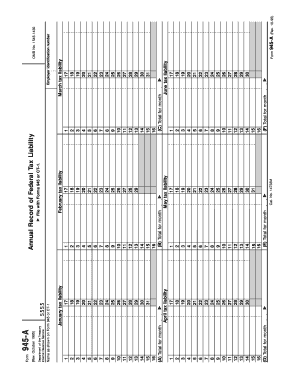

1095 Form 945 a Annual Record of Federal Tax Liability

What is the 1095 Form 945 A Annual Record Of Federal Tax Liability

The 1095 Form 945 A Annual Record Of Federal Tax Liability is a crucial document used by businesses in the United States to report their federal tax liabilities. This form provides a summary of the total federal taxes owed over the course of a year, helping organizations maintain compliance with tax regulations. It is particularly important for employers and businesses that need to accurately report their tax obligations to the Internal Revenue Service (IRS).

How to use the 1095 Form 945 A Annual Record Of Federal Tax Liability

Using the 1095 Form 945 A involves several steps to ensure accurate reporting. First, businesses must gather all relevant financial data, including payroll records and any other income sources subject to federal tax. Once the information is compiled, the form can be filled out, detailing the total tax liabilities incurred throughout the year. After completing the form, it should be reviewed for accuracy before submission to the IRS.

Steps to complete the 1095 Form 945 A Annual Record Of Federal Tax Liability

Completing the 1095 Form 945 A involves a series of methodical steps:

- Collect all necessary financial documents, including payroll records and tax statements.

- Fill out the form with accurate figures reflecting total federal tax liabilities.

- Double-check all entries for accuracy and completeness.

- Sign and date the form as required.

- Submit the form to the IRS by the specified deadline.

Legal use of the 1095 Form 945 A Annual Record Of Federal Tax Liability

The legal use of the 1095 Form 945 A is essential for compliance with federal tax laws. This form serves as an official record of tax liabilities and must be filed accurately to avoid penalties. It is important for businesses to understand the legal implications of submitting incorrect information, which can lead to audits or fines from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 1095 Form 945 A are critical for compliance. Typically, the form must be submitted to the IRS by the end of January of the following year. Businesses should also be aware of any state-specific deadlines that may apply. Keeping track of these dates helps ensure that organizations remain in good standing with tax authorities.

Who Issues the Form

The 1095 Form 945 A is issued by the Internal Revenue Service (IRS). Employers and businesses are responsible for completing and submitting this form, ensuring that it accurately reflects their federal tax liabilities. Understanding the issuance process is important for maintaining compliance and avoiding potential legal issues.

Quick guide on how to complete 1095 form 945 a annual record of federal tax liability

Complete 1095 Form 945 A Annual Record Of Federal Tax Liability effortlessly on any device

Online document management has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle 1095 Form 945 A Annual Record Of Federal Tax Liability on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign 1095 Form 945 A Annual Record Of Federal Tax Liability without effort

- Find 1095 Form 945 A Annual Record Of Federal Tax Liability and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Highlight important parts of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you choose. Edit and electronically sign 1095 Form 945 A Annual Record Of Federal Tax Liability and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1095 form 945 a annual record of federal tax liability

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1095 Form 945 A Annual Record Of Federal Tax Liability?

The 1095 Form 945 A Annual Record Of Federal Tax Liability is a key document that businesses must file to report their federal tax liabilities for the year. It provides essential information to the IRS and can help ensure compliance with federal tax regulations. Understanding this form is crucial for maintaining accurate tax records.

-

How can airSlate SignNow assist with the 1095 Form 945 A Annual Record Of Federal Tax Liability?

airSlate SignNow streamlines the process of signing and sending the 1095 Form 945 A Annual Record Of Federal Tax Liability through its easy-to-use platform. With electronic signatures, you can efficiently gather required signatures and ensure swift delivery. This reduces the paperwork burden and helps maintain compliance.

-

What are the pricing options for using airSlate SignNow for tax forms like the 1095 Form 945 A Annual Record Of Federal Tax Liability?

airSlate SignNow offers several pricing plans that are cost-effective for businesses of all sizes. Depending on your needs, you can choose from monthly or annual subscriptions that cater to specific requirements related to processes like handling the 1095 Form 945 A Annual Record Of Federal Tax Liability. Each plan includes features designed to enhance document management.

-

What features does airSlate SignNow offer for managing the 1095 Form 945 A Annual Record Of Federal Tax Liability?

Our platform provides features such as customizable templates, bulk sending, and real-time tracking of documents like the 1095 Form 945 A Annual Record Of Federal Tax Liability. Additionally, you can automate reminders for signatories, ensuring timely completion of important tax documents and enhancing overall productivity.

-

Are there any integrations available with airSlate SignNow for processing the 1095 Form 945 A Annual Record Of Federal Tax Liability?

Yes, airSlate SignNow integrates seamlessly with various applications, including CRM systems and accounting software, to facilitate the processing of the 1095 Form 945 A Annual Record Of Federal Tax Liability. These integrations help streamline workflow and simplify the overall signing and document management process.

-

What benefits does airSlate SignNow offer for businesses handling the 1095 Form 945 A Annual Record Of Federal Tax Liability?

Businesses that use airSlate SignNow to manage the 1095 Form 945 A Annual Record Of Federal Tax Liability enjoy increased efficiency and reduced errors in document handling. The ability to track signatures and manage documents electronically translates to faster processing times and enhanced compliance with federal regulations.

-

How secure is airSlate SignNow when handling sensitive documents like the 1095 Form 945 A Annual Record Of Federal Tax Liability?

airSlate SignNow prioritizes security to ensure that sensitive documents, including the 1095 Form 945 A Annual Record Of Federal Tax Liability, are protected. We employ encryption, secure access controls, and compliance with major data security regulations to safeguard your information and provide peace of mind.

Get more for 1095 Form 945 A Annual Record Of Federal Tax Liability

Find out other 1095 Form 945 A Annual Record Of Federal Tax Liability

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament