Form 8801 Credit for Prior Year Minimum TaxIndividuals, Estates, and Trusts

Understanding Form 8801: Credit for Prior Year Minimum Tax

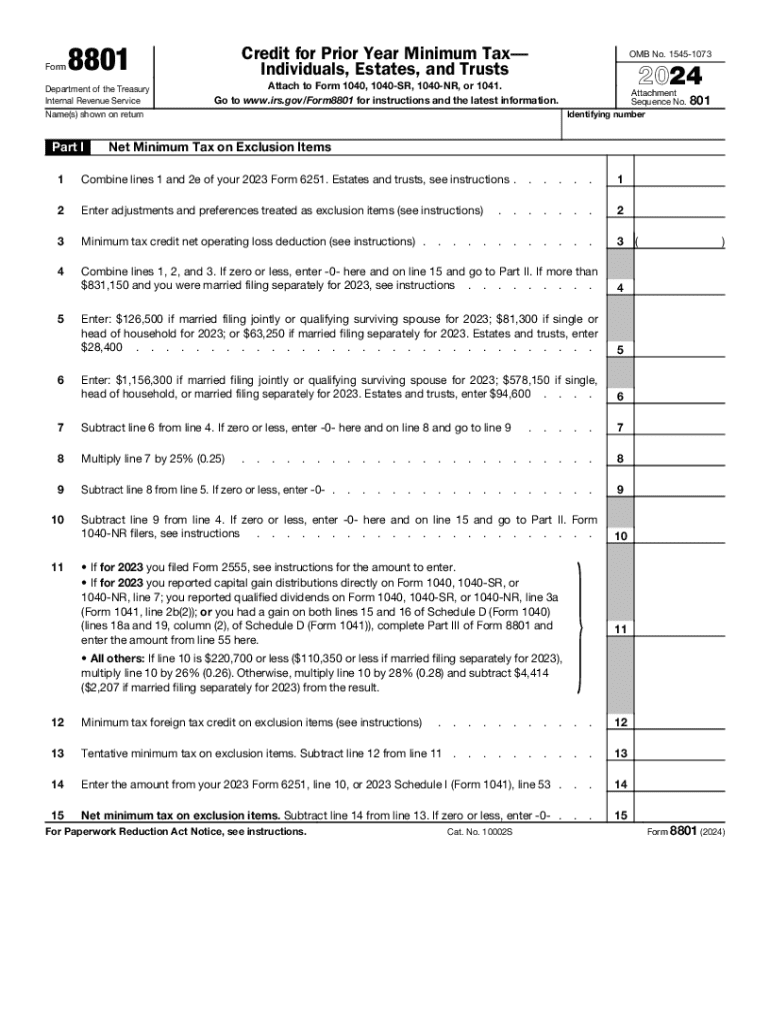

Form 8801 is utilized to claim a credit for prior year minimum tax for individuals, estates, and trusts. This credit is designed to help taxpayers who may have paid alternative minimum tax (AMT) in previous years. The purpose of the form is to ensure that taxpayers can recover some of the AMT they paid if they are no longer subject to it in the current tax year. This can be particularly beneficial for those whose income fluctuates or who have experienced changes in their financial circumstances.

Steps to Complete Form 8801

Completing Form 8801 requires careful attention to detail to ensure accuracy. Here are the essential steps:

- Gather necessary financial documents, including prior year tax returns and any records related to AMT.

- Fill out the identification section, providing your name, Social Security number, and other required details.

- Calculate the prior year minimum tax and determine the credit amount you are eligible for based on your calculations.

- Complete the form by following the provided instructions, ensuring all figures are accurate and properly documented.

- Review the completed form for any errors before submission.

Obtaining Form 8801

Form 8801 can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. It is important to ensure that you are using the most current version of the form, as tax laws and requirements can change from year to year. If you prefer a paper version, you may also request it by calling the IRS or visiting a local IRS office.

