Wage Garnishment Form

What is the Wage Garnishment Form

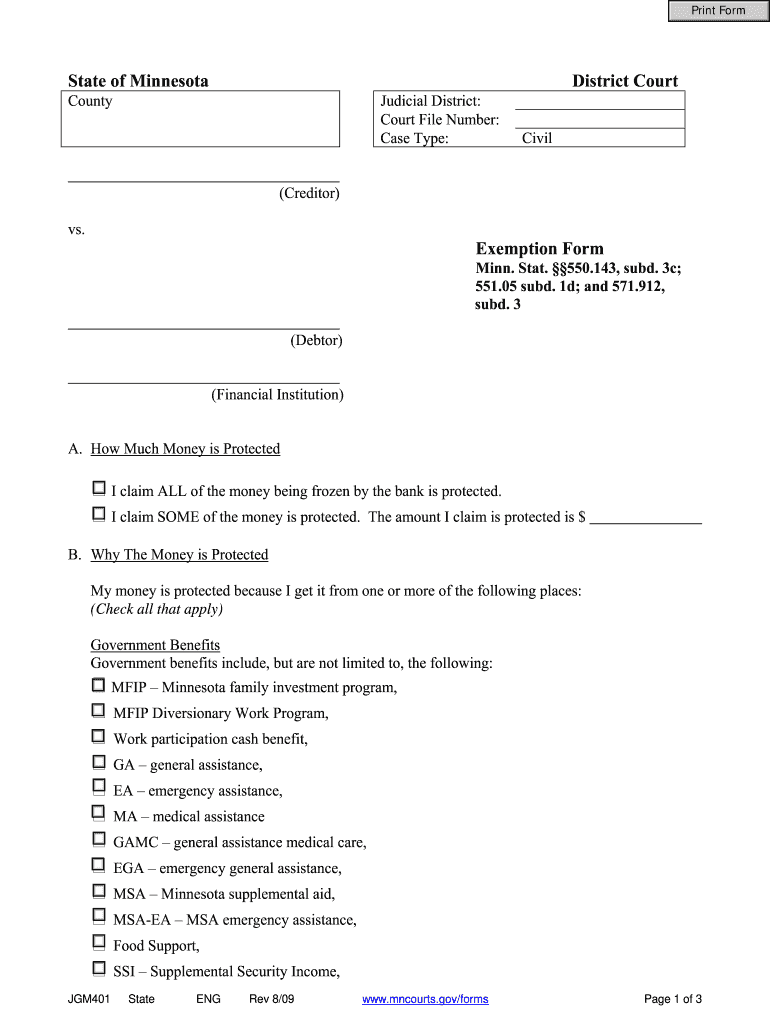

The wage garnishment form is a legal document used to request the withholding of a portion of an individual's earnings to satisfy a debt. This form is typically initiated by a creditor who has obtained a court judgment against the debtor. The garnishment process allows creditors to collect debts directly from the debtor's paycheck, ensuring that they receive payment in a structured manner. Understanding the purpose and function of this form is essential for anyone facing wage garnishment or seeking to claim an exemption from it.

Steps to complete the Wage Garnishment Form

Completing the wage garnishment form involves several key steps to ensure accuracy and compliance with legal requirements. Here’s a brief overview:

- Gather necessary information: Collect personal details, including your name, address, and Social Security number, as well as information about your employer.

- Identify the debt: Clearly state the nature of the debt and the amount owed, referencing any relevant court judgments or agreements.

- Complete the form: Fill out the form accurately, ensuring all sections are completed. This may include providing details about your income and expenses to support your claim of exemption.

- Review for accuracy: Double-check all information for correctness to avoid delays or complications in the processing of your form.

- Sign and date: Ensure that you sign and date the form as required, as this validates the information provided.

Legal use of the Wage Garnishment Form

The legal use of the wage garnishment form is governed by state and federal laws. It is crucial to understand that this form must be used in accordance with the Fair Debt Collection Practices Act and other relevant regulations. This ensures that the rights of the debtor are protected during the garnishment process. The form serves not only as a request for garnishment but also allows debtors to assert any exemptions they may qualify for, such as those based on income levels or specific financial hardships.

Key elements of the Wage Garnishment Form

When completing the wage garnishment form, several key elements must be included to ensure its validity:

- Debtor information: Full name, address, and Social Security number.

