P35 Form PDF

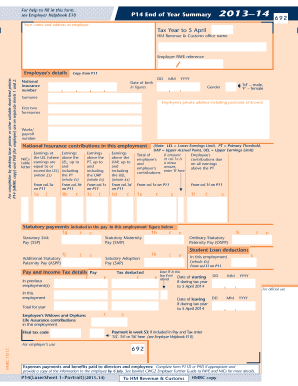

What is the P35 Form PDF?

The P35 form is a crucial document used in the United States for reporting annual payroll information to the Internal Revenue Service (IRS). It provides details about the total wages paid to employees and the taxes withheld throughout the year. This form is particularly important for employers as it ensures compliance with federal tax regulations and helps in the accurate reporting of employee earnings. The P35 form PDF version allows for easy access and digital completion, streamlining the process for businesses.

How to Use the P35 Form PDF

Using the P35 form PDF involves several steps to ensure accurate reporting. First, download the form from a reliable source. Once you have the form, gather all necessary payroll records, including total wages paid and taxes withheld for each employee. Carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submitting it to the IRS. Utilizing digital tools can enhance this process, allowing for easy editing and secure submission.

Steps to Complete the P35 Form PDF

Completing the P35 form PDF requires a systematic approach:

- Download the P35 form PDF from a trusted source.

- Gather payroll records for the year, including employee wages and tax withholdings.

- Fill in the required fields, ensuring accuracy in all entries.

- Review the completed form for any discrepancies or missing information.

- Submit the form electronically or via mail to the IRS, adhering to submission guidelines.

Legal Use of the P35 Form PDF

The P35 form PDF is legally recognized as a valid document for reporting payroll information to the IRS. To ensure its legal standing, it must be completed accurately and submitted within the specified deadlines. Employers should also retain a copy of the submitted form for their records. Compliance with IRS regulations is essential to avoid penalties and ensure that all employee tax information is reported correctly.

Filing Deadlines / Important Dates

Filing deadlines for the P35 form are critical for compliance. Employers must submit the form by the IRS deadline, which typically falls at the end of January for the previous tax year. It is important to stay informed about any changes in deadlines, as failure to file on time can result in penalties. Keeping a calendar of important dates related to tax filings can help ensure timely submissions.

Who Issues the Form

The P35 form is issued by the Internal Revenue Service (IRS) in the United States. Employers are responsible for obtaining the form and ensuring it is filled out correctly. The IRS provides guidelines and instructions for completing the form, which can be found on their official website or through tax preparation resources. Understanding the issuing authority helps in navigating the requirements for accurate payroll reporting.

Quick guide on how to complete p35 form pdf

Complete P35 Form Pdf effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle P35 Form Pdf on any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest way to edit and electronically sign P35 Form Pdf without hassle

- Find P35 Form Pdf and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and electronically sign P35 Form Pdf and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the p35 form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the p35 form pdf and why do I need it?

The p35 form pdf is an essential document used for declaring income and tax details to the tax authorities. Businesses need this form to ensure compliance and accurate reporting of employee earnings. By using airSlate SignNow, you can easily fill out and eSign your p35 form pdf online.

-

How can I eSign the p35 form pdf using airSlate SignNow?

With airSlate SignNow, eSigning your p35 form pdf is simple and efficient. You can upload your PDF, add your signature, and send it securely to recipients. Our user-friendly interface makes the process quick, allowing you to manage documents anywhere, anytime.

-

Is there a cost associated with using airSlate SignNow for p35 form pdf?

airSlate SignNow offers a cost-effective solution for managing your p35 form pdf and other documents. We provide various pricing plans, so you can choose one that best fits your business needs and budget. Start with a free trial to see how our platform can benefit you.

-

What features does airSlate SignNow offer for p35 form pdf?

airSlate SignNow includes features such as document templates, secure eSigning, and real-time tracking specifically for p35 form pdf. You can also collaborate with multiple stakeholders and store your documents securely in the cloud. These features simplify the process of handling your important documents.

-

Can I integrate airSlate SignNow with other applications for handling p35 form pdf?

Yes, airSlate SignNow supports integration with various applications, including CRM and document management systems, to streamline your workflow related to p35 form pdf. This ensures that your processes are efficient and that data transfer is seamless across your preferred tools.

-

How secure is airSlate SignNow when handling sensitive p35 form pdf documents?

AirSlate SignNow prioritizes your security by employing robust encryption methods for storing and sharing p35 form pdf documents. We adhere to industry standards to protect your sensitive information, ensuring that only authorized users can access your documents.

-

Can I use airSlate SignNow on mobile devices for my p35 form pdf?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to manage your p35 form pdf documents from your smartphone or tablet. Whether you are on the go or working remotely, you can easily upload, eSign, and send your documents hassle-free.

Get more for P35 Form Pdf

- Lactation consultants winter springs fl form

- Dss 5251 icpc financial medical plan info dhhs state nc form

- Imm 5604 sample form

- General medical and surgical form

- Pension application form

- Montana secretary of state business forms 01a

- Dog license application north bergen northbergen form

- Hr confidentiality agreement template form

Find out other P35 Form Pdf

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors