Withholding Tax Payments Line Instructions for Completing Form WH 1 2015

What is the Withholding Tax Payments Line Instructions For Completing Form WH-1

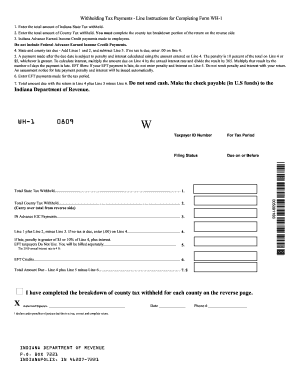

The Withholding Tax Payments Line Instructions for Completing Form WH-1 provides essential guidance for individuals and businesses required to report and remit withholding taxes. This form is primarily used by employers to report federal income tax withheld from employee wages, as well as other withholding obligations. Understanding the instructions is crucial for ensuring compliance with tax regulations and avoiding potential penalties.

Steps to Complete the Withholding Tax Payments Line Instructions For Completing Form WH-1

Completing the Withholding Tax Payments Line Instructions for Form WH-1 involves several key steps:

- Gather necessary information, including employer identification number (EIN), total wages paid, and amounts withheld.

- Carefully read each line of the instructions to understand what information is required.

- Fill out the form accurately, ensuring that all figures are correct and match your payroll records.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the designated deadline to avoid penalties.

Legal Use of the Withholding Tax Payments Line Instructions For Completing Form WH-1

The legal use of the Withholding Tax Payments Line Instructions for Completing Form WH-1 is vital for compliance with federal tax laws. The form must be filled out accurately and submitted on time to avoid legal repercussions. Additionally, electronic filing options are available, which can streamline the process and ensure that submissions are received promptly.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Withholding Tax Payments Line Instructions for Completing Form WH-1 is essential to avoid penalties. Typically, employers must submit their withholding tax payments on a monthly or quarterly basis, depending on their tax liability. It is important to check the IRS guidelines for specific due dates to ensure timely compliance.

Who Issues the Form

The Withholding Tax Payments Line Instructions for Completing Form WH-1 is issued by the Internal Revenue Service (IRS). The IRS provides these instructions to assist taxpayers in accurately reporting their withholding tax obligations. It is important to refer to the latest version of the form and instructions to ensure compliance with current regulations.

Penalties for Non-Compliance

Failure to comply with the Withholding Tax Payments Line Instructions for Completing Form WH-1 can result in significant penalties. These may include fines for late submissions, interest on unpaid taxes, and additional charges for inaccuracies. Employers should prioritize timely and accurate reporting to mitigate these risks.

Quick guide on how to complete withholding tax payments line instructions for completing form wh 1

Complete Withholding Tax Payments Line Instructions For Completing Form WH 1 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it on the web. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Handle Withholding Tax Payments Line Instructions For Completing Form WH 1 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Withholding Tax Payments Line Instructions For Completing Form WH 1 with ease

- Obtain Withholding Tax Payments Line Instructions For Completing Form WH 1 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight relevant sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Withholding Tax Payments Line Instructions For Completing Form WH 1 while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct withholding tax payments line instructions for completing form wh 1

Create this form in 5 minutes!

How to create an eSignature for the withholding tax payments line instructions for completing form wh 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Withholding Tax Payments Line Instructions For Completing Form WH 1?

The Withholding Tax Payments Line Instructions For Completing Form WH 1 provide detailed guidance on how to accurately fill out the form. This includes specific instructions on reporting withheld taxes and ensuring compliance with state regulations, making it essential for businesses managing payroll.

-

How can airSlate SignNow assist with Withholding Tax Payments Line Instructions For Completing Form WH 1?

airSlate SignNow offers intuitive eSigning and document management tools that simplify the process of completing and submitting Form WH 1. By streamlining your document workflows, it helps ensure that your Withholding Tax Payments are processed accurately and on time, reducing the risk of errors.

-

What is the pricing structure for using airSlate SignNow for Withholding Tax Payments?

airSlate SignNow provides a variety of pricing plans tailored to meet the needs of businesses managing their Withholding Tax Payments. Our flexible pricing ensures you get the features you need to efficiently navigate the complexities of Form WH 1 without breaking the bank.

-

Are there specific features in airSlate SignNow that cater to Withholding Tax Payments?

Yes, airSlate SignNow includes features designed to facilitate Withholding Tax Payments, such as automated reminders for payment due dates and customizable templates for Form WH 1. These tools enhance your workflow efficiency and ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other financial software for managing Withholding Tax Payments?

Absolutely! airSlate SignNow seamlessly integrates with various financial and accounting software, making it easy to manage Withholding Tax Payments. This integration simplifies data sharing and helps keep your records organized, particularly when completing Form WH 1.

-

What are the benefits of using airSlate SignNow for Withholding Tax Payments?

Using airSlate SignNow for Withholding Tax Payments streamlines document processing and enhances compliance with tax obligations. It reduces the time spent on paperwork and allows businesses to focus on core activities, ensuring that Form WH 1 is completed accurately and efficiently.

-

Is airSlate SignNow secure for handling sensitive Withholding Tax Payments information?

Yes, airSlate SignNow prioritizes the security of your sensitive data, including Withholding Tax Payments information. With industry-standard encryption protocols and secure cloud storage, it ensures that your information related to Form WH 1 is protected from unauthorized access.

Get more for Withholding Tax Payments Line Instructions For Completing Form WH 1

- Framing inspection checklist 422059741 form

- Police report 76505341 form

- Form ps 31174 2

- Pmsby form

- Ebiz meezan form

- Form cd410 ampquotnotice of intent to dissolveampquot georgia

- Chatham county georgia alarm registration fees annual renewal chathamcounty form

- Robeson county nc demo permit application form

Find out other Withholding Tax Payments Line Instructions For Completing Form WH 1

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe