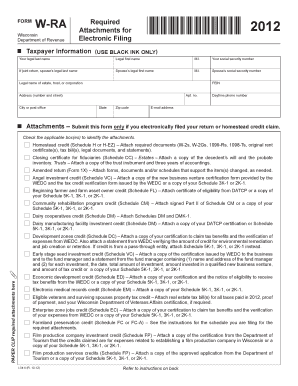

Form W Ra

What is the Form W-RA?

The Form W-RA is a specific document used in the state of Wisconsin to report certain tax-related information. It is often required for individuals and businesses to ensure compliance with state tax regulations. This form is particularly relevant for those who need to report income, deductions, or credits related to Wisconsin tax obligations. Understanding the purpose of the W-RA is essential for accurate tax reporting and compliance.

How to Obtain the Form W-RA

Obtaining the Form W-RA is straightforward. It can be accessed through the official Wisconsin Department of Revenue website or requested directly from tax offices within the state. Additionally, many tax preparation software programs may include the W-RA form as part of their documentation, making it easier for users to fill it out electronically.

Steps to Complete the Form W-RA

Completing the Form W-RA involves several key steps:

- Gather necessary documentation, such as income statements and previous tax returns.

- Fill out personal information, including name, address, and Social Security number.

- Report income and applicable deductions accurately on the form.

- Review the completed form for any errors or omissions.

- Sign and date the form before submission.

Following these steps ensures that the form is filled out correctly, reducing the risk of delays or penalties.

Legal Use of the Form W-RA

The Form W-RA is legally binding when completed correctly and submitted on time. It must adhere to the guidelines set forth by the Wisconsin Department of Revenue to be considered valid. Compliance with these regulations is crucial, as improper use of the form can lead to penalties, fines, or additional scrutiny from tax authorities.

IRS Guidelines for the Form W-RA

While the Form W-RA is a state-specific document, it is important to be aware of how it interacts with IRS guidelines. The IRS may require certain information reported on the W-RA for federal tax purposes. Taxpayers should ensure that the information aligns with federal requirements to avoid discrepancies that could trigger audits or penalties.

Form Submission Methods

The Form W-RA can be submitted through various methods, including:

- Online submission via the Wisconsin Department of Revenue's e-file system.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices.

Choosing the right submission method can impact the processing time and ease of tracking the form's status.

Quick guide on how to complete form w ra 29343161

Effortlessly Prepare Form W Ra on Any Device

Managing documents online has gained signNow traction among both organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Handle Form W Ra on any device with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The Easiest Way to Modify and eSign Form W Ra Effortlessly

- Obtain Form W Ra and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Form W Ra to ensure effective communication at every stage of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w ra 29343161

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form w ra, and how is it used?

A form w ra is a document used in various business processes to collect essential information from employees or clients. With airSlate SignNow, you can easily create and manage your form w ra to ensure it meets the specific needs of your organization.

-

How does airSlate SignNow help with filling out a form w ra?

airSlate SignNow streamlines the process of filling out a form w ra by providing an intuitive interface for both senders and signers. Users can easily input information, add signatures, and submit the form, making the process quick and efficient.

-

What are the pricing options for using airSlate SignNow with a form w ra?

airSlate SignNow offers competitive pricing plans tailored to suit different business needs, including options for small teams as well as larger organizations. When utilizing the form w ra, you can choose a plan that provides the necessary features to optimize your document workflows.

-

Can I integrate airSlate SignNow with other software while using a form w ra?

Yes, airSlate SignNow supports various integrations with popular software tools like Google Drive, Salesforce, and Microsoft applications. This allows you to seamlessly manage your form w ra alongside existing apps, ensuring streamlined workflows.

-

What features does airSlate SignNow offer for managing a form w ra?

AirSlate SignNow provides features such as real-time editing, customizable templates, and automated reminders that enhance the management of your form w ra. These capabilities ensure that your documents are efficiently handled and organized.

-

What are the benefits of using airSlate SignNow for my form w ra?

Using airSlate SignNow for your form w ra can signNowly improve efficiency and reduce errors in document handling. Additionally, it enhances collaboration by allowing multiple users to access and complete documents simultaneously.

-

Is it secure to send a form w ra through airSlate SignNow?

Absolutely! airSlate SignNow implements robust security measures, including encryption and multi-factor authentication, to protect your form w ra and sensitive information from unauthorized access. Your data is safe with us.

Get more for Form W Ra

- Printable cereal box book report template form

- Thehartfordatwork form

- Smoke detector addendum rental property investing info form

- Printable counselling contract template 393077965 form

- Transamerica annuity policy change form

- Sfn 58711 state of north dakota nd form

- Department of homeland security s coast guarden form

- Form i 590 registration for classification as a refugee

Find out other Form W Ra

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document