T1236 Form

What is the T1236?

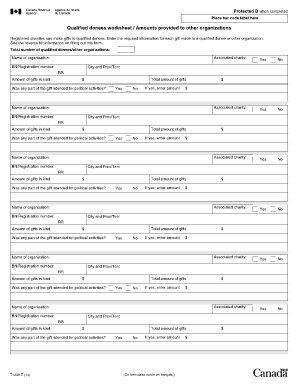

The T1236 fillable form, also known as the CRA T1236, is a document used in the United States for tax purposes. It serves as a qualified donees worksheet, allowing organizations to claim tax credits for donations made to eligible charities. This form is essential for ensuring compliance with the Internal Revenue Service (IRS) regulations regarding charitable contributions. By accurately completing the T1236, taxpayers can verify their eligibility for deductions and maintain proper records of their charitable activities.

How to use the T1236

Using the T1236 fillable form involves several straightforward steps. First, gather all necessary information regarding the donations made, including the names of the charities, the amounts donated, and the dates of the contributions. Next, access the fillable form online and input the required details in the designated fields. Ensure that all entries are accurate and complete to avoid any potential issues during the filing process. Once filled out, review the form for any errors before submitting it as part of your tax return.

Steps to complete the T1236

Completing the T1236 form requires careful attention to detail. Follow these steps for a smooth process:

- Gather documentation of your donations, including receipts and acknowledgment letters from the charities.

- Download the T1236 fillable form from a reliable source.

- Open the form and fill in your personal information, such as your name, address, and taxpayer identification number.

- Enter the details of each donation, including the charity's name, donation amount, and date of donation.

- Review all information for accuracy and completeness.

- Save the completed form and keep a copy for your records.

Legal use of the T1236

The T1236 fillable form must be used in accordance with IRS regulations to ensure its legal validity. It is crucial to understand that the information provided on the form is subject to scrutiny by tax authorities. To maintain compliance, ensure that all donations listed are made to qualified donees recognized by the IRS. Additionally, retain all supporting documentation, as it may be required during an audit or review process. Using a reliable eSignature solution can further enhance the legal standing of your completed T1236 form.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the T1236 form is essential to avoid penalties. Generally, the form should be submitted along with your annual tax return. Be aware of the specific deadlines for your tax filing, which can vary based on your filing status and whether you are self-employed or a business entity. Mark your calendar with important dates to ensure timely submission and compliance with IRS regulations.

Required Documents

To successfully complete the T1236 fillable form, several documents are necessary. These include:

- Receipts or acknowledgment letters from the charities to which donations were made.

- Your tax identification number or Social Security number.

- Any previous tax returns that may provide context for your current filing.

Having these documents ready will streamline the completion process and help ensure that your form is accurate and compliant.

Quick guide on how to complete t1236

Effortlessly Prepare T1236 on Any Device

Managing documents online has become increasingly popular among both businesses and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed papers, as you can access the necessary form and securely keep it online. airSlate SignNow offers all the tools you require to create, modify, and eSign your documents quickly and efficiently. Handle T1236 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Easily Modify and eSign T1236

- Find T1236 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form—via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign T1236 and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t1236

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t1236 fillable form and how can I use it?

The t1236 fillable form is a customizable document that allows users to input specific information easily. With airSlate SignNow, you can create and manage the t1236 fillable form efficiently, ensuring that all necessary data is collected and stored securely. This streamlines your workflow and enhances productivity.

-

What features does the airSlate SignNow offer for the t1236 fillable form?

AirSlate SignNow provides various features for the t1236 fillable form, including real-time collaboration, secure eSignatures, and customizable templates. These features make it easy to create and send the t1236 fillable form while ensuring that all parties can sign documents electronically with ease.

-

Is the t1236 fillable form compatible with other software?

Yes, the t1236 fillable form can be integrated with various software applications through airSlate SignNow’s API. This means you can connect the t1236 fillable form with tools you already use, enhancing your workflow and automating document processes seamlessly.

-

What are the pricing options for using the t1236 fillable form with airSlate SignNow?

AirSlate SignNow offers competitive pricing plans that accommodate businesses of all sizes looking to use the t1236 fillable form. You can choose from various subscription tiers that best fit your needs, with options for additional features and integrations. This flexibility means you can find a solution that meets your budget.

-

How can the t1236 fillable form benefit my business?

Utilizing the t1236 fillable form can signNowly enhance your business operations by minimizing paperwork and reducing manual errors. With airSlate SignNow, you can ensure efficient document processing, save time, and improve overall customer experience. This leads to faster transactions and increased client satisfaction.

-

Can I track the status of the t1236 fillable form once sent?

Absolutely! AirSlate SignNow allows you to track the status of your t1236 fillable form in real-time. You will receive updates on whether the document has been viewed, signed, or requires further action, giving you complete control and visibility over your document workflow.

-

Is it easy to create a t1236 fillable form in airSlate SignNow?

Creating a t1236 fillable form in airSlate SignNow is straightforward and user-friendly. The platform allows you to design your form quickly using drag-and-drop features, making it easy to add fields and customize the layout. You don't need extensive technical skills to get started.

Get more for T1236

Find out other T1236

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple