Schedule E Worksheet 2013-2026

What is the Schedule E Worksheet

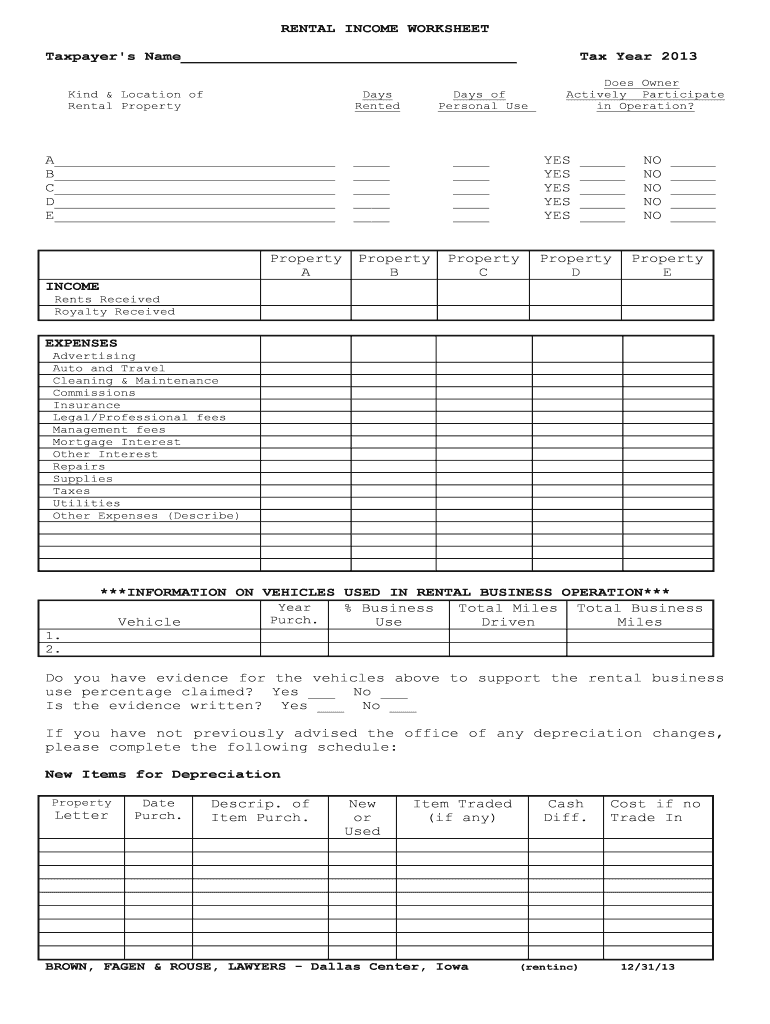

The Schedule E Worksheet is a tax form used by individuals in the United States to report income or loss from rental real estate, partnerships, S corporations, estates, trusts, and certain other sources. This form is integral for taxpayers who need to detail their earnings from these activities, ensuring compliance with IRS regulations. It helps in calculating the net income or loss that will ultimately affect the taxpayer's overall tax liability. Understanding the Schedule E Worksheet is crucial for accurate tax reporting and maximizing potential deductions.

How to use the Schedule E Worksheet

Using the Schedule E Worksheet involves several steps to ensure accurate reporting of income and expenses. Taxpayers should start by gathering all relevant financial information related to their rental properties or other income sources. This includes receipts for expenses, records of rental income, and any applicable depreciation schedules. The worksheet guides users through entering this data systematically, allowing for a clear overview of income, expenses, and net earnings. It is essential to follow the instructions carefully to ensure that all entries are accurate and complete.

Steps to complete the Schedule E Worksheet

Completing the Schedule E Worksheet requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents, including income statements and expense receipts.

- Begin by entering the property address and type of rental activity.

- List all rental income received during the tax year.

- Detail all allowable expenses, such as repairs, maintenance, and property management fees.

- Calculate the total income and total expenses to determine the net income or loss.

- Review the completed worksheet for accuracy before submission.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule E Worksheet, ensuring that taxpayers understand their obligations. These guidelines outline which types of income must be reported and what expenses are deductible. Taxpayers should refer to the IRS instructions for Schedule E, which detail the necessary calculations and provide examples of common scenarios. Staying informed about these guidelines helps in avoiding errors that could lead to penalties or audits.

Examples of using the Schedule E Worksheet

Examples of using the Schedule E Worksheet can clarify how to apply the form in real-life situations. For instance, a taxpayer who rents out a single-family home would report rental income received, along with expenses such as mortgage interest, property taxes, and repairs. Another example includes a partner in a business partnership who must report their share of the partnership's income and expenses. These examples illustrate the versatility of the Schedule E Worksheet and its importance in various tax scenarios.

Legal use of the Schedule E Worksheet

The legal use of the Schedule E Worksheet is essential for ensuring compliance with tax laws. Taxpayers must accurately report all income and expenses related to their rental properties and other sources of income. Failure to do so can result in penalties, interest, or audits by the IRS. It is important to maintain proper documentation and adhere to IRS guidelines to uphold the legal validity of the reported information. Understanding the legal implications of the Schedule E Worksheet reinforces the importance of accuracy in tax reporting.

Quick guide on how to complete schedule e worksheet online form

Complete Schedule E Worksheet seamlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without delays. Manage Schedule E Worksheet on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Schedule E Worksheet effortlessly

- Obtain Schedule E Worksheet and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information before clicking on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you choose. Modify and electronically sign Schedule E Worksheet and ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What is the right way to fill out Two-Earners Worksheet tax form?

Wages, in this context, are what you expect to appear in box 1 of your W-2.The IRS recommends that the additional withholding be applied to the higher-paid spouse and that the lesser-paid spouse should simply claim zero withholding allowances, as this is usually more accurate (due to the way that withholding is actually calculated by payroll programs, you may wind up with less withheld than you want if you split it).

-

For the new 2018 W-4 form, do I also print out the separate A-H worksheet and fill that out for my employer?

No, an employee is not required to give the separate worksheet to the employer. Keep it for your own records.

-

How do I fill out an Indian passport form online?

You need to be careful while filling up the Passport form online. If is better if you download the Passport form and fill it up offline. You can upload the form again after you completely fill it up. You can check the complete procedure to know : How to Apply for Indian Passport Online ?

-

What is the procedure for filling out the CPT registration form online?

CHECK-LIST FOR FILLING-UP CPT JUNE - 2017 EXAMINATION APPLICATION FORM1 - BEFORE FILLING UP THE FORM, PLEASE DETERMINE YOUR ELIGIBILITY AS PER DETAILS GIVEN AT PARA 1.3 (IGNORE FILLING UP THE FORM IN CASE YOU DO NOT COMPLY WITH THE ELIGIBILITY REQUIREMENTS).2 - ENSURE THAT ALL COLUMNS OF THE FORM ARE FILLED UP/SELECTED CORRECTLY AND ARE CORRECTLY APPEARING IN THE PDF.3 - CENTRE IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF. (FOR REFERENCE SEE APPENDIX-A).4 - MEDIUM OF THE EXAMINATION IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.5 - THE SCANNED COPY OF THE DECLARATION UPLOADED PERTAINS TO THE CURRENT EXAM CYCLE.6 - ENSURE THAT PHOTOGRAPHS AND SIGNATURES HAVE BEEN AFFIXED (If the same are not appearing in the pdf) AT APPROPRIATE COLUMNS OF THE PRINTOUT OF THE EXAM FORM.7 - ADDRESS HAS BEEN RECORDED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.8 - IN CASE THE PDF IS NOT CONTAINING THE PHOTO/SIGNATURE THEN CANDIDATE HAS TO GET THE DECLARATION SIGNED AND PDF IS GOT ATTESTED.9 - RETAIN A COPY OF THE PDF/FILLED-IN FORM FOR YOUR FUTURE REFERENCE.10 - IN CASE THE PHOTO/SIGN IS NOT APPEARING IN THE PDF, PLEASE TAKE ATTESTATIONS AND SEND THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION BY SPEED POST/REGISTERED POST ONLY.11 - KEEP IN SAFE CUSTODY THE SPEED POST/REGISTERED POST RECEIPT ISSUED BY POSTAL AUTHORITY FOR SENDING THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION FORM TO THE INSTITUTE/ RECEIPT ISSUED BY ICAI IN CASE THE APPLICATION IS DEPOSITED BY HAND.Regards,Scholar For CA089773 13131Like us on facebookScholar for ca,cma,cs https://m.facebook.com/scholarca...Sambamurthy Nagar, 5th Street, Kakinada, Andhra Pradesh 533003https://g.co/kgs/VaK6g0

-

How do I fill out the online form on Mymoneysage?

Hi…If you are referring to eCAN form, then please find the below details for your reference.The CAN is a new mutual fund investment identification number using which investor can hold schemes from different AMCs. To utilise the services of Mymoneysage (Client)for investing in direct plans of mutual funds, you require a CAN. If you want to invest as a single holder in some schemes and as joint holders in others, then you will need two CANs to do so.For eCAN, you need to provide some basic details in the form like1) CAN holder type2) Demographic Details3) Bank details (in which you want to transact with)4) And Nominee details.Applying eCAN is completely Free.To apply one please visit Log In

-

How can we fill out an online ATM form?

Have you asked your bank? I am unsure of what you want to accomplish. If you have an acount you can transfer funds online; from savings to checking via bill pay. Otherwise I can not tell you how to solve your problem. Sorry that I am unable to help, perhaps someone else can.

Create this form in 5 minutes!

How to create an eSignature for the schedule e worksheet online form

How to generate an eSignature for your Schedule E Worksheet Online Form in the online mode

How to generate an electronic signature for your Schedule E Worksheet Online Form in Google Chrome

How to generate an electronic signature for putting it on the Schedule E Worksheet Online Form in Gmail

How to generate an electronic signature for the Schedule E Worksheet Online Form straight from your mobile device

How to generate an eSignature for the Schedule E Worksheet Online Form on iOS devices

How to make an electronic signature for the Schedule E Worksheet Online Form on Android

People also ask

-

What is a Schedule E Worksheet and why do I need it?

A Schedule E Worksheet is a crucial form used for reporting supplemental income, such as rental properties or royalties, on your tax return. By utilizing the Schedule E Worksheet, you can organize your income and expenses effectively, ensuring compliance with IRS regulations while maximizing your deductions.

-

How can airSlate SignNow help me with my Schedule E Worksheet?

AirSlate SignNow offers a streamlined solution for sending and eSigning your Schedule E Worksheet. With our easy-to-use platform, you can quickly share your worksheet with clients or tax professionals, facilitating collaboration and making the process more efficient.

-

Is there a cost to use airSlate SignNow for my Schedule E Worksheet?

Yes, airSlate SignNow offers various pricing plans to fit your business needs. Our cost-effective solutions ensure that you can manage your Schedule E Worksheet and other documents without breaking the bank. Check our pricing page for more details on available plans.

-

Can I integrate airSlate SignNow with my accounting software for my Schedule E Worksheet?

Absolutely! AirSlate SignNow seamlessly integrates with popular accounting software, allowing you to manage your Schedule E Worksheet more effectively. This integration helps streamline your workflow, ensuring that all your financial documents are in sync and easily accessible.

-

What features does airSlate SignNow offer for managing my Schedule E Worksheet?

AirSlate SignNow provides robust features for managing your Schedule E Worksheet, including customizable templates, electronic signatures, and real-time tracking. These features enhance your document management process, making it easier to handle your tax documents efficiently.

-

How secure is my data when using airSlate SignNow for my Schedule E Worksheet?

Your data security is our top priority at airSlate SignNow. When managing your Schedule E Worksheet, we implement advanced encryption and security protocols to protect your sensitive information, ensuring that your documents are safe and confidential.

-

Can I access my Schedule E Worksheet on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage your Schedule E Worksheet from anywhere. Whether you’re on the go or at home, our mobile app ensures that you can handle your documents seamlessly.

Get more for Schedule E Worksheet

Find out other Schedule E Worksheet

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now