About Form 8843, Statement for Exempt Individuals and IRS

What is the About Form 8843, Statement For Exempt Individuals And IRS

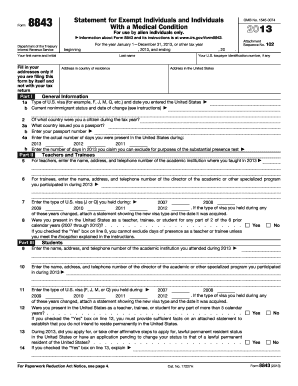

The About Form 8843, Statement for Exempt Individuals and IRS, is a tax form used by certain non-resident aliens to explain their status and claim exemptions from certain tax requirements. This form is particularly relevant for individuals such as students, teachers, and researchers who may qualify for exemptions under specific tax treaties or provisions. By filing this form, these individuals can clarify their non-resident status and avoid unnecessary taxation on income earned in the United States.

How to use the About Form 8843, Statement For Exempt Individuals And IRS

Using the About Form 8843 involves providing accurate information regarding your residency status and the purpose of your stay in the United States. It is essential to complete the form thoroughly, ensuring that all sections are filled out correctly to reflect your situation. This form can be filed alongside other tax forms, such as Form 1040NR, to support your claims for tax exemptions. Proper usage of this form helps to ensure compliance with IRS regulations and prevents potential issues with your tax filings.

Steps to complete the About Form 8843, Statement For Exempt Individuals And IRS

Completing the About Form 8843 requires several steps:

- Gather necessary information, including your identification details, visa status, and the purpose of your stay.

- Fill out the form accurately, ensuring that each section reflects your current situation.

- Review the completed form for any errors or omissions.

- Submit the form along with any required supporting documents by the appropriate deadline.

Following these steps carefully can help ensure that your filing is correct and compliant with IRS requirements.

Legal use of the About Form 8843, Statement For Exempt Individuals And IRS

The legal use of the About Form 8843 is crucial for maintaining compliance with U.S. tax laws. This form serves as a declaration of your non-resident status and the exemptions you are claiming. It is essential to file this form accurately to avoid penalties or issues with the IRS. The form must be submitted in accordance with IRS guidelines to ensure it is legally recognized and accepted.

Filing Deadlines / Important Dates

Filing deadlines for the About Form 8843 are typically aligned with the tax filing season. Generally, the form must be submitted by April 15 of the year following the tax year in question. If you are a non-resident alien who has been granted an extension for filing your tax return, you may also extend the deadline for submitting Form 8843. It is important to stay informed about specific deadlines to avoid late filing penalties.

Required Documents

When completing the About Form 8843, certain documents may be required to support your claims. These may include:

- Copy of your visa or immigration documents.

- Proof of enrollment or employment in the U.S.

- Any relevant tax treaty documentation.

Having these documents on hand can facilitate the completion of the form and ensure that all necessary information is accurately reported.

Eligibility Criteria

Eligibility to use the About Form 8843 generally applies to non-resident aliens who are in the U.S. under specific visa categories, such as F-1, J-1, or M-1. Individuals must demonstrate that they meet the criteria for exemption from certain tax obligations. This includes proving that they have not exceeded the allowable number of days in the U.S. and that their primary purpose for being in the country aligns with the exemptions claimed on the form.

Quick guide on how to complete about form 8843 statement for exempt individuals and irs

Complete About Form 8843, Statement For Exempt Individuals And IRS effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage About Form 8843, Statement For Exempt Individuals And IRS on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign About Form 8843, Statement For Exempt Individuals And IRS with ease

- Locate About Form 8843, Statement For Exempt Individuals And IRS and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign About Form 8843, Statement For Exempt Individuals And IRS to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 8843 statement for exempt individuals and irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8843, Statement For Exempt Individuals And IRS?

Form 8843, Statement For Exempt Individuals And IRS, is a document for certain nonresident aliens and foreign students to claim exemption from the substantial presence test in the U.S. It helps them avoid being classified as U.S. residents for tax purposes. Completing this form is crucial for maintaining your non-resident status.

-

Who needs to file Form 8843?

Individuals who are in the U.S. under specific exemptions, such as students, teachers, or trainees, must file Form 8843. This includes those on F, J, M, or Q visas who wish to demonstrate their exempt status. Filing this form ensures compliance with IRS regulations regarding non-resident aliens.

-

How can airSlate SignNow facilitate the signing of Form 8843?

airSlate SignNow empowers users to easily send and eSign Form 8843, Statement For Exempt Individuals And IRS, without cumbersome paperwork. The platform’s intuitive interface allows for quick document preparation and secure electronic signatures. This streamlines the process and ensures timely submissions to the IRS.

-

What are the benefits of using airSlate SignNow for Form 8843?

Using airSlate SignNow for Form 8843 offers numerous benefits, including enhanced security, ease of use, and time savings. You can access the platform from anywhere, making it convenient for international students. Additionally, real-time tracking of your document’s status ensures you don’t miss any deadlines.

-

Is there a cost associated with using airSlate SignNow for Form 8843?

Yes, airSlate SignNow offers various pricing plans to suit different user needs, including plans for individuals and businesses. The cost is competitive, providing considerable value for the features offered. By investing in airSlate SignNow, you get a reliable platform for managing your Form 8843 and other crucial documents.

-

Can I integrate airSlate SignNow with other tools for filing Form 8843?

Absolutely! airSlate SignNow integrates seamlessly with numerous business tools and applications, enhancing your workflow when dealing with Form 8843. Whether you use Cloud storage or project management tools, airSlate SignNow ensures that you can manage documents efficiently across platforms.

-

How does airSlate SignNow ensure the security of Form 8843 submissions?

airSlate SignNow employs industry-standard encryption and security protocols to protect all documents, including Form 8843, Statement For Exempt Individuals And IRS. We prioritize user data privacy and ensure compliance with relevant regulations. Rest assured, your information is safe when using our platform.

Get more for About Form 8843, Statement For Exempt Individuals And IRS

Find out other About Form 8843, Statement For Exempt Individuals And IRS

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile