St 9a Worksheet Form

What is the St 9a Worksheet

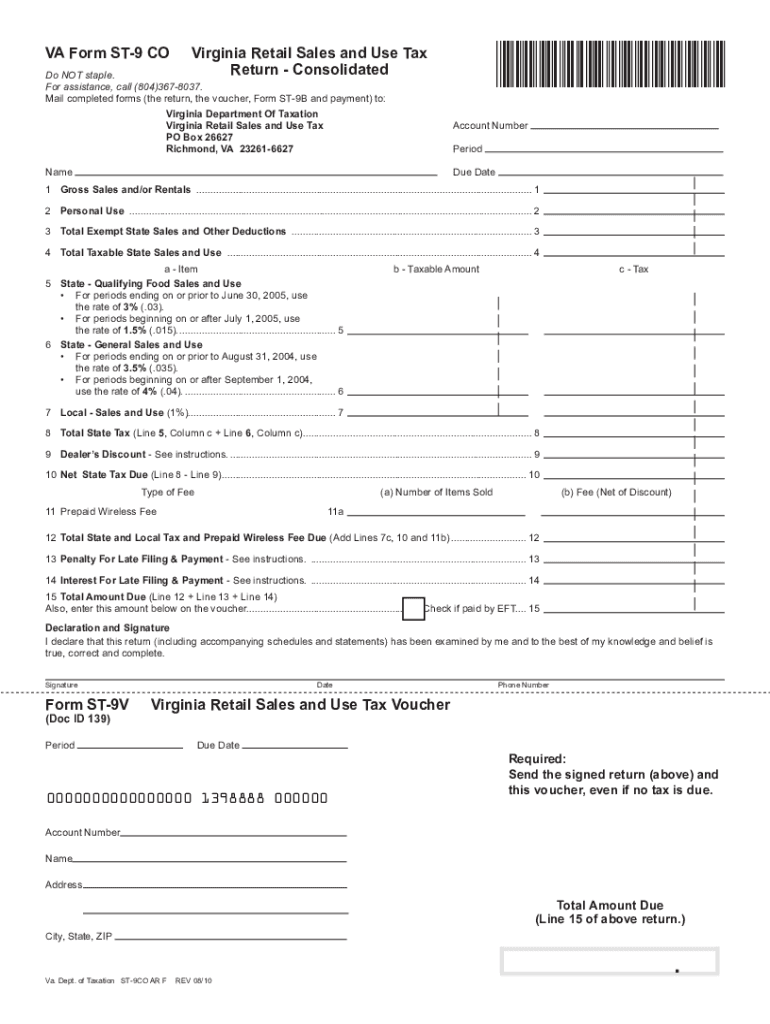

The St 9a worksheet is a document used in Virginia for reporting certain tax information. It is primarily utilized by individuals and businesses to provide details necessary for the calculation of state taxes. This worksheet is essential for ensuring compliance with Virginia tax laws and helps in accurately determining tax liabilities. It is important for taxpayers to understand the purpose and requirements of this form to avoid any potential issues with the state tax authority.

How to Use the St 9a Worksheet

Using the St 9a worksheet involves several steps to ensure accurate completion. Taxpayers should first gather all necessary financial documents, including income statements and deduction records. Once the relevant information is collected, individuals can begin filling out the worksheet by following the provided instructions carefully. It is crucial to double-check all entries for accuracy before submitting the form to avoid delays or penalties.

Steps to Complete the St 9a Worksheet

Completing the St 9a worksheet requires a systematic approach. Here are the key steps:

- Review the instructions provided with the form to understand the requirements.

- Gather all necessary documentation, including income statements and any applicable deductions.

- Fill out the worksheet, ensuring that all information is accurate and complete.

- Review the completed worksheet for any errors or omissions.

- Submit the form according to the guidelines, either electronically or by mail.

Legal Use of the St 9a Worksheet

The St 9a worksheet is legally recognized as a valid document for tax reporting in Virginia. To ensure its legal standing, it must be completed accurately and submitted within the designated deadlines. Compliance with state tax laws is critical, as failure to properly use this worksheet can result in penalties or legal repercussions. Taxpayers should maintain copies of submitted forms for their records.

Required Documents

To complete the St 9a worksheet, several documents are typically required. These may include:

- Income statements, such as W-2s or 1099s.

- Records of any deductions or credits claimed.

- Previous tax returns for reference.

- Any supporting documentation related to income sources.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy.

Form Submission Methods

The St 9a worksheet can be submitted through various methods, including:

- Online submission via the Virginia Department of Taxation website.

- Mailing a printed copy to the appropriate tax office.

- In-person submission at designated tax offices.

Choosing the right submission method can depend on personal preference and the urgency of processing.

Quick guide on how to complete st 9a worksheet

Prepare St 9a Worksheet effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents quickly without any holdups. Manage St 9a Worksheet on any system with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and eSign St 9a Worksheet without hassle

- Find St 9a Worksheet and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure confidential information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just a few seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to record your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes necessitating the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and eSign St 9a Worksheet and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 9a worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ST 9A worksheet?

The ST 9A worksheet is a crucial document for businesses, used to report sales tax exemptions in the state. airSlate SignNow simplifies the process of completing and signing this worksheet, ensuring compliance and accuracy.

-

How can airSlate SignNow help with the ST 9A worksheet?

airSlate SignNow allows you to fill out the ST 9A worksheet digitally, ensuring that you can send and eSign the document quickly. Our platform streamlines collaboration among team members, making document management effortless.

-

Is there a cost associated with using airSlate SignNow for the ST 9A worksheet?

Yes, airSlate SignNow offers various pricing plans that are cost-effective for businesses of all sizes. You can choose a plan that fits your specific needs for managing documents like the ST 9A worksheet efficiently.

-

What features does airSlate SignNow offer for ST 9A worksheet users?

airSlate SignNow provides features such as template creation, document tracking, and secure eSignature options that greatly enhance your experience with the ST 9A worksheet. These tools ensure you can manage your documents effectively.

-

Can I integrate airSlate SignNow with other software for ST 9A worksheet management?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to synchronize data and improve workflow for handling the ST 9A worksheet. This integration capability enhances productivity.

-

What benefits does using airSlate SignNow bring when handling the ST 9A worksheet?

Using airSlate SignNow for the ST 9A worksheet offers signNow benefits, including reduced paperwork, faster processing times, and enhanced accuracy. Our platform also provides a secure environment to protect your sensitive information.

-

Is there support available for users filling out the ST 9A worksheet?

Yes, airSlate SignNow provides comprehensive support for users working with the ST 9A worksheet. Our knowledgeable customer service team is available to assist you with any questions or issues you may encounter.

Get more for St 9a Worksheet

- Form nj 2450

- Request to hirerecruitment approval form

- Algeria visa application form visacenter us

- Tsa student copyright checklist form

- Form it 204 cp new york corporate partners schedule k 1 tax year 772089043

- American heart association course evaluation form

- Room and board for parents agreement template form

- Government contract template form

Find out other St 9a Worksheet

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document