Form 4095 Michigan

What is the Form 4095 Michigan

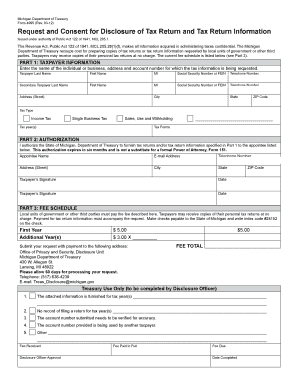

The Form 4095 Michigan is a document issued by the Michigan Department of Treasury, primarily used for reporting specific tax-related information. This form is essential for individuals and businesses who need to comply with state tax regulations. It serves as a means to provide necessary details regarding income, deductions, and credits that may affect tax liabilities. Understanding the purpose and requirements of Form 4095 is crucial for accurate tax reporting and compliance.

How to use the Form 4095 Michigan

Using the Form 4095 Michigan involves several key steps to ensure proper completion and submission. First, gather all relevant financial documents, including income statements and previous tax returns. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to follow the instructions provided with the form to avoid errors that could lead to penalties. Once completed, the form can be submitted to the Michigan Department of Treasury through the designated channels.

Steps to complete the Form 4095 Michigan

Completing the Form 4095 Michigan requires careful attention to detail. Start by entering your personal information, such as your name, address, and Social Security number. Then, proceed to report your income sources, ensuring that you include all relevant figures. After that, calculate any deductions or credits you may qualify for, as these can significantly impact your tax obligations. Finally, review the entire form for accuracy before signing and dating it. Properly completing these steps will help ensure compliance and minimize the risk of errors.

Legal use of the Form 4095 Michigan

The legal use of the Form 4095 Michigan is governed by state tax laws and regulations. To be considered valid, the form must be filled out accurately and submitted by the appropriate deadlines. Additionally, electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Ensuring that the form is used legally protects taxpayers from potential penalties and legal issues.

Form Submission Methods

The Form 4095 Michigan can be submitted through various methods to accommodate different preferences. Taxpayers have the option to submit the form electronically via the Michigan Department of Treasury's online portal, ensuring a quick and efficient process. Alternatively, the form can be mailed to the designated address provided in the instructions. For those who prefer in-person submissions, visiting a local tax office is also an option. Each method has its own advantages, and choosing the right one depends on individual circumstances.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4095 Michigan are critical for compliance. Typically, the form must be submitted by the annual tax filing deadline, which is usually April fifteenth for most taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or special filing statuses. It is important to stay informed about these deadlines to avoid late fees or penalties that could arise from missed submissions.

Quick guide on how to complete form 4095 michigan

Effortlessly Prepare Form 4095 Michigan on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing easy access to the right form and secure online storage. airSlate SignNow provides all the necessary tools to swiftly create, modify, and electronically sign your documents without any delays. Manage Form 4095 Michigan on any device through the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

The easiest way to modify and electronically sign Form 4095 Michigan effortlessly

- Find Form 4095 Michigan and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of your documents or redact sensitive data using tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional pen-and-ink signature.

- Review all the details and click on the Done button to store your updates.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or inaccuracies that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 4095 Michigan to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4095 michigan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 4095 Michigan and how is it used?

Form 4095 Michigan is a specific document required for certain tax and administrative processes in the state. It is often used to report information related to business transactions and can be easily managed with airSlate SignNow's eSigning solutions.

-

How can airSlate SignNow help with the completion of form 4095 Michigan?

airSlate SignNow simplifies the process of completing form 4095 Michigan by allowing users to fill out and eSign the document digitally. This eliminates the need for printing and scanning, making it a more efficient solution for businesses.

-

Is there a cost associated with using airSlate SignNow for form 4095 Michigan?

Yes, there is a pricing structure for using airSlate SignNow, which varies based on the features you choose. However, the service is designed to be cost-effective, especially when handling documents like form 4095 Michigan efficiently.

-

What features are available in airSlate SignNow for handling form 4095 Michigan?

airSlate SignNow offers a range of features including templates, real-time collaboration, and secure eSigning for form 4095 Michigan. These tools are designed to streamline the entire document management process.

-

Can I integrate airSlate SignNow with other applications for form 4095 Michigan?

Yes, airSlate SignNow offers integrations with various applications, making it easier to manage and eSign form 4095 Michigan alongside other business tools. This enhances workflow efficiency and document tracking.

-

What are the benefits of using airSlate SignNow for form 4095 Michigan?

Using airSlate SignNow for form 4095 Michigan provides benefits such as enhanced security, faster processing times, and a user-friendly interface. These advantages help businesses save time and reduce errors.

-

Is airSlate SignNow compliant with regulatory standards for form 4095 Michigan?

Yes, airSlate SignNow is compliant with regulatory standards, ensuring that all eSignatures on form 4095 Michigan hold legal validity. This compliance is crucial for businesses to maintain trust and accountability.

Get more for Form 4095 Michigan

Find out other Form 4095 Michigan

- Electronic signature Alabama Limited Partnership Agreement Online

- Can I Electronic signature Wisconsin Retainer Agreement Template

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast