Irs Non Filing Form

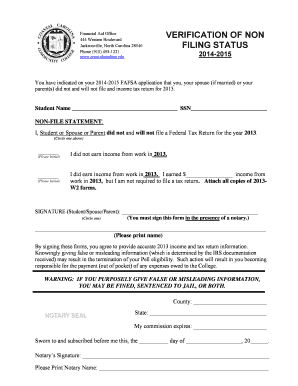

What is the IRS Non Filing Form

The IRS non filing letter is an official document issued by the Internal Revenue Service to individuals who are not required to file a federal income tax return for a specific tax year. This letter serves as verification that the individual has no filing obligations, which can be essential for various purposes, such as applying for loans, government assistance, or other financial services. The letter confirms the taxpayer's status and provides peace of mind regarding their tax responsibilities.

How to Use the IRS Non Filing Form

The IRS non filing letter can be utilized in several situations. For instance, if you are applying for a loan or financial aid, lenders may request proof of your tax status. The letter confirms that you are not required to file a return, which can help streamline the application process. Additionally, it may be necessary for verifying income when applying for government assistance programs or other financial benefits.

Steps to Complete the IRS Non Filing Form

Completing the IRS non filing form involves several key steps:

- Gather necessary personal information, including your Social Security number and tax year in question.

- Visit the IRS website or contact the IRS to request the non filing letter.

- Provide any required documentation that supports your request, such as proof of income or other relevant information.

- Submit your request through the designated method, either online or via mail, as specified by the IRS.

Legal Use of the IRS Non Filing Form

The IRS non filing letter holds legal significance, as it serves as official documentation from the IRS regarding your tax status. This letter can be used in legal contexts, such as when verifying your financial situation in court or during audits. It is crucial to ensure that the letter is obtained directly from the IRS to maintain its validity and authenticity.

Required Documents

When requesting the IRS non filing letter, certain documents may be necessary to support your application. These typically include:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN).

- Proof of identity, such as a driver's license or state ID.

- Any relevant tax documents that may help substantiate your non-filing status.

Eligibility Criteria

To qualify for an IRS non filing letter, you must meet specific criteria. Generally, individuals who earn below the minimum income threshold set by the IRS for a given tax year are eligible. Additionally, certain life circumstances, such as being a dependent or having no taxable income, may also qualify you for this status. It is essential to review the IRS guidelines to determine your eligibility accurately.

Quick guide on how to complete irs non filing form

Finish Irs Non Filing Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without any hold-ups. Manage Irs Non Filing Form on any system with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to alter and eSign Irs Non Filing Form with ease

- Find Irs Non Filing Form and click Get Form to initiate.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misdirected documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Irs Non Filing Form and ensure great communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs non filing form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS non filing letter?

An IRS non filing letter is an official document issued by the IRS stating that an individual or business has not filed their tax return for a specific year. This letter can be crucial for clarifying tax status, applying for loans, or fulfilling financial obligations.

-

How can airSlate SignNow help with IRS non filing letters?

AirSlate SignNow enables users to easily create, send, and eSign documents, including IRS non filing letters. Our platform streamlines the process, allowing for quick submissions and efficient management of all your important tax documents.

-

Is airSlate SignNow affordable for small businesses needing IRS non filing letters?

Yes, airSlate SignNow offers a cost-effective solution tailored for small businesses, allowing you to manage IRS non filing letters without breaking the bank. Our competitively priced plans ensure that you have access to essential features without excessive costs.

-

What features does airSlate SignNow offer for handling IRS non filing letters?

Our platform provides a range of features for handling IRS non filing letters, including customizable templates, secure eSigning, and document tracking. This ensures that your letters are not only compliant but also processed quickly and efficiently.

-

Can I integrate airSlate SignNow with other applications for IRS non filing letters?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance your workflow for IRS non filing letters. Whether you use CRM software or cloud storage solutions, our integrations help streamline document management.

-

How secure is my information when using airSlate SignNow for IRS non filing letters?

Security is a top priority at airSlate SignNow. When you use our platform for IRS non filing letters, your information is protected with industry-standard encryption protocols and secure storage solutions to keep your documents safe.

-

How long does it take to create and send an IRS non filing letter using airSlate SignNow?

Creating and sending an IRS non filing letter with airSlate SignNow can take just a few minutes. Our user-friendly interface allows for quick document preparation, enabling you to focus on other important tasks.

Get more for Irs Non Filing Form

Find out other Irs Non Filing Form

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later

- Sign Oklahoma LLC Operating Agreement Safe