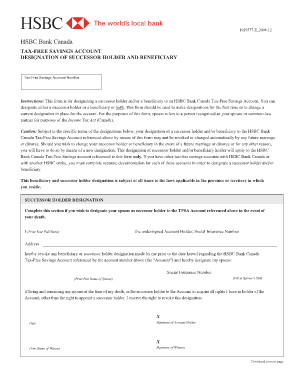

Hsbc Beneficiary Form

What is the HSBC Beneficiary?

The HSBC beneficiary refers to an individual or entity designated to receive the benefits of a bank account, insurance policy, or financial asset in the event of the account holder's death. This designation ensures that the assets are transferred directly to the beneficiary without going through probate, which can be a lengthy and complex process. Understanding the role of a beneficiary is crucial for effective estate planning and ensuring that your wishes are honored after your passing.

Steps to Complete the HSBC Beneficiary Form

Completing the HSBC beneficiary form involves several important steps to ensure accuracy and compliance. Here is a straightforward guide:

- Gather necessary information about the beneficiary, including their full name, date of birth, and contact details.

- Access the HSBC beneficiary form through your online banking account or request a physical copy from your local branch.

- Fill out the form with accurate details, ensuring that all required fields are completed.

- Review the information for any errors or omissions before submission.

- Submit the form electronically through your online account or return it to the bank via mail or in person, depending on your preference.

Legal Use of the HSBC Beneficiary

The legal use of the HSBC beneficiary designation is governed by state laws and banking regulations. This designation is legally binding and ensures that the assets are transferred according to the account holder's wishes. It is essential to keep the beneficiary information updated, especially after significant life events such as marriage, divorce, or the birth of a child. Additionally, understanding the implications of tax laws regarding inherited assets can help beneficiaries manage their new assets effectively.

Key Elements of the HSBC Beneficiary Designation

Several key elements are important when designating a beneficiary with HSBC:

- Clarity: Clearly specify the beneficiary's relationship to you and ensure their details are accurate.

- Contingent Beneficiaries: Consider naming contingent beneficiaries who will inherit the assets if the primary beneficiary is unable to do so.

- Revocation: Understand that you can revoke or change the beneficiary designation at any time, provided you follow the proper procedures.

How to Use the HSBC Beneficiary Designation

Using the HSBC beneficiary designation effectively involves understanding how it impacts your financial planning. Once you designate a beneficiary, they will have rights to the account upon your passing, allowing for a smoother transition of assets. It is advisable to communicate your wishes with your beneficiaries to avoid confusion and ensure they are aware of their rights. Regularly reviewing your beneficiary designations as part of your financial planning can help ensure they align with your current situation and intentions.

Required Documents for HSBC Beneficiary Designation

When completing the HSBC beneficiary form, certain documents may be required to validate the designation. These documents typically include:

- A valid form of identification for both the account holder and the beneficiary, such as a driver's license or passport.

- Proof of relationship, if applicable, to establish the connection between the account holder and the beneficiary.

- Any existing estate planning documents that reference the beneficiary designation, such as a will or trust document.

Examples of Using the HSBC Beneficiary Designation

There are various scenarios in which the HSBC beneficiary designation can be beneficial:

- Designating a spouse as the primary beneficiary ensures that they receive the account assets directly, simplifying the process during a difficult time.

- Choosing a trust as a beneficiary can provide ongoing management of assets for minor children or individuals who may not be financially responsible.

- Designating multiple beneficiaries allows for shared inheritance, which can be particularly useful in blended families.

Quick guide on how to complete hsbc beneficiary

Handle Hsbc Beneficiary effortlessly on any gadget

Digital document administration has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily find the required form and securely keep it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly and efficiently. Manage Hsbc Beneficiary on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Hsbc Beneficiary without hassle

- Find Hsbc Beneficiary and click on Get Form to begin.

- Make use of the tools available to fill out your form.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and eSign Hsbc Beneficiary and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hsbc beneficiary

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an HSBC beneficiary and why is it important?

An HSBC beneficiary is an individual or entity that receives funds from an HSBC account. It's crucial to accurately designate beneficiaries to ensure seamless transactions and to comply with legal requirements. By establishing clear beneficiary designations, you can avoid delays and complications in financial processes.

-

How does airSlate SignNow help with HSBC beneficiary documentation?

AirSlate SignNow simplifies the process of sending and eSigning documents related to HSBC beneficiaries. With our platform, you can create, manage, and securely send documents for signature, ensuring that all necessary information is captured accurately. This enhances efficiency and reduces the risk of errors when dealing with HSBC beneficiary assignments.

-

Are there any costs associated with airSlate SignNow when managing HSBC beneficiaries?

AirSlate SignNow offers various pricing plans tailored to suit your business needs, including those specifically designed for managing HSBC beneficiary documentation. Our pricing is competitive and provides great value, especially when considering the time saved in document management. You can start with a free trial to assess its affordability and features.

-

Can I integrate airSlate SignNow with other applications when handling HSBC beneficiary information?

Yes, airSlate SignNow allows seamless integration with numerous applications and systems, making the management of HSBC beneficiary information more efficient. This includes CRM systems, cloud storage solutions, and financial software, which enhances your workflow. Through these integrations, you can streamline processes while ensuring secure document handling.

-

What features does airSlate SignNow offer for eSigning HSBC beneficiary forms?

AirSlate SignNow provides robust eSigning features that are ideal for managing HSBC beneficiary forms. Users can easily add signature fields, required boxes, and customize templates to meet their specific needs. Additionally, our secure authentication methods ensure that all signatures are legally binding, ensuring compliance in beneficiary transactions.

-

How can airSlate SignNow improve the management of HSBC beneficiary agreements?

With airSlate SignNow, managing HSBC beneficiary agreements becomes more organized and efficient. The platform allows for quick document routing with automated reminders, reducing turnaround time. Additionally, real-time tracking provides visibility into each document's status, which enhances accountability and speeds up the agreement process.

-

What benefits can businesses expect by using airSlate SignNow for HSBC beneficiary documentation?

Businesses using airSlate SignNow for HSBC beneficiary documentation can expect signNow time savings and enhanced productivity. Our user-friendly interface allows for faster document preparation and execution, ultimately leading to quicker payment processing. Furthermore, the security features built into the platform ensure that all beneficiary information is protected.

Get more for Hsbc Beneficiary

- Pdf intercultural communication an application to group form

- Contact usdiplomat diplomat specialty pharmacy form

- Southcoast health mychart form

- Sutter release form

- Duke childrens internship application form

- Illinois immunization form

- Workers compensation accidentillness report form

- Hope college accident injury report form case

Find out other Hsbc Beneficiary

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online