Dtf 803 Fillable Form

What is the Dtf 803 Fillable Form

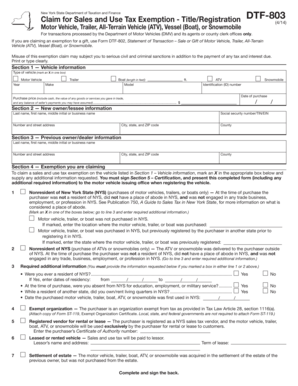

The Dtf 803 fillable form is a tax-related document used by businesses and individuals in the United States to report specific financial information to the state. This form is essential for ensuring compliance with state tax regulations and is often required for various tax filings. The Dtf 803 serves as a means to disclose pertinent data that may affect tax liabilities, deductions, or credits. Understanding its purpose is crucial for accurate tax reporting and avoiding potential penalties.

How to Use the Dtf 803 Fillable Form

Using the Dtf 803 fillable form involves several straightforward steps. First, access the form through a reliable source, ensuring it is the most recent version. Next, fill in the required fields with accurate information, including your name, address, and any relevant financial data. Once completed, review the form for any errors or omissions. Finally, submit the form according to the specified guidelines, whether online, by mail, or in person, to ensure timely processing.

Steps to Complete the Dtf 803 Fillable Form

Completing the Dtf 803 fillable form can be done effectively by following these steps:

- Download the latest version of the form from a trusted source.

- Fill in your personal and business information accurately.

- Provide details regarding your financial activities as required by the form.

- Double-check all entries to ensure accuracy and completeness.

- Sign and date the form where indicated.

- Submit the form according to the instructions provided, either electronically or via mail.

Legal Use of the Dtf 803 Fillable Form

The Dtf 803 fillable form is legally binding when filled out correctly and submitted according to state regulations. To ensure its legal validity, it is important to comply with all requirements outlined by the state tax authority. This includes providing accurate information and signatures. Failure to adhere to these guidelines may result in penalties or the rejection of the form.

Who Issues the Form

The Dtf 803 fillable form is issued by the state tax authority, which is responsible for regulating tax compliance within its jurisdiction. This authority provides the form to facilitate the reporting of specific financial information necessary for tax assessment and compliance. It is essential for users to obtain the form directly from the state tax authority or its official website to ensure they are using the correct version.

Form Submission Methods

The Dtf 803 fillable form can be submitted through various methods, depending on the preferences of the filer and the requirements set by the state tax authority. Common submission methods include:

- Online submission through the state tax authority’s secure portal.

- Mailing a printed copy of the completed form to the designated address.

- In-person submission at local tax offices or designated locations.

Quick guide on how to complete dtf 803 fillable form

Easily create Dtf 803 Fillable Form on any device

Managing documents online has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents efficiently without delays. Handle Dtf 803 Fillable Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Dtf 803 Fillable Form effortlessly

- Locate Dtf 803 Fillable Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive data with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes requiring new document prints. airSlate SignNow meets your document management requirements with just a few clicks from any device you prefer. Modify and eSign Dtf 803 Fillable Form and ensure superior communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dtf 803 fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dtf 803 fillable form?

The dtf 803 fillable form is a digital document designed for tax-related purposes in New York state. It allows users to fill in their information electronically and submit the form efficiently. By using the dtf 803 fillable form, individuals can streamline their tax filing process.

-

How can I access the dtf 803 fillable form?

You can easily access the dtf 803 fillable form through the airSlate SignNow platform. Simply navigate to the document section, and you’ll find a variety of fillable forms, including the dtf 803. This makes it convenient for users to manage and complete their tax documentation.

-

Is the dtf 803 fillable form compliant with tax regulations?

Yes, the dtf 803 fillable form is compliant with current New York state tax regulations. airSlate SignNow ensures that all forms, including the dtf 803, are updated to meet the latest requirements. You can file with confidence knowing that your documents are in good standing.

-

What are the benefits of using the dtf 803 fillable form via airSlate SignNow?

Using the dtf 803 fillable form through airSlate SignNow offers numerous benefits. It provides a user-friendly interface, reduces paper waste, and allows for easy e-signing and document tracking. This ultimately saves time and improves efficiency for businesses and individuals alike.

-

Can I integrate the dtf 803 fillable form with other applications?

Absolutely! The dtf 803 fillable form can be integrated with various applications such as CRM and accounting software through the airSlate SignNow API. This integration enhances workflow, allowing for seamless document management and data transfer across platforms.

-

What is the pricing structure for using the dtf 803 fillable form?

The pricing for using the dtf 803 fillable form through airSlate SignNow is competitive and varies based on your subscription plan. airSlate offers a range of pricing options to fit different business needs, including monthly and annual packages that allow unlimited access to fillable forms.

-

Can the dtf 803 fillable form be filled out on mobile devices?

Yes, the dtf 803 fillable form is fully accessible and optimized for mobile devices via the airSlate SignNow app. Users can fill out forms, sign documents, and manage their paperwork on-the-go, making it a flexible choice for busy professionals.

Get more for Dtf 803 Fillable Form

- Mycgs approver designation form

- I 015 schedule h ez wisconsin homestead credit easy form revenue wi

- Mechanical permit application kaba mi org form

- Fh form 7033

- Forklift certification cards blank form

- Mdufa foreign small business certification request form

- Designation and appearance of counsel forms

- Seo consulting agreement template form

Find out other Dtf 803 Fillable Form

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT