Pay Corptax Oregon Form

What is the Pay Corptax Oregon Form

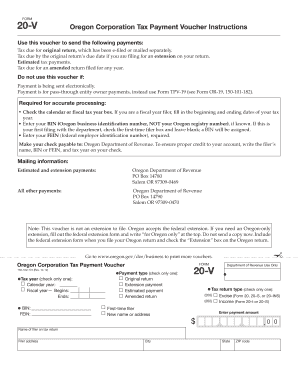

The Pay Corptax Oregon Form is a tax document specifically designed for corporations operating in Oregon. This form is essential for reporting and paying corporate income taxes to the state. Corporations must accurately complete this form to comply with Oregon tax laws and regulations. It captures vital financial information, including income, deductions, and credits, which determine the corporation's tax liability. Understanding the purpose and requirements of this form is crucial for ensuring compliance and avoiding penalties.

How to use the Pay Corptax Oregon Form

Using the Pay Corptax Oregon Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as income statements and expense reports. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. After completing the form, review it for any errors or omissions. Finally, submit the form to the appropriate state office by the designated deadline, either electronically or through traditional mail. Proper use of this form helps maintain compliance with state tax obligations.

Steps to complete the Pay Corptax Oregon Form

Completing the Pay Corptax Oregon Form requires a systematic approach. Follow these steps for a thorough submission:

- Gather Information: Collect all relevant financial data, including revenue, expenses, and previous tax filings.

- Fill Out the Form: Input the required details accurately, ensuring that all sections are completed.

- Review Entries: Double-check all information for accuracy, including figures and calculations.

- Sign and Date: Ensure that the form is signed and dated by an authorized representative of the corporation.

- Submit the Form: Send the completed form to the appropriate Oregon tax authority by the deadline.

Legal use of the Pay Corptax Oregon Form

The Pay Corptax Oregon Form is legally binding when completed and submitted in accordance with Oregon tax laws. For the form to be considered valid, it must be filled out truthfully and accurately. Any misrepresentation or omission of information can lead to legal consequences, including fines or penalties. Corporations are responsible for understanding the legal implications of their submissions and ensuring compliance with all applicable regulations.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Pay Corptax Oregon Form to avoid penalties. Typically, the form is due on the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, the deadline is April 15. It is crucial to stay informed about any changes to deadlines or additional requirements that may arise, ensuring timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Pay Corptax Oregon Form can be submitted through various methods, providing flexibility for corporations. Options include:

- Online Submission: Corporations can file electronically through the Oregon Department of Revenue's online portal, which is often the fastest method.

- Mail Submission: The completed form can be printed and mailed to the designated state office. Ensure that it is postmarked by the filing deadline.

- In-Person Submission: Corporations may also choose to deliver the form in person to their local tax office, although this method may require an appointment.

Quick guide on how to complete pay corptax oregon form

Effortlessly Prepare Pay Corptax Oregon Form on Any Device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your files quickly without delays. Manage Pay Corptax Oregon Form on any platform with the airSlate SignNow apps for Android or iOS, and enhance any document-based workflow today.

Easily Modify and eSign Pay Corptax Oregon Form without Hassle

- Find Pay Corptax Oregon Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just moments and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you prefer. Modify and eSign Pay Corptax Oregon Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pay corptax oregon form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to Pay Corptax Oregon Form using airSlate SignNow?

To Pay Corptax Oregon Form using airSlate SignNow, simply upload your tax document to our platform, sign it electronically, and send it for processing. Our intuitive interface makes it easy to navigate through the entire process. You can also track the status of your submission directly from your dashboard.

-

What are the pricing options for using airSlate SignNow to Pay Corptax Oregon Form?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you're a small business or a large enterprise, you can choose a plan that suits your budget while utilizing features to Pay Corptax Oregon Form efficiently. Check our website for detailed pricing information and any ongoing promotions.

-

Are there any benefits to using airSlate SignNow for the Pay Corptax Oregon Form?

Using airSlate SignNow to Pay Corptax Oregon Form provides you with a fast and secure way to handle your tax documents. You save time and reduce the risk of errors with our eSigning solution. Additionally, all your documentation remains organized and accessible at any time.

-

Can airSlate SignNow integrate with other software to assist in the Pay Corptax Oregon Form process?

Yes, airSlate SignNow integrates seamlessly with a variety of popular software applications, enhancing your workflow when you Pay Corptax Oregon Form. This allows you to effortlessly combine tools and automate various aspects of your business operations. Check our integration page for specific applications.

-

Is there customer support available if I have questions about Pay Corptax Oregon Form?

Absolutely! airSlate SignNow provides dedicated customer support to assist you with any inquiries related to Pay Corptax Oregon Form. Our knowledgeable team is available through chat, email, and phone to ensure you have all the help you need during the process.

-

What security measures does airSlate SignNow implement for Pay Corptax Oregon Form?

airSlate SignNow takes security very seriously, especially when it comes to sensitive documents like the Pay Corptax Oregon Form. We use advanced encryption techniques and secure cloud storage to protect your information. You can trust that your data is safe with us.

-

How can I track the status of my Pay Corptax Oregon Form submission in airSlate SignNow?

After submitting your Pay Corptax Oregon Form via airSlate SignNow, you can easily track its status from your dashboard. Our platform provides real-time updates, so you will be notified of any changes or completions. This feature helps keep you informed throughout the process.

Get more for Pay Corptax Oregon Form

Find out other Pay Corptax Oregon Form

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later