Indiana State Form 96 2010

What is the Indiana State Form 96

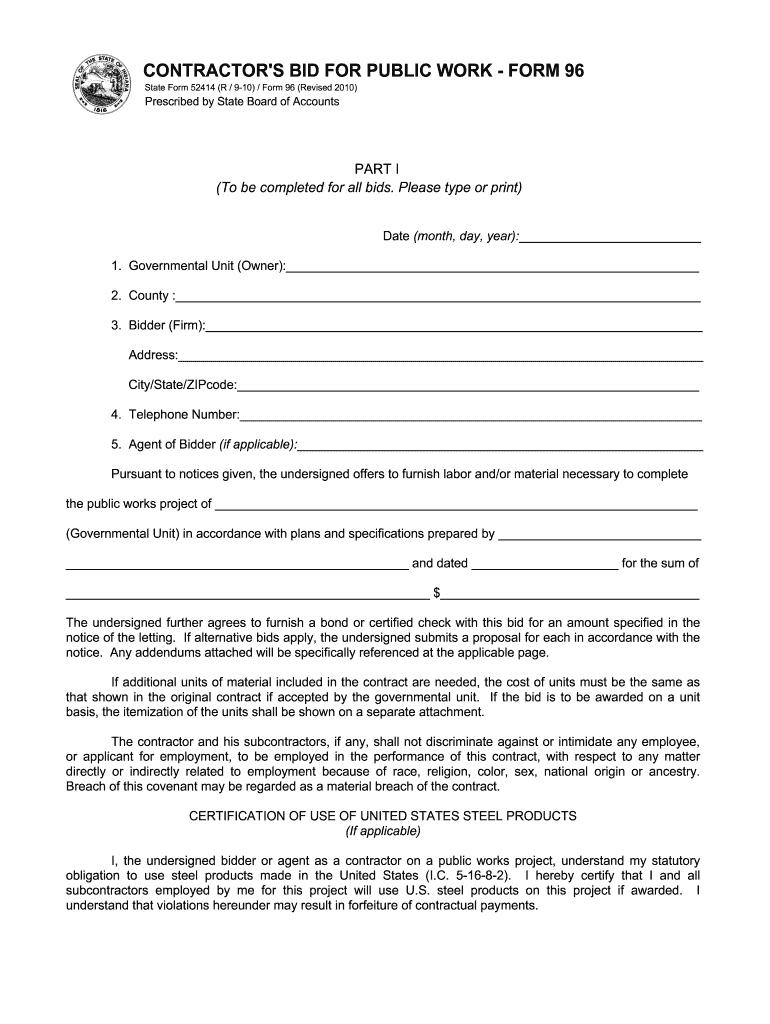

The Indiana State Form 96 is a legal document used primarily for the purpose of requesting a variance from the Indiana Department of Local Government Finance. This form is essential for property owners or developers seeking adjustments to property tax assessments or zoning regulations. By submitting this form, individuals can formally present their case for why a variance should be granted, ensuring their requests are documented and processed according to state regulations.

How to use the Indiana State Form 96

To effectively use the Indiana State Form 96, individuals must first ensure they meet the eligibility criteria for filing a variance request. After confirming eligibility, the next step involves accurately completing the form, which requires detailed information about the property, the nature of the requested variance, and supporting documentation. Once completed, the form should be submitted to the appropriate local government office for review. It is advisable to keep copies of all submitted documents for personal records.

Steps to complete the Indiana State Form 96

Completing the Indiana State Form 96 involves several key steps:

- Gather necessary information about the property, including its location, current zoning classification, and any previous variance requests.

- Clearly outline the specific variance being requested and the reasons for the request, ensuring to reference any applicable local ordinances.

- Attach any required supporting documents, such as site plans or photographs, that substantiate the request.

- Review the completed form for accuracy and completeness before submission.

- Submit the form to the local government office responsible for processing variance requests.

Legal use of the Indiana State Form 96

The legal use of the Indiana State Form 96 is governed by state laws and local ordinances. It is crucial that the form is filled out in compliance with these regulations to ensure its validity. Proper use includes providing truthful information and adhering to deadlines set by local authorities. Failure to comply with legal requirements can result in the denial of the variance request or potential penalties.

Key elements of the Indiana State Form 96

Key elements of the Indiana State Form 96 include:

- Property Information: Details about the property in question, including address and current zoning.

- Variance Request: A clear description of the variance being sought and the rationale behind it.

- Supporting Documentation: Any additional materials that support the request, such as diagrams or photographs.

- Signature and Date: The applicant's signature confirming the accuracy of the information provided.

Form Submission Methods

The Indiana State Form 96 can typically be submitted through various methods, depending on local regulations. Common submission methods include:

- Online Submission: Some jurisdictions may allow for electronic filing through their official websites.

- Mail: The completed form can be mailed to the appropriate local government office.

- In-Person Submission: Individuals may also choose to deliver the form in person to ensure immediate receipt and to address any questions directly.

Quick guide on how to complete indiana state form 96

Manage Indiana State Form 96 from any location, at any time

Your everyday organizational tasks may necessitate additional attention when handling state-specific business documents. Reclaim your working hours and minimize the expenses related to document-intensive processes with airSlate SignNow. airSlate SignNow provides you with numerous pre-made business templates, such as Indiana State Form 96, which you can utilize and share with your business associates. Manage your Indiana State Form 96 effortlessly with powerful editing and eSignature features and send it directly to your recipients.

How to obtain Indiana State Form 96 in just a few clicks:

- Select a form pertinent to your state.

- Click Learn More to view the document and verify its accuracy.

- Choose Get Form to begin using it.

- Indiana State Form 96 will automatically open in the editor, with no further steps required.

- Utilize airSlate SignNow’s sophisticated editing tools to complete or modify the form.

- Click the Sign tool to create your signature and eSign the document.

- When ready, click Done, save the changes, and access your file.

- Email or SMS the form, or use a link-to-fill option with partners, or allow them to download the document.

airSlate SignNow greatly reduces the time spent managing Indiana State Form 96 and enables you to find important documents in one centralized location. An extensive catalog of forms is organized and designed to facilitate essential business processes required for your operations. The advanced editor minimizes errors, allowing you to easily correct mistakes and review your documents on any device before sending them out. Start your free trial today to discover all the advantages of airSlate SignNow for your daily organizational workflows.

Create this form in 5 minutes or less

Find and fill out the correct indiana state form 96

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Do you have to fill out a separate form to avail state quota in NEET?

No..you dont have to fill form..But you have to register yourself in directorate of medical education/DME of your state for state quota counselling process..DME Will issue notice regarding process, date, of 1st round of counsellingCounselling schedule have info regarding date for registration , process of counselling etc.You will have to pay some amount of fee at the time of registration as registration fee..As soon as neet result is out..check for notification regarding counselling on DmE site..Hope this helpBest wishes dear.

-

Do I need to fill out the state admission form to participate in state counselling in the NEET UG 2018?

There is two way to participate in state counseling》Fill the state quota counseling admission form(for 15% quota) and give the preference to your own state with this if your marks are higher and if you are eligible to get admission in your state then you will get the college.》Fill out the form for state counseling like karnataka state counseling has started and Rajasthan counseling will start from 18th june.In 2nd way you will fill the form for 85% state quota and has higher chances to get college in your own state.NOTE= YOU WILL GET COLLEGE IN OTHER STATE (IN 15% QUOTA) WHEN YOU WILL CROSS THE PARTICULAR CUT OFF OF THE NEET AND THAT STATE.BEST OF LUCK.PLEASE DO FOLLOW ME ON QUORA.

Create this form in 5 minutes!

How to create an eSignature for the indiana state form 96

How to create an eSignature for the Indiana State Form 96 in the online mode

How to make an eSignature for the Indiana State Form 96 in Google Chrome

How to generate an eSignature for signing the Indiana State Form 96 in Gmail

How to make an eSignature for the Indiana State Form 96 straight from your smart phone

How to generate an eSignature for the Indiana State Form 96 on iOS

How to make an electronic signature for the Indiana State Form 96 on Android

People also ask

-

What is the Indiana State Form 96?

The Indiana State Form 96 is a state-specific document used for various administrative purposes, such as business registrations and tax reporting. Understanding its requirements is crucial for compliance in Indiana. Using airSlate SignNow, you can easily create, send, and eSign this form digitally.

-

How can airSlate SignNow help with Indiana State Form 96?

airSlate SignNow simplifies the process of handling the Indiana State Form 96 by allowing users to electronically sign and send documents securely. The platform streamlines workflows, reduces errors, and enhances overall efficiency in document management. This ensures your Indiana State Form 96 is processed smoothly.

-

Is there a cost associated with using airSlate SignNow for Indiana State Form 96?

Yes, there is a competitive pricing structure for using airSlate SignNow that can fit various budgets. You can choose from different subscription plans based on your business needs and usage frequency. This ensures that you can file the Indiana State Form 96 affordably.

-

Are there any features that specifically assist with Indiana State Form 96?

airSlate SignNow offers features like customizable templates and workflow automation, specifically designed to assist users working with documents such as the Indiana State Form 96. These functionalities ensure that your forms are compliant and filled out correctly, saving time and reducing the risk of mistakes.

-

Can I integrate airSlate SignNow with existing software for Indiana State Form 96?

Absolutely! airSlate SignNow provides numerous integrations with popular applications to streamline your workflow, including those used for managing the Indiana State Form 96. This means you can connect it with CRMs, cloud storage, and other tools to enhance productivity and ensure all necessary documents are readily available.

-

What benefits does airSlate SignNow offer for businesses dealing with Indiana State Form 96?

Using airSlate SignNow allows businesses to save time and resources when dealing with Indiana State Form 96. The platform enhances security by providing encrypted eSigning options, ensuring your sensitive information is protected. Furthermore, it increases accountability with tracking features, making it easier to manage your document processes.

-

How long does it take to complete the Indiana State Form 96 using airSlate SignNow?

With airSlate SignNow, completing the Indiana State Form 96 can take just a few minutes. The user-friendly interface allows you to fill out the form quickly and eSign without needing to print or fax any documents. This speed of processing can signNowly reduce turnaround time.

Get more for Indiana State Form 96

Find out other Indiana State Form 96

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online

- How To eSign Michigan Life-Insurance Quote Form

- Can I eSign Colorado Business Insurance Quotation Form

- Can I eSign Hawaii Certeficate of Insurance Request

- eSign Nevada Certeficate of Insurance Request Now

- Can I eSign Missouri Business Insurance Quotation Form

- How Do I eSign Nevada Business Insurance Quotation Form

- eSign New Mexico Business Insurance Quotation Form Computer

- eSign Tennessee Business Insurance Quotation Form Computer

- How To eSign Maine Church Directory Form

- How To eSign New Hampshire Church Donation Giving Form