Eligibility Criteria for Form 8801

To qualify for the credit claimed on Form 8801, taxpayers must meet specific eligibility criteria. Generally, you must have paid AMT in a prior year and be filing a return for the current year where you are not subject to AMT. Additionally, the credit is available to individuals, estates, and trusts that meet the income and tax liability thresholds set by the IRS. It's essential to review the IRS guidelines to confirm your eligibility before filing.

IRS Guidelines for Form 8801

The IRS provides detailed guidelines for completing Form 8801, including instructions on how to calculate the credit and any supporting documentation required. Taxpayers should carefully read these guidelines to ensure compliance and avoid potential issues. The IRS also outlines the filing deadlines and any specific conditions under which the credit can be claimed, making it crucial for taxpayers to stay informed about their responsibilities.

Filing Deadlines for Form 8801

Timely filing of Form 8801 is essential to ensure that you receive the credit you are entitled to. The form must typically be submitted along with your annual tax return by the standard deadline, which is usually April 15th for individuals. If you are unable to meet this deadline, you may file for an extension, but it is important to submit Form 8801 by the extended due date to avoid penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8801 credit for prior year minimum taxindividuals estates and trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the number 8801 in airSlate SignNow?

The number 8801 refers to a specific feature set within airSlate SignNow that enhances document management. This feature allows users to streamline their eSigning process, making it more efficient and user-friendly. By utilizing 8801, businesses can ensure that their document workflows are optimized for speed and accuracy.

-

How does airSlate SignNow's pricing structure work for the 8801 feature?

The pricing for airSlate SignNow, including the 8801 feature, is designed to be cost-effective for businesses of all sizes. Users can choose from various subscription plans that cater to different needs, ensuring they only pay for what they use. This flexibility allows companies to scale their usage of the 8801 feature as their needs grow.

-

What are the key benefits of using the 8801 feature in airSlate SignNow?

The 8801 feature in airSlate SignNow offers numerous benefits, including improved efficiency in document signing and enhanced security measures. By leveraging this feature, businesses can reduce turnaround times and minimize errors in their document workflows. Additionally, the 8801 feature supports compliance with industry standards, ensuring that your documents are handled securely.

-

Can I integrate airSlate SignNow's 8801 feature with other software?

Yes, airSlate SignNow's 8801 feature is designed to integrate seamlessly with various third-party applications. This allows businesses to incorporate eSigning into their existing workflows without disruption. Popular integrations include CRM systems, project management tools, and cloud storage services, enhancing overall productivity.

-

Is the 8801 feature user-friendly for non-technical users?

Absolutely! The 8801 feature in airSlate SignNow is built with user experience in mind, making it accessible for non-technical users. The intuitive interface allows anyone to send and eSign documents easily, reducing the learning curve and enabling quick adoption across teams. This ensures that all employees can utilize the 8801 feature effectively.

-

What types of documents can I manage with the 8801 feature?

With the 8801 feature in airSlate SignNow, you can manage a wide variety of documents, including contracts, agreements, and forms. This versatility allows businesses to handle all their essential paperwork within a single platform. The ability to customize templates further enhances the functionality of the 8801 feature.

-

How does airSlate SignNow ensure the security of documents signed with the 8801 feature?

Security is a top priority for airSlate SignNow, especially with the 8801 feature. The platform employs advanced encryption methods and secure access controls to protect sensitive information. Additionally, audit trails are maintained for all signed documents, providing transparency and accountability throughout the signing process.

Get more for Form 8801 Credit For Prior Year Minimum TaxIndividuals, Estates, And Trusts

- Guyana passport renewal form new york

- Wise county 911 addressing form

- Predator prey lab exercise l1 answer key form

- Photography fillable contract form

- Su461 form

- Horseback rider liability waiverthis form is req

- Application for readmission ringling college of art and design ringling form

- Declaration of finances and international student beloit college beloit form

Find out other Form 8801 Credit For Prior Year Minimum TaxIndividuals, Estates, And Trusts

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form