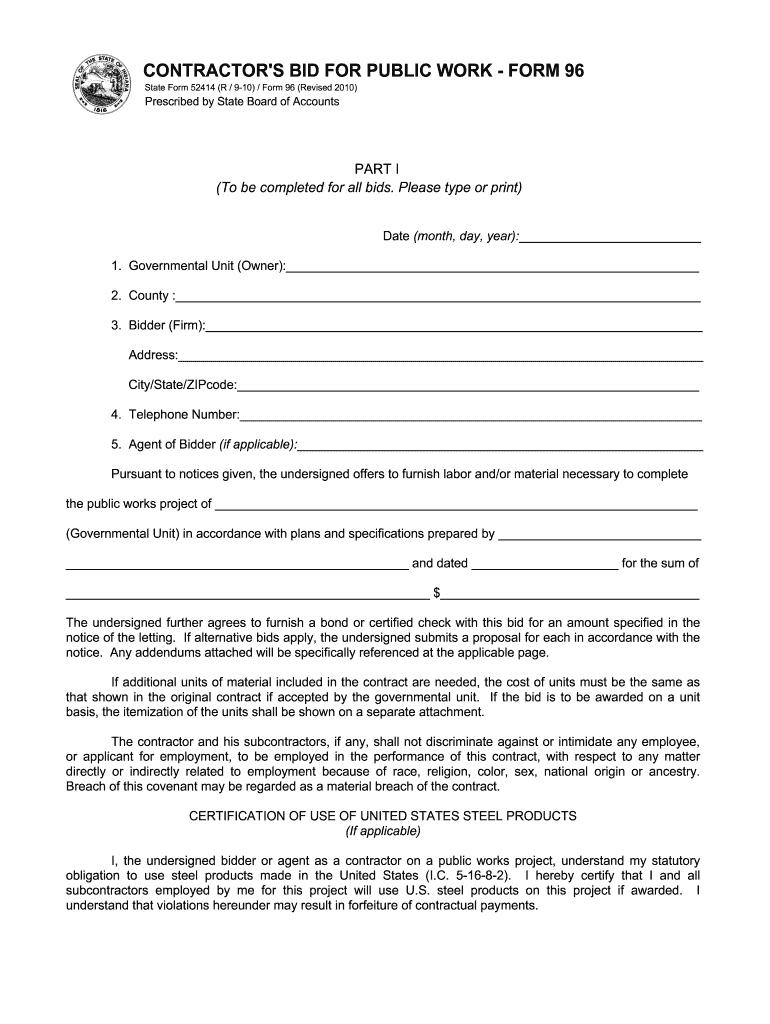

Indiana State Form 96 2010

What is the Indiana State Form 96

The Indiana State Form 96 is a legal document used primarily for the purpose of requesting a variance from the Indiana Department of Local Government Finance. This form is essential for property owners or developers seeking adjustments to property tax assessments or zoning regulations. By submitting this form, individuals can formally present their case for why a variance should be granted, ensuring their requests are documented and processed according to state regulations.

How to use the Indiana State Form 96

To effectively use the Indiana State Form 96, individuals must first ensure they meet the eligibility criteria for filing a variance request. After confirming eligibility, the next step involves accurately completing the form, which requires detailed information about the property, the nature of the requested variance, and supporting documentation. Once completed, the form should be submitted to the appropriate local government office for review. It is advisable to keep copies of all submitted documents for personal records.

Steps to complete the Indiana State Form 96

Completing the Indiana State Form 96 involves several key steps:

- Gather necessary information about the property, including its location, current zoning classification, and any previous variance requests.

- Clearly outline the specific variance being requested and the reasons for the request, ensuring to reference any applicable local ordinances.

- Attach any required supporting documents, such as site plans or photographs, that substantiate the request.

- Review the completed form for accuracy and completeness before submission.

- Submit the form to the local government office responsible for processing variance requests.

Legal use of the Indiana State Form 96

The legal use of the Indiana State Form 96 is governed by state laws and local ordinances. It is crucial that the form is filled out in compliance with these regulations to ensure its validity. Proper use includes providing truthful information and adhering to deadlines set by local authorities. Failure to comply with legal requirements can result in the denial of the variance request or potential penalties.

Key elements of the Indiana State Form 96

Key elements of the Indiana State Form 96 include:

- Property Information: Details about the property in question, including address and current zoning.

- Variance Request: A clear description of the variance being sought and the rationale behind it.

- Supporting Documentation: Any additional materials that support the request, such as diagrams or photographs.

- Signature and Date: The applicant's signature confirming the accuracy of the information provided.

Form Submission Methods

The Indiana State Form 96 can typically be submitted through various methods, depending on local regulations. Common submission methods include:

- Online Submission: Some jurisdictions may allow for electronic filing through their official websites.

- Mail: The completed form can be mailed to the appropriate local government office.

- In-Person Submission: Individuals may also choose to deliver the form in person to ensure immediate receipt and to address any questions directly.

Quick guide on how to complete indiana state form 96

Manage Indiana State Form 96 from any location, at any time

Your everyday organizational tasks may necessitate additional attention when handling state-specific business documents. Reclaim your working hours and minimize the expenses related to document-intensive processes with airSlate SignNow. airSlate SignNow provides you with numerous pre-made business templates, such as Indiana State Form 96, which you can utilize and share with your business associates. Manage your Indiana State Form 96 effortlessly with powerful editing and eSignature features and send it directly to your recipients.

How to obtain Indiana State Form 96 in just a few clicks:

- Select a form pertinent to your state.

- Click Learn More to view the document and verify its accuracy.

- Choose Get Form to begin using it.

- Indiana State Form 96 will automatically open in the editor, with no further steps required.

- Utilize airSlate SignNow’s sophisticated editing tools to complete or modify the form.

- Click the Sign tool to create your signature and eSign the document.

- When ready, click Done, save the changes, and access your file.

- Email or SMS the form, or use a link-to-fill option with partners, or allow them to download the document.

airSlate SignNow greatly reduces the time spent managing Indiana State Form 96 and enables you to find important documents in one centralized location. An extensive catalog of forms is organized and designed to facilitate essential business processes required for your operations. The advanced editor minimizes errors, allowing you to easily correct mistakes and review your documents on any device before sending them out. Start your free trial today to discover all the advantages of airSlate SignNow for your daily organizational workflows.

Create this form in 5 minutes or less

Find and fill out the correct indiana state form 96

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Do you have to fill out a separate form to avail state quota in NEET?

No..you dont have to fill form..But you have to register yourself in directorate of medical education/DME of your state for state quota counselling process..DME Will issue notice regarding process, date, of 1st round of counsellingCounselling schedule have info regarding date for registration , process of counselling etc.You will have to pay some amount of fee at the time of registration as registration fee..As soon as neet result is out..check for notification regarding counselling on DmE site..Hope this helpBest wishes dear.

-

Do I need to fill out the state admission form to participate in state counselling in the NEET UG 2018?

There is two way to participate in state counseling》Fill the state quota counseling admission form(for 15% quota) and give the preference to your own state with this if your marks are higher and if you are eligible to get admission in your state then you will get the college.》Fill out the form for state counseling like karnataka state counseling has started and Rajasthan counseling will start from 18th june.In 2nd way you will fill the form for 85% state quota and has higher chances to get college in your own state.NOTE= YOU WILL GET COLLEGE IN OTHER STATE (IN 15% QUOTA) WHEN YOU WILL CROSS THE PARTICULAR CUT OFF OF THE NEET AND THAT STATE.BEST OF LUCK.PLEASE DO FOLLOW ME ON QUORA.

Create this form in 5 minutes!

How to create an eSignature for the indiana state form 96

How to create an eSignature for the Indiana State Form 96 in the online mode

How to make an eSignature for the Indiana State Form 96 in Google Chrome

How to generate an eSignature for signing the Indiana State Form 96 in Gmail

How to make an eSignature for the Indiana State Form 96 straight from your smart phone

How to generate an eSignature for the Indiana State Form 96 on iOS

How to make an electronic signature for the Indiana State Form 96 on Android

People also ask

-

What is the Indiana State Form 96 and how can it be used with airSlate SignNow?

The Indiana State Form 96 is a specific document used for various legal and administrative purposes in Indiana. With airSlate SignNow, you can easily fill out, send, and eSign the Indiana State Form 96, streamlining your document management process and ensuring compliance with state regulations.

-

How does airSlate SignNow simplify the completion of the Indiana State Form 96?

airSlate SignNow simplifies the completion of the Indiana State Form 96 by providing a user-friendly interface that allows you to fill out the form digitally. You can add signatures, initials, and other required information directly on the form, reducing the time spent on paperwork and helping you stay organized.

-

What are the pricing options for using airSlate SignNow to manage the Indiana State Form 96?

airSlate SignNow offers flexible pricing plans that cater to different business needs while managing documents like the Indiana State Form 96. Whether you're a small business or a larger organization, you can choose a plan that suits your budget, ensuring you get the best value for your eSigning and document management needs.

-

Can I integrate airSlate SignNow with other software to streamline my Indiana State Form 96 processes?

Yes, airSlate SignNow offers seamless integrations with various software applications, allowing you to streamline your workflows involving the Indiana State Form 96. By connecting with your existing tools, such as CRM systems or cloud storage, you can enhance your document management efficiency.

-

What benefits does airSlate SignNow provide for electronic signing of the Indiana State Form 96?

Using airSlate SignNow for electronic signing of the Indiana State Form 96 provides numerous benefits, including faster turnaround times and improved security. E-signatures are legally binding and compliant, ensuring your documents are processed quickly and safely.

-

Is airSlate SignNow compliant with Indiana state laws for the Indiana State Form 96?

Absolutely! airSlate SignNow is fully compliant with Indiana state laws regarding electronic signatures, making it a reliable choice for managing the Indiana State Form 96. You can trust that your signed documents meet all legal requirements, which is crucial for business operations.

-

How can I ensure my Indiana State Form 96 is secure when using airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including the Indiana State Form 96, through advanced encryption and secure data storage. With multiple layers of security, you can confidently send and sign documents without worrying about unauthorized access.

Get more for Indiana State Form 96

Find out other Indiana State Form 96

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template