Form T778

What is the Form T778

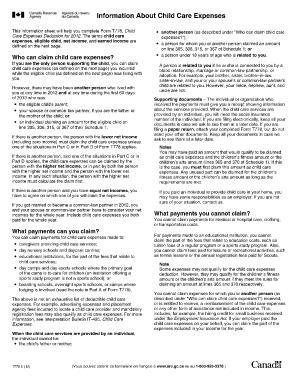

The Form T778 is a Canadian tax form used to claim child care expenses. Specifically designed for parents and guardians, this form allows individuals to deduct eligible child care costs incurred during the tax year. By utilizing the T778, taxpayers can reduce their taxable income, potentially leading to a lower tax liability. It is essential for those who have paid for child care services while working, studying, or seeking employment.

How to use the Form T778

Using the Form T778 involves several steps to ensure accurate completion and submission. First, gather all necessary documentation related to child care expenses, including receipts and invoices. Next, fill out the form with the required information, such as the total amount spent on child care and the details of the service providers. Finally, submit the completed form along with your tax return to the Canada Revenue Agency (CRA) to claim your deduction.

Steps to complete the Form T778

Completing the Form T778 requires careful attention to detail. Follow these steps:

- Collect all relevant child care expense receipts and documentation.

- Enter your personal information, including your name, address, and Social Insurance Number (SIN).

- List the names and ages of your children for whom you are claiming expenses.

- Detail the amount spent on child care services for each child.

- Provide the name and address of the child care provider.

- Sign and date the form before submitting it with your tax return.

Legal use of the Form T778

The Form T778 must be filled out accurately to be considered legally binding. It is essential to ensure that all information provided is truthful and supported by appropriate documentation. The CRA may request additional information or proof of expenses, so maintaining copies of all related documents is advisable. Compliance with tax regulations is crucial to avoid penalties or delays in processing your tax return.

Key elements of the Form T778

Several key elements are essential to understand when working with the Form T778. These include:

- Eligible Expenses: Only specific child care costs qualify for deduction, such as daycare fees, after-school programs, and summer camps.

- Maximum Deduction Limits: There are limits to the amount that can be claimed based on the age of the child and the type of care provided.

- Service Provider Information: Accurate details about the child care provider are necessary, including their registration number if applicable.

Examples of using the Form T778

Examples of using the Form T778 can help clarify its application. For instance, a single parent who pays for daycare while working can claim those expenses using the T778. Similarly, parents who enroll their children in summer camps for educational purposes may also deduct those costs. Each scenario requires careful documentation to ensure compliance with CRA regulations.

Quick guide on how to complete form t778

Complete Form T778 effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle Form T778 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Form T778 with ease

- Find Form T778 and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools designed specifically for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional signed signature.

- Review the details and click on the Done button to preserve your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any selected device. Modify and eSign Form T778 and maintain excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form t778

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form t778 and why is it important?

The form t778 is a specific tax form used in Canada to calculate and claim the Disabilities Tax Credit. Understanding how to accurately fill out the form t778 is crucial for ensuring you receive the benefits you qualify for, which can signNowly reduce your tax burden.

-

How can airSlate SignNow help with completing the form t778?

airSlate SignNow provides an intuitive platform allowing users to fill out and eSign form t778 electronically. With templates available, users can efficiently complete the required information, ensuring accuracy and compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for form t778?

Yes, airSlate SignNow offers various pricing plans designed to meet the needs of different users. These plans include features specifically for managing documents like form t778, allowing you to choose the option that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the form t778?

airSlate SignNow features include document sharing, templates, eSigning, and cloud storage, all of which can streamline the process of completing and submitting the form t778. The platform ensures your documents are secure and accessible from anywhere.

-

Can I integrate airSlate SignNow with my existing tools for handling form t778?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, allowing you to manage form t778 workflow alongside your existing tools. This ensures a smooth experience whether you’re using CRM systems, email, or other platforms.

-

What are the benefits of using airSlate SignNow for form t778 submissions?

Using airSlate SignNow for form t778 submissions enhances efficiency and accuracy. The electronic signing process reduces the time taken to complete the form t778, and the ability to track changes and access signed documents anytime allows for better organization.

-

Is there customer support available when using airSlate SignNow for form t778?

Yes, airSlate SignNow offers comprehensive customer support to assist you with any queries related to form t778. You can signNow out through various channels including live chat, email, and phone support, ensuring you have the guidance you need.

Get more for Form T778

Find out other Form T778

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile