resources to assist individuals and businesses in fulfilling their tax obligations. Understanding the role of the Colorado Department of Revenue is essential for navigating the tax filing process effectively.

Quick guide on how to complete 1083 form

Fill out 1083 Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Handle 1083 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign 1083 Form with ease

- Obtain 1083 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Decide how you wish to share your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign 1083 Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1083 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1083 tax form and why is it important?

The 1083 tax form is a crucial document for individuals and businesses to report specific financial transactions to the IRS. It's important because it ensures compliance with tax regulations and can impact your tax liability. Having an accurate 1083 tax form is essential for avoiding penalties and ensuring that your tax returns are processed smoothly.

-

How can airSlate SignNow help me with the 1083 tax form?

airSlate SignNow simplifies the process of obtaining signatures and sending your 1083 tax form securely. With its intuitive interface, you can easily upload your form, send it out for eSignature, and track its status in real-time. This efficiency saves time and helps ensure that your tax documents are handled professionally.

-

Is there a cost associated with using airSlate SignNow for the 1083 tax form?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Each plan provides access to tools that can help you efficiently manage documents, including the 1083 tax form. You can start with a free trial to see how our features align with your requirements before committing.

-

What features does airSlate SignNow offer for managing the 1083 tax form?

airSlate SignNow provides essential features like eSignature, document tracking, and secure sharing, all of which enhance the management of your 1083 tax form. Additionally, you can customize templates and set reminders for signing to streamline your workflow. These features ensure your documents are always organized and accessible.

-

Can I integrate airSlate SignNow with other platforms for my 1083 tax form?

Absolutely! airSlate SignNow offers seamless integrations with various platforms, making it easier to manage your 1083 tax form alongside your other business applications. Whether you're using CRM systems, accounting software, or cloud storage solutions, our integrations help keep your documents synchronized and accessible.

-

How secure is the process of eSigning my 1083 tax form with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols to ensure that your 1083 tax form and all related documents are kept secure during the signing process. You can trust that your sensitive information will be protected and only accessible to authorized users.

-

What are the benefits of using airSlate SignNow for business documentation like the 1083 tax form?

Using airSlate SignNow for your 1083 tax form can signNowly reduce processing time and errors associated with paper documentation. The platform makes it easy to collect signatures quickly and ensure compliance with tax regulations. Additionally, digital records of your forms are well-organized, making audits simpler and more efficient.

Get more for 1083 Form

- Field trip waiver form sample

- Green valley meats form

- Transmittal form 193614

- Salon partnership agreement form

- Great falls transition center form

- File police report online denver colorado form

- Zoning confirmation letter request form palm beach county

- Alternative septic system riley county official website form

Find out other 1083 Form

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free