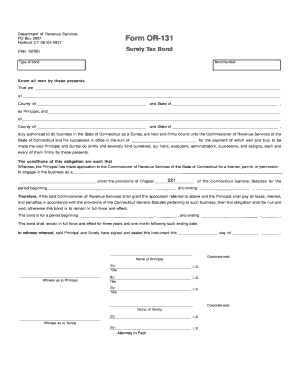

Form or 131

What is the Form OR 131

The Form OR 131 is a tax document used in Connecticut for reporting specific financial information to the state’s revenue services. This form is essential for individuals and businesses that need to disclose income, deductions, and other pertinent financial data to comply with state tax regulations. It plays a crucial role in ensuring accurate tax calculations and proper reporting to the Connecticut Department of Revenue Services.

How to use the Form OR 131

Using the Form OR 131 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements, deduction records, and previous tax returns. Next, fill out the form by providing the required information in each section. It is important to follow the instructions carefully to avoid errors that could lead to compliance issues. Once completed, the form can be submitted electronically or via mail, depending on your preference and state guidelines.

Steps to complete the Form OR 131

Completing the Form OR 131 requires careful attention to detail. Start by entering your personal information, such as your name, address, and Social Security number. Then, move on to the income section, where you will report all sources of income. After that, include any deductions you are eligible for, ensuring you have documentation to support your claims. Finally, review the entire form for accuracy before signing and dating it. This thorough approach helps ensure compliance with state tax laws.

Legal use of the Form OR 131

The Form OR 131 is legally binding once it is completed and submitted according to state regulations. It is crucial to understand that providing false information on this form can lead to penalties, including fines or legal action. Therefore, it is essential to ensure that all information is accurate and complete. Utilizing a reliable eSignature solution can further enhance the legal validity of the document, ensuring it meets all necessary compliance standards.

Required Documents

To successfully complete the Form OR 131, certain documents are required. These typically include:

- Income statements, such as W-2s or 1099s

- Documentation for any deductions claimed

- Previous tax returns for reference

- Identification documents, such as a driver's license or Social Security card

Having these documents ready will streamline the process and help ensure accuracy in your submission.

Form Submission Methods

The Form OR 131 can be submitted through various methods, offering flexibility to users. The primary submission options include:

- Online: Many users prefer to submit the form electronically through the Connecticut Department of Revenue Services website, which often provides a faster processing time.

- Mail: Alternatively, the completed form can be printed and mailed to the appropriate state office. Ensure that it is sent to the correct address to avoid delays.

- In-Person: Some individuals may choose to deliver the form in person at designated state offices, allowing for immediate confirmation of receipt.

Choosing the right submission method depends on personal preference and the urgency of processing.

Quick guide on how to complete form or 131

Easily prepare Form OR 131 on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Form OR 131 on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to modify and eSign Form OR 131 effortlessly

- Find Form OR 131 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that task.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal weight as a conventional wet ink signature.

- Review all the information and click the Done button to save your edits.

- Choose how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device you prefer. Modify and eSign Form OR 131 to ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form or 131

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form or 131 and how does it work with airSlate SignNow?

Form or 131 is a document type that can be easily eSigned using airSlate SignNow. This platform allows users to upload, edit, and send the form for electronic signatures, streamlining the approval process.

-

What are the pricing options for using airSlate SignNow with form or 131?

airSlate SignNow offers various pricing plans suitable for different business needs that use form or 131. Each plan includes features that support electronic signing and document management, ensuring you find a cost-effective solution.

-

Can I integrate airSlate SignNow with other tools when using form or 131?

Yes, airSlate SignNow easily integrates with numerous applications when working with form or 131. This feature enhances productivity by allowing users to connect their favorite tools, making document workflows seamless.

-

What are the main features of airSlate SignNow for form or 131?

Key features of airSlate SignNow for form or 131 include easy document signing, templates for repetitive tasks, workflow automation, and secure storage. These functionalities help businesses manage their documents efficiently.

-

How can using airSlate SignNow with form or 131 benefit my business?

Using airSlate SignNow with form or 131 can signNowly improve your document turnaround time. This solution not only enhances efficiency but also reduces costs associated with paper-based signing processes.

-

Is airSlate SignNow secure for handling form or 131?

Absolutely! airSlate SignNow employs advanced security measures to ensure that all documents, including form or 131, are protected. This includes encryption and compliance with various data protection regulations, giving you peace of mind.

-

Can I track the status of my form or 131 using airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your form or 131 throughout the signing process. You can see when it's sent, viewed, and signed, ensuring you are always updated.

Get more for Form OR 131

Find out other Form OR 131

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding