Form 872 B

What is the Form 872 B

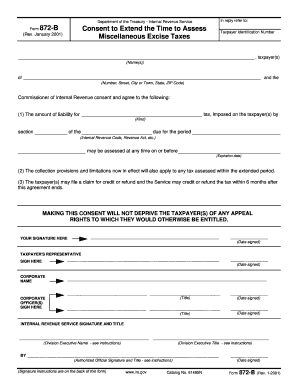

The Form 872 B is a document used by the Internal Revenue Service (IRS) in the United States to extend the statute of limitations on the assessment of tax liabilities. This form is particularly relevant for taxpayers who may need additional time for the IRS to assess their tax returns. By signing this form, taxpayers agree to extend the time the IRS has to audit their returns or assess additional taxes, ensuring that both parties have clarity on the timeline for tax assessments.

How to use the Form 872 B

Using the Form 872 B involves a straightforward process. Taxpayers must fill out the form with their identifying information, including their name, address, and taxpayer identification number. After completing the form, it must be signed by the taxpayer and submitted to the IRS. It is essential to ensure that the form is submitted before the original statute of limitations expires to be effective. This extension can provide peace of mind for taxpayers who may be facing complex tax situations.

Steps to complete the Form 872 B

Completing the Form 872 B requires careful attention to detail. Here are the steps to follow:

- Obtain a blank IRS Form 872 B from the IRS website or other official sources.

- Fill in your name, address, and taxpayer identification number in the designated fields.

- Specify the tax years for which the extension is being requested.

- Sign and date the form to validate your request.

- Submit the completed form to the appropriate IRS office as indicated in the instructions.

Legal use of the Form 872 B

The legal use of the Form 872 B is crucial for ensuring that the extension of the statute of limitations is recognized by the IRS. When properly executed, this form becomes a binding agreement between the taxpayer and the IRS. It is important to understand that the form must be signed voluntarily and that both parties must agree to the terms outlined in the document. This legal framework helps protect the rights of taxpayers while allowing the IRS to conduct thorough audits when necessary.

Key elements of the Form 872 B

Several key elements are essential to the Form 872 B, including:

- Taxpayer Identification: Accurate identification of the taxpayer is critical.

- Tax Years: Clearly specifying the tax years for which the extension applies.

- Signatures: Both the taxpayer's signature and the IRS representative's signature are required.

- Effective Date: The date on which the extension becomes effective must be clearly indicated.

IRS Guidelines

The IRS provides specific guidelines regarding the use and submission of the Form 872 B. Taxpayers should refer to these guidelines to ensure compliance. This includes understanding the appropriate circumstances under which the form should be used, the necessary information to include, and the deadlines for submission. Following IRS guidelines helps avoid potential issues and ensures that the extension is valid and recognized.

Quick guide on how to complete form 872 b

Effortlessly Prepare Form 872 B on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an optimal eco-friendly option compared to conventional printed and signed papers, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the features necessary to generate, alter, and electronically sign your documents quickly and without hassle. Manage Form 872 B on any device using airSlate SignNow's Android or iOS apps and streamline any document-related process today.

How to Modify and Electronically Sign Form 872 B with Ease

- Find Form 872 B and click on Get Form to begin.

- Utilize the tools we provide to finish your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from whichever device you prefer. Modify and electronically sign Form 872 B and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 872 b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 872 b and how is it used?

Form 872 b is a specific document utilized for extending the statute of limitations on tax assessments. Businesses often use this form to ensure that they have sufficient time to resolve any discrepancies with the IRS. Using airSlate SignNow, users can easily eSign and send form 872 b to the appropriate parties securely and efficiently.

-

How does airSlate SignNow handle form 872 b?

airSlate SignNow simplifies the process of managing form 872 b by providing users with an intuitive platform to create, edit, and send the document electronically. This platform allows for seamless e-signatures, ensuring that all necessary parties can sign the form quickly and securely. With airSlate SignNow, managing form 872 b becomes hassle-free.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet different business needs. Prices start at an affordable rate, providing access to features needed for managing documents like form 872 b. By selecting the plan that suits your requirements, you can leverage all the capabilities, including eSigning and document management.

-

Can multiple users collaborate on form 872 b using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on form 872 b in real-time. Team members can review, edit, and sign the document from their devices, ensuring seamless teamwork. This collaborative feature enhances efficiency and reduces the time it takes to finalize important documents.

-

What integration options does airSlate SignNow provide?

airSlate SignNow offers integration with popular business tools and platforms, allowing you to connect your workflow efficiently. Whether it's CRM systems, cloud storage solutions, or accounting software, integrating airSlate SignNow can streamline the process of handling form 872 b and other important forms. This ensures a more cohesive working environment.

-

Is airSlate SignNow compliant with legal requirements for form 872 b?

Yes, airSlate SignNow is designed to comply with legal requirements for electronic signatures, making it suitable for documents like form 872 b. The platform ensures that all signatures are secure and legally binding, providing peace of mind as you manage critical tax documents. Compliance with laws helps protect your business during audits.

-

What are the key benefits of using airSlate SignNow for form 872 b?

Using airSlate SignNow for form 872 b offers numerous benefits, including improved efficiency, cost-effectiveness, and enhanced security. The platform allows for quick electronic signing, reducing turnaround times signNowly. Furthermore, airSlate SignNow maintains all documents in an organized manner, making retrieval easy when needed.

Get more for Form 872 B

- Frequently asked questions presidents education awards program form

- Bbh degreerequirements checklistnamepsu email id form

- Training attestation mc vanderbilt edu form

- Missing assignment log form

- Uic application fee waiver form

- Note official transcripts are generally processed within 72 hours higher demand periods may extend this time form

- Email opt in form template jotform

- Chapter 4 test form 2a answers

Find out other Form 872 B

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form