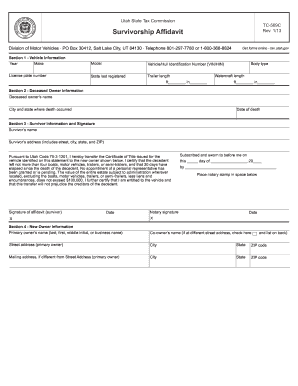

Tc 569c Form

What is the TC 569C?

The TC 569C form is a specific document used within the United States tax system, primarily for reporting certain tax-related information. It is essential for individuals and businesses to understand this form as it relates to their tax obligations. The TC 569C is typically utilized to communicate details that may affect tax calculations or eligibility for credits and deductions. Familiarity with this form can help ensure compliance with IRS regulations and avoid potential issues during tax filing.

How to Use the TC 569C

Using the TC 569C form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal identification details and relevant financial data. Next, carefully fill out the form, ensuring that all entries are clear and legible. After completing the form, review it for any errors or omissions. Once verified, the TC 569C can be submitted according to the guidelines provided by the IRS, either electronically or via mail. Understanding the proper use of this form is crucial for maintaining compliance with tax laws.

Steps to Complete the TC 569C

Completing the TC 569C form requires attention to detail and adherence to specific guidelines. The following steps outline the process:

- Gather all necessary documentation, such as previous tax returns and financial records.

- Obtain the TC 569C form from the IRS website or authorized sources.

- Fill in personal information, including name, address, and Social Security number.

- Provide the required financial details, ensuring accuracy in all entries.

- Review the completed form for any mistakes or missing information.

- Submit the form through the appropriate channels, either online or by mail.

Legal Use of the TC 569C

The TC 569C form holds legal significance in the context of tax reporting. When filled out correctly, it serves as an official record of the information provided to the IRS. Compliance with IRS guidelines ensures that the form is legally binding, which can protect taxpayers from penalties or audits. Understanding the legal implications of this form is essential for individuals and businesses to avoid potential disputes with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the TC 569C form are crucial for taxpayers to observe. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for most individuals. However, specific circumstances may warrant different deadlines, such as extensions or special filing situations. Staying informed about these important dates helps ensure timely compliance and can prevent unnecessary penalties.

Required Documents

To successfully complete the TC 569C form, certain documents are required. These may include:

- Previous tax returns for reference

- W-2 forms or 1099 statements showing income

- Documentation of any deductions or credits claimed

- Identification documents, such as a driver's license or Social Security card

Having all necessary documents on hand can simplify the completion process and enhance accuracy.

Quick guide on how to complete tc 569c

Effortlessly Prepare Tc 569c on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Tc 569c on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to Edit and eSign Tc 569c with Ease

- Find Tc 569c and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with the tools airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select how you want to submit your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate the hassle of missing or lost files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Tc 569c and guarantee excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 569c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tc 569c and how does it relate to airSlate SignNow?

The tc 569c is a specific code used in document processing within various industries. airSlate SignNow integrates this code efficiently, allowing users to seamlessly send and eSign documents, ensuring compliance and accuracy in their transactions.

-

How much does airSlate SignNow cost for users looking to utilize tc 569c?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides features specifically designed for workflows involving tc 569c, making it a cost-effective solution for eSigning and document management.

-

What features does airSlate SignNow offer for managing tc 569c documents?

airSlate SignNow provides powerful features for managing tc 569c documents, including customizable templates, secure eSigning, and real-time tracking. These tools streamline document workflows and enhance efficiency for businesses handling tc 569c-related processes.

-

What are the benefits of using airSlate SignNow for tc 569c transactions?

Using airSlate SignNow for tc 569c transactions enhances speed and accuracy in document processing. It allows businesses to minimize errors, reduce turnaround times, and improve overall compliance with industry regulations related to tc 569c documents.

-

Can airSlate SignNow integrate with other applications when handling tc 569c?

Yes, airSlate SignNow offers seamless integrations with numerous applications, which is beneficial when managing tc 569c. This interoperability enhances workflow efficiency and allows users to utilize their existing tools alongside airSlate SignNow.

-

Is it easy to eSign tc 569c documents using airSlate SignNow?

Absolutely! airSlate SignNow is designed for user-friendliness, making it easy to eSign tc 569c documents. With a simple interface and guided workflows, even users with minimal tech experience can navigate the process effortlessly.

-

How can airSlate SignNow enhance collaboration on tc 569c documents?

airSlate SignNow promotes collaboration on tc 569c documents through shared access and real-time editing features. Users can easily invite others to review and sign documents, ensuring everyone is on the same page and speeding up the approval process.

Get more for Tc 569c

Find out other Tc 569c

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online