- Creditor information: Name and contact details of the creditor initiating the garnishment.

- Amount owed: Total amount of the debt that is subject to garnishment.

- Exemption claim: Any claims for exemption must be clearly stated, including supporting documentation if required.

- Signature: A valid signature of the debtor, affirming the accuracy of the information provided.

Eligibility Criteria

Eligibility for filing a claim of exemption on the wage garnishment form varies by state but generally includes certain income thresholds and specific circumstances. Common criteria include:

- Income limits: Debtors may qualify for exemptions if their income falls below a certain level, often based on federal poverty guidelines.

- Dependents: Having dependents may also impact eligibility, as it can affect the amount of disposable income available for garnishment.

- Financial hardship: Demonstrating financial hardship due to medical expenses, unemployment, or other significant costs can support a claim for exemption.

Form Submission Methods (Online / Mail / In-Person)

Submitting the wage garnishment form can be done through various methods, depending on state regulations and personal preference. Common submission methods include:

- Online submission: Many states offer online portals for filing legal documents, allowing for quicker processing and confirmation.

- Mail: Sending the completed form via certified mail ensures a record of submission and receipt.

- In-person delivery: Delivering the form directly to the appropriate court or agency can expedite processing and allow for immediate questions or clarifications.

Quick guide on how to complete wage garnishment form

Easily Prepare Wage Garnishment Form on Any Device

Managing documents online has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly and without delays. Handle Wage Garnishment Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The Simplest Way to Edit and Electronically Sign Wage Garnishment Form Effortlessly

- Obtain Wage Garnishment Form and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Mark signNow sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Wage Garnishment Form and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wage garnishment form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a claim of exemption form for wage garnishment?

A claim of exemption form for wage garnishment is a legal document that individuals can file to protect their wages from being garnished by creditors. By submitting this form, you can request that a court recognizes your financial situation and potentially exempts certain income from garnishment.

-

How can I complete a claim of exemption form for wage garnishment using airSlate SignNow?

With airSlate SignNow, you can easily complete a claim of exemption form for wage garnishment by using our intuitive eSigning solution. Simply upload your document, fill in the necessary fields, and eSign securely. Our platform streamlines the process, ensuring that you can submit it efficiently.

-

Are there any costs associated with filing a claim of exemption form for wage garnishment through airSlate SignNow?

While airSlate SignNow offers a variety of plans, the cost depends on the features you choose. You can access essential tools to complete your claim of exemption form for wage garnishment at an affordable price. Check our pricing page for more details on subscription options.

-

What features does airSlate SignNow offer for managing claim of exemption forms for wage garnishment?

airSlate SignNow provides several features to assist with claim of exemption forms for wage garnishment, including customizable templates, collaborative editing, and secure cloud storage. These tools allow you to manage documents efficiently while ensuring the protection of sensitive information.

-

Can airSlate SignNow integrate with other applications I use for claims management?

Yes, airSlate SignNow offers a variety of integrations with popular applications that can help streamline your claims management process. Integrating with tools such as CRM systems and project management software can enhance your workflow, especially when handling a claim of exemption form for wage garnishment.

-

What are the benefits of using airSlate SignNow for my claim of exemption form for wage garnishment?

Using airSlate SignNow for your claim of exemption form for wage garnishment offers numerous benefits, including time-saving automation and simplified document management. Our user-friendly interface and secure signing features mean you can handle legal documents confidently and efficiently.

-

Is my information secure when I use airSlate SignNow to file a claim of exemption form for wage garnishment?

Absolutely. airSlate SignNow prioritizes the security of your information when filing a claim of exemption form for wage garnishment. We use industry-standard encryption and security protocols to protect your data, ensuring that your documents remain confidential.

Get more for Wage Garnishment Form

- Form jv 438 ampquottwelve month permanency attachment

- Get the free dsa 93 pre application meeting request form

- Wwwirsgovpubirs tegehealth care provider reference guide irs tax forms

- Wwwsignnowcomfill and sign pdf form87315 howhow to fillup email form fill out and sign printable pdf

- This application may only be submitted for the lausd form

- Eyequest prior auth form shohratgazir

- Form or 18 wc v instructions oregon

- Sop authorization and release form stanford university

Find out other Wage Garnishment Form

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT