Form I R 163A

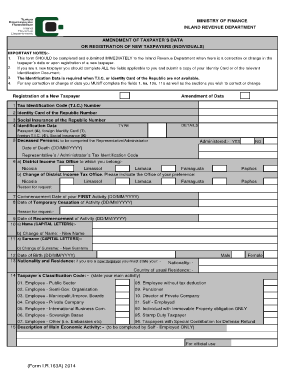

What is the Form I R 163A

The Form I R 163A is a specific document used in various legal and administrative contexts in the United States. It serves as an official record for certain transactions or declarations, ensuring compliance with relevant regulations. Understanding the purpose of this form is crucial for individuals and businesses alike, as it can impact legal standing and operational procedures.

How to use the Form I R 163A

Using the Form I R 163A involves several steps to ensure proper completion and submission. First, gather all necessary information and documentation required to fill out the form accurately. Next, complete the form with precise details, ensuring that all sections are filled out according to the guidelines. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, depending on the requirements set forth by the issuing authority.

Steps to complete the Form I R 163A

Completing the Form I R 163A can be broken down into a series of methodical steps:

- Review the instructions provided with the form to understand the requirements.

- Collect all necessary information, including personal identification and relevant financial data.

- Fill out the form, ensuring accuracy in every section.

- Double-check the completed form for any errors or omissions.

- Submit the form as directed, retaining a copy for your records.

Legal use of the Form I R 163A

The legal use of the Form I R 163A is governed by specific regulations that dictate its validity and application. It is essential to ensure that the form is used in accordance with the law to avoid potential penalties or legal issues. Compliance with relevant statutes and guidelines is necessary to maintain the integrity of the document and its intended purpose.

Required Documents

When preparing to submit the Form I R 163A, certain documents may be required to support the information provided. These documents can include:

- Proof of identity, such as a driver's license or passport.

- Financial statements or tax documents relevant to the form's purpose.

- Any additional forms or attachments specified in the instructions.

Form Submission Methods (Online / Mail / In-Person)

The Form I R 163A can typically be submitted through various methods, depending on the guidelines set by the issuing authority. Common submission methods include:

- Online submission through a designated portal, which may offer faster processing times.

- Mailing the completed form to the appropriate address, ensuring it is postmarked by the deadline.

- In-person submission at designated offices, which may provide immediate confirmation of receipt.

Quick guide on how to complete form i r 163a

Effortlessly Prepare Form I R 163A on Any Device

Managing documents online has gained traction among organizations and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to easily find the necessary form and securely maintain it online. airSlate SignNow provides you with all the features required to create, modify, and eSign your documents promptly without complications. Handle Form I R 163A on any system using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to Modify and eSign Form I R 163A with Ease

- Find Form I R 163A and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Mark important parts of your documents or obscure sensitive data with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature with the Sign feature, which takes just seconds and holds the same legal significance as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhausting form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management demands in a few clicks from any device of your choice. Alter and eSign Form I R 163A and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form i r 163a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IR form sample and how can it be used with airSlate SignNow?

An IR form sample is a template that businesses can use to create individualized reports or forms for income reporting. With airSlate SignNow, you can easily customize, send, and eSign your IR form sample, streamlining the documentation process and ensuring compliance.

-

What features does airSlate SignNow offer for managing IR form samples?

airSlate SignNow provides a variety of features for managing IR form samples, including customizable templates, secure eSignature capabilities, and real-time tracking of document statuses. These features enhance efficiency and make the management of your IR forms seamless and effective.

-

How much does it cost to use airSlate SignNow for IR form samples?

The pricing for airSlate SignNow varies based on the features and functionalities you require. Generally, it offers cost-effective plans that cater to different business sizes, ensuring you get the best value for managing your IR form samples and other essential documents.

-

Can I integrate airSlate SignNow with other applications for my IR form samples?

Yes, airSlate SignNow offers integration with various applications such as CRM systems, cloud storage, and other productivity tools. This allows you to efficiently manage your IR form samples alongside your existing workflows, improving overall productivity.

-

How does airSlate SignNow ensure the security of my IR form samples?

airSlate SignNow prioritizes the security of your documents by implementing industry-standard encryption and compliance regulations. This ensures that your IR form samples are protected throughout the signing and sending process, giving you peace of mind.

-

Is it possible to customize an IR form sample using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your IR form samples easily. You can add your branding, modify fields, and tailor the template to meet your specific requirements, helping you stand out and enhance your business identity.

-

What are the benefits of using airSlate SignNow for IR form samples?

Using airSlate SignNow for your IR form samples offers numerous benefits, including faster processing times, reduced paper usage, and improved tracking capabilities. Additionally, the user-friendly interface enhances the signing experience for both senders and signers.

Get more for Form I R 163A

Find out other Form I R 163A

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free