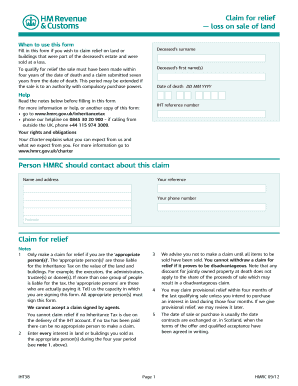

Iht38 Form

What is the Iht38 Form

The Iht38 form is a crucial document used in the United States for reporting the transfer of assets and calculating inheritance tax. This form is typically required when an individual passes away, and their estate exceeds a certain value threshold. It serves to provide the necessary information to the tax authorities regarding the deceased's assets, liabilities, and any applicable deductions. Understanding the purpose and requirements of the Iht38 form is essential for executors and beneficiaries involved in estate administration.

How to use the Iht38 Form

Using the Iht38 form involves several steps to ensure accurate completion and compliance with tax regulations. First, gather all relevant financial documents, including bank statements, property deeds, and investment records. Next, fill out the form with detailed information about the deceased's estate, including asset valuations and any debts owed. It is important to double-check all entries for accuracy before submission. Once completed, the form must be filed with the appropriate tax authority, either online or by mail, depending on local regulations.

Steps to complete the Iht38 Form

Completing the Iht38 form requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary documents, including the deceased's will and financial records.

- Fill out the personal information section, including the deceased's name, date of death, and Social Security number.

- List all assets, providing accurate valuations for each item, such as real estate, bank accounts, and investments.

- Document any debts or liabilities that the estate owes, which can reduce the taxable value.

- Review the completed form for accuracy and completeness.

- Submit the form as required, ensuring that it is filed by the deadline set by tax authorities.

Legal use of the Iht38 Form

The legal use of the Iht38 form is governed by federal and state tax laws. To be considered valid, the form must be completed accurately and submitted within the required timeframe. It is important to ensure compliance with all relevant regulations to avoid penalties. The form serves as a formal declaration of the estate's value and is used by tax authorities to assess any inheritance tax owed. Utilizing a reliable e-signature platform, like signNow, can enhance the legal validity of the completed form by providing secure and compliant electronic signatures.

Required Documents

To successfully complete the Iht38 form, several documents are required. These include:

- The deceased's will or trust documents.

- Death certificate to confirm the date of death.

- Financial statements, including bank account details and investment portfolios.

- Property deeds for any real estate owned by the deceased.

- Documentation of any debts or liabilities associated with the estate.

Form Submission Methods

The Iht38 form can be submitted through various methods, depending on the requirements of the local tax authority. Common submission methods include:

- Online submission via the tax authority's official website.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, if applicable.

Choosing the appropriate submission method is essential to ensure timely processing and compliance with legal requirements.

Quick guide on how to complete iht38 form

Prepare Iht38 Form effortlessly on any device

Online document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Iht38 Form on any device using the airSlate SignNow applications for Android or iOS, and simplify any document-related task today.

How to modify and eSign Iht38 Form with ease

- Obtain Iht38 Form and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with the tools specifically offered by airSlate SignNow for this purpose.

- Create your signature utilizing the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form—by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and eSign Iht38 Form and achieve excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iht38 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the iht38 form and how is it used?

The iht38 form is a legal document used in the UK for inheritance tax. It is essential for individuals who are administrating the estate of a deceased person to report their estate's value and any potential inheritance tax liabilities. Using airSlate SignNow, you can easily prepare, send, and eSign the iht38 form securely.

-

How can airSlate SignNow help with filling out the iht38 form?

AirSlate SignNow simplifies the process of filling out the iht38 form by offering user-friendly templates and step-by-step guidance. This ensures that you complete the document accurately and efficiently, reducing the risk of errors. With our platform, you can also collaborate with other stakeholders involved in the process.

-

Is there a cost associated with using airSlate SignNow for the iht38 form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Each plan includes the capability to manage documents like the iht38 form efficiently. We recommend checking our pricing page for detailed information on subscription options and any available discounts.

-

Can I track the status of my iht38 form once sent through airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track the status of your iht38 form after sending it for signature. Our platform provides real-time notifications and updates, so you know when it's been viewed, signed, or if there are any actions required from the recipients.

-

What integrations does airSlate SignNow offer for managing the iht38 form?

AirSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and CRMs to streamline the management of your iht38 form. This allows you to easily access, store, and collaborate on documents within your existing workflow. Integration enhances efficiency and ensures that all your documents are easily accessible.

-

Are electronic signatures on the iht38 form legally binding?

Yes, electronic signatures on the iht38 form are legally binding in the UK, provided that the signatures comply with the Electronic Communications Act 2000. By using airSlate SignNow, you can ensure that your electronic signatures meet all legal requirements, making your document valid and enforceable.

-

How secure is airSlate SignNow for handling the iht38 form?

AirSlate SignNow prioritizes your security, implementing advanced encryption and security protocols to protect sensitive documents like the iht38 form. Our platform is designed to keep your data safe, ensuring that only authorized signers have access to your documents. You can be confident in the confidentiality and integrity of your information.

Get more for Iht38 Form

- What does a college application look like form

- Sbux application for merchant registration form

- Affix passport size photo 54070719 form

- Author visit to godwin school book order form highland mpsnj

- Ps100 form

- Unlicensed contractor complaint form florida dbpr cilb 4355

- Form ri w3 rhode island division of taxation

- Equipment transfer agreement template 787742075 form

Find out other Iht38 Form

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF