St 119 1 10 11 Blank Form

What is the St 119 1 10 11 Blank

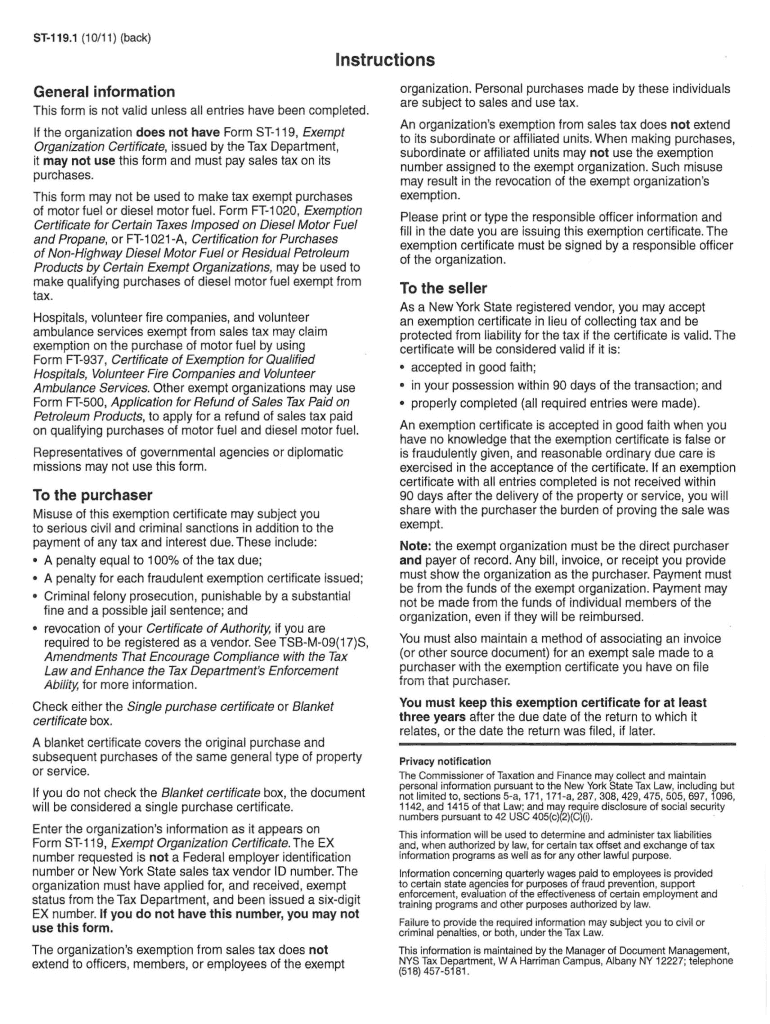

The St 119 1 10 11 blank form is a document used in New York State for tax exemption purposes. It serves as a certificate that allows certain organizations to make purchases without paying sales tax. This form is essential for non-profit organizations, governmental entities, and other qualifying groups that seek to avoid sales tax on eligible purchases. Understanding its purpose is crucial for compliance with state tax regulations.

How to obtain the St 119 1 10 11 Blank

To obtain the St 119 1 10 11 blank form, individuals or organizations can visit the New York State Department of Taxation and Finance website. The form is available for download in a PDF format, allowing users to print and fill it out as needed. Alternatively, physical copies may be requested from local tax offices or obtained during tax-related workshops and seminars.

Steps to complete the St 119 1 10 11 Blank

Completing the St 119 1 10 11 blank form involves several key steps:

- Begin by entering the name of the organization requesting the exemption.

- Provide the address and contact information of the organization.

- Specify the type of organization and its tax-exempt status.

- List the items or services for which the exemption is being requested.

- Include the signature of an authorized representative, along with the date.

It is important to ensure that all information is accurate and complete to avoid delays or issues with the exemption process.

Legal use of the St 119 1 10 11 Blank

The legal use of the St 119 1 10 11 blank form hinges on compliance with New York State tax laws. Organizations must ensure they meet the eligibility criteria for tax exemption. Misuse of the form can lead to penalties, including fines and the requirement to pay back taxes. Therefore, it is vital to understand the legal implications of using this form correctly.

Form Submission Methods

The St 119 1 10 11 blank form can be submitted in several ways. Organizations can choose to submit the completed form online, by mail, or in person at designated tax offices. Each submission method has its own processing times, so it is advisable to consider the urgency of the exemption request when selecting a submission method.

Key elements of the St 119 1 10 11 Blank

Key elements of the St 119 1 10 11 blank form include:

- The organization's name and address.

- The type of exemption being claimed.

- A detailed description of the items or services purchased.

- The signature of an authorized individual.

These elements are critical for establishing the legitimacy of the exemption claim and ensuring compliance with state regulations.

Quick guide on how to complete st 119 1 10 11 blank

Effortlessly Create St 119 1 10 11 Blank on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely manage it online. airSlate SignNow equips you with all the tools you need to produce, alter, and eSign your documents swiftly without any delays. Handle St 119 1 10 11 Blank across any platform with the airSlate SignNow mobile applications for Android or iOS and enhance any document-related workflow today.

How to Edit and eSign St 119 1 10 11 Blank with Ease

- Locate St 119 1 10 11 Blank and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of your documents or obscure sensitive details using tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and press the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign St 119 1 10 11 Blank to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 119 1 10 11 blank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 119 1 10 11 blank form used for?

The st 119 1 10 11 blank form is primarily used for tax-exempt purchases in certain states. By filling out this form, businesses can avoid paying sales tax on eligible transactions, making it a vital tool for financial savings.

-

How can airSlate SignNow help with the st 119 1 10 11 blank form?

With airSlate SignNow, you can easily fill out, sign, and share the st 119 1 10 11 blank form digitally. Our platform streamlines the process, ensuring that your documents are securely stored and accessible at any time.

-

Is there a cost associated with using airSlate SignNow for the st 119 1 10 11 blank?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Whether you need to manage one st 119 1 10 11 blank form or a multitude, our cost-effective solutions make it easy to eSign and manage your documents.

-

Can I integrate airSlate SignNow with other applications for the st 119 1 10 11 blank?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to manage the st 119 1 10 11 blank form alongside your other business tools. This integration enhances productivity and simplifies your document management workflow.

-

What are the security features for handling the st 119 1 10 11 blank in airSlate SignNow?

Security is paramount at airSlate SignNow, especially when dealing with sensitive documents like the st 119 1 10 11 blank form. We employ advanced encryption and compliance measures to ensure your data is protected at all times.

-

Can I customize the st 119 1 10 11 blank form in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize the st 119 1 10 11 blank form to meet specific business needs. You can add fields, logos, and other relevant information to tailor the form to your requirements.

-

What are the benefits of using airSlate SignNow for the st 119 1 10 11 blank?

Using airSlate SignNow for the st 119 1 10 11 blank form offers numerous benefits, including increased efficiency, cost savings, and improved document tracking. The digital process minimizes paperwork and ensures that signing is faster and straightforward.

Get more for St 119 1 10 11 Blank

Find out other St 119 1 10 11 Blank

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement