Transunion Fraud Alert Removal Letter Form

What is the Transunion Fraud Alert Removal Letter

The Transunion fraud alert removal letter is a formal document that individuals use to request the removal of a fraud alert placed on their credit report. A fraud alert is a notification that warns potential creditors to take extra steps to verify a person's identity before extending credit. This alert can be beneficial for protecting against identity theft, but it may also hinder legitimate credit applications. By submitting this letter, individuals can initiate the process to remove the fraud alert, allowing for smoother access to credit when needed.

How to use the Transunion Fraud Alert Removal Letter

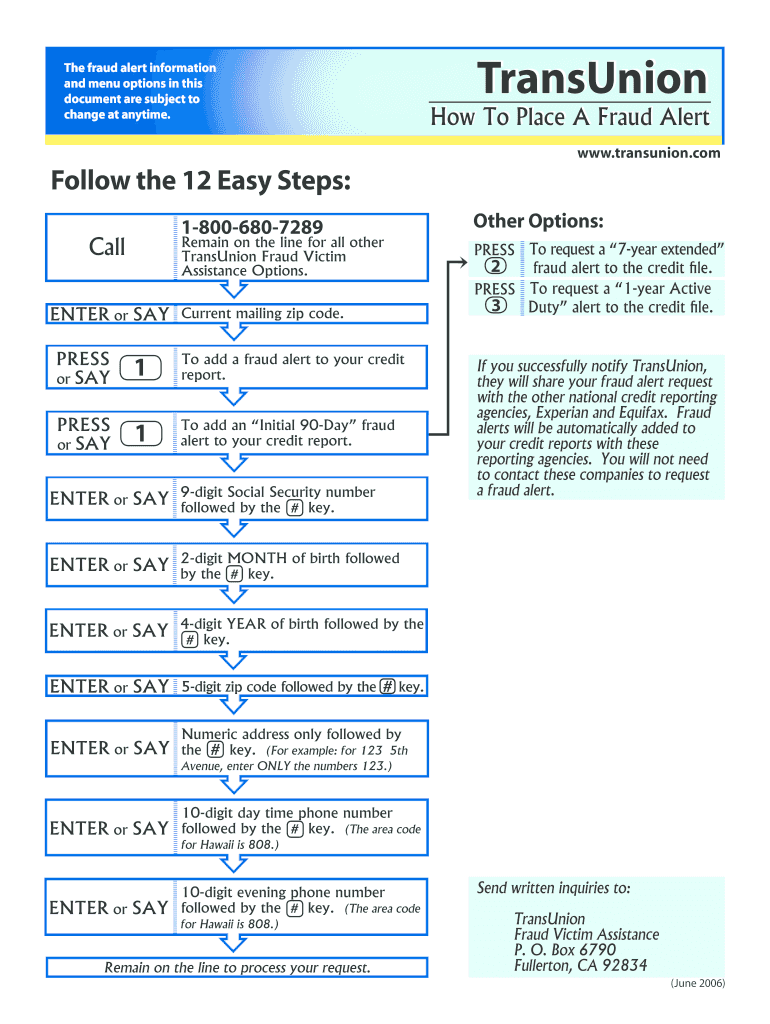

To effectively use the Transunion fraud alert removal letter, individuals should follow a structured approach. First, ensure that the letter contains accurate personal information, including your full name, address, and Social Security number. Clearly state your request to remove the fraud alert and provide any necessary identification documentation to support your request. After completing the letter, it can be submitted via mail, email, or through an online portal, depending on Transunion's guidelines. Keeping a copy of the letter for your records is also advisable.

Steps to complete the Transunion Fraud Alert Removal Letter

Completing the Transunion fraud alert removal letter involves several key steps:

- Begin by addressing the letter to Transunion's fraud department.

- Include your personal information, such as name, address, and Social Security number.

- Clearly state your intention to remove the fraud alert and provide a brief explanation.

- Attach copies of any required identification documents, such as a driver's license or utility bill.

- Sign and date the letter before sending it to ensure authenticity.

Legal use of the Transunion Fraud Alert Removal Letter

The legal use of the Transunion fraud alert removal letter is grounded in consumer protection laws that allow individuals to manage their credit reports. Under the Fair Credit Reporting Act, consumers have the right to request the removal of fraud alerts. This letter serves as a formal request and must comply with all relevant legal standards. Ensuring that the letter is properly formatted and includes all necessary information helps maintain its legitimacy in the eyes of credit reporting agencies.

Required Documents

When submitting the Transunion fraud alert removal letter, certain documents may be required to verify your identity. These documents typically include:

- A copy of your government-issued photo ID, such as a driver's license or passport.

- A recent utility bill or bank statement that shows your name and address.

- Any additional documentation that may support your request, such as a police report if applicable.

Form Submission Methods (Online / Mail / In-Person)

The Transunion fraud alert removal letter can be submitted through various methods to accommodate different preferences. Options include:

- Online: Some users may have the option to submit their request through Transunion's online portal, which can provide a quicker response.

- Mail: Sending the letter via certified mail is a secure method that allows for tracking and confirmation of receipt.

- In-Person: While less common, individuals may choose to visit a local Transunion office to submit their request directly.

Quick guide on how to complete transunion fraud alert removal letter

Prepare Transunion Fraud Alert Removal Letter effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Transunion Fraud Alert Removal Letter on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Transunion Fraud Alert Removal Letter without hassle

- Locate Transunion Fraud Alert Removal Letter and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Transunion Fraud Alert Removal Letter and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the transunion fraud alert removal letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fraud alert on a TransUnion credit report?

A fraud alert is a warning placed on your TransUnion credit report to indicate that you may be a victim of identity theft. It prompts lenders to take extra steps to verify your identity before issuing credit. Understanding how to remove a fraud alert from your TransUnion credit report is essential if you no longer feel threatened.

-

How do I remove a fraud alert from my TransUnion credit report?

To remove a fraud alert from your TransUnion credit report, you typically need to contact TransUnion directly, either online or through customer service. You'll need to provide identification and possibly a letter stating that you no longer wish to have the alert. Knowing how to remove a fraud alert from your TransUnion credit report can streamline your credit activities.

-

What documents do I need to remove a fraud alert?

To successfully remove a fraud alert from your TransUnion credit report, you usually need to provide proof of identity, such as a government-issued ID or utility bill showing your current address. Be sure to check TransUnion's website for specific requirements. Understanding how to remove a fraud alert from your TransUnion credit report includes knowing the necessary documentation.

-

How long does a fraud alert stay on my credit report?

A fraud alert typically remains on your TransUnion credit report for 90 days, but you can renew it if necessary. If you are a victim of identity theft, you can request an extended alert lasting up to seven years. If you're trying to understand how to remove a fraud alert from your TransUnion credit report, it's helpful to know the duration.

-

Is there a fee to remove a fraud alert from my credit report?

There is no fee to remove a fraud alert from your TransUnion credit report. This process is free of charge, ensuring that consumers can protect themselves from identity theft without financial barriers. Thus, if you're looking to understand how to remove a fraud alert from your TransUnion credit report, you can do so without worrying about costs.

-

What are the benefits of removing a fraud alert?

Removing a fraud alert allows you to apply for credit more easily and quickly, as it no longer requires lenders to take additional verification steps. It can also prevent delays in obtaining loans or credit cards. Knowing how to remove a fraud alert from your TransUnion credit report can signNowly simplify your financial processes.

-

Can I remove a fraud alert online?

Yes, you can often remove a fraud alert from your TransUnion credit report online via their website. You’ll need to authenticate your identity during this process. Learning how to remove a fraud alert from your TransUnion credit report online can save you time and effort.

Get more for Transunion Fraud Alert Removal Letter

Find out other Transunion Fraud Alert Removal Letter

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy