05 139 Final Corporation Franchise Tax Report Texas Comptroller Window State Tx 2007-2026

Key elements of the 05-139 Final Corporation Franchise Tax Report

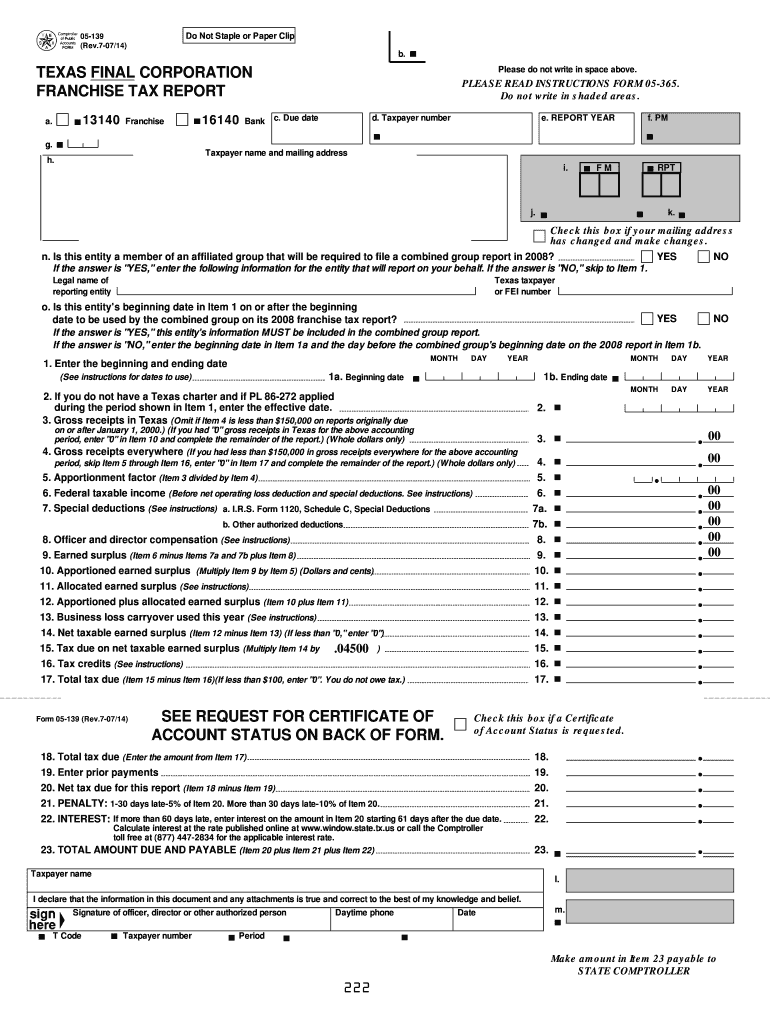

The 05-139 Final Corporation Franchise Tax Report is a crucial document for Texas corporations. It serves as the final report for entities that are ceasing operations or have undergone a significant change in their business structure. Key elements of this report include:

- Entity Information: This section requires the legal name of the corporation, the Texas Comptroller webfile number, and the federal employer identification number (EIN).

- Tax Calculation: Corporations must calculate their franchise tax based on revenue thresholds and applicable rates. Understanding the Texas no tax due threshold 2024 is essential for determining tax liability.

- Signature Requirement: The report must be signed by an authorized officer of the corporation, ensuring accountability and compliance.

- Filing Method: Corporations can submit the report electronically or via mail, depending on their preference and compliance needs.

Steps to complete the 05-139 Final Corporation Franchise Tax Report

Completing the 05-139 Final Corporation Franchise Tax Report involves several steps that ensure accuracy and compliance with Texas tax laws. Here’s a structured approach:

- Gather necessary documents, including the corporation's financial statements and previous tax filings.

- Calculate the total revenue to determine if the corporation meets the no tax due threshold.

- Fill out the report, ensuring all sections are completed accurately, including entity details and tax calculations.

- Review the report for any errors or omissions before submission.

- Submit the report electronically through the Texas Comptroller's website or mail it to the appropriate address.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 05-139 Final Corporation Franchise Tax Report is critical to avoid penalties. Key dates include:

- Filing Deadline: The report is typically due on May 15 of each year, but if this date falls on a weekend or holiday, the deadline may be extended.

- Extension Requests: Corporations may request an extension, but this must be submitted before the original deadline to avoid late fees.

Penalties for Non-Compliance

Failure to file the 05-139 Final Corporation Franchise Tax Report on time can result in significant penalties. These may include:

- Late Filing Penalty: A percentage of the tax due may be assessed for each month the report is late.

- Interest Charges: Interest accrues on unpaid taxes, increasing the total amount owed over time.

- Loss of Good Standing: Non-compliance can lead to the corporation losing its good standing with the state, affecting future business operations.

Required Documents

To complete the 05-139 Final Corporation Franchise Tax Report, several documents are necessary:

- Financial Statements: Recent financial statements provide the necessary data for revenue calculations.

- Previous Tax Returns: These help ensure consistency and accuracy in reporting.

- Entity Formation Documents: Proof of the corporation's legal status may be required for verification.

Digital vs. Paper Version

Corporations have the option to file the 05-139 Final Corporation Franchise Tax Report either digitally or on paper. Each method has its benefits:

- Digital Filing: Offers faster processing times, immediate confirmation of submission, and reduced risk of lost documents.

- Paper Filing: May be preferred by those who are not comfortable with digital platforms, but it can lead to longer processing times.

Quick guide on how to complete 05 139 final corporation franchise tax report texas comptroller window state tx

Prepare 05 139 Final Corporation Franchise Tax Report Texas Comptroller Window State Tx effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your papers quickly without delays. Handle 05 139 Final Corporation Franchise Tax Report Texas Comptroller Window State Tx on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign 05 139 Final Corporation Franchise Tax Report Texas Comptroller Window State Tx without effort

- Locate 05 139 Final Corporation Franchise Tax Report Texas Comptroller Window State Tx and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which requires seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign 05 139 Final Corporation Franchise Tax Report Texas Comptroller Window State Tx and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 05 139 final corporation franchise tax report texas comptroller window state tx

How to create an eSignature for the 05 139 Final Corporation Franchise Tax Report Texas Comptroller Window State Tx in the online mode

How to generate an eSignature for your 05 139 Final Corporation Franchise Tax Report Texas Comptroller Window State Tx in Google Chrome

How to generate an eSignature for signing the 05 139 Final Corporation Franchise Tax Report Texas Comptroller Window State Tx in Gmail

How to generate an eSignature for the 05 139 Final Corporation Franchise Tax Report Texas Comptroller Window State Tx from your smart phone

How to make an eSignature for the 05 139 Final Corporation Franchise Tax Report Texas Comptroller Window State Tx on iOS devices

How to generate an electronic signature for the 05 139 Final Corporation Franchise Tax Report Texas Comptroller Window State Tx on Android

People also ask

-

What are the Texas franchise tax instructions 2024?

The Texas franchise tax instructions 2024 provide detailed guidelines for businesses on how to calculate and report their franchise taxes. These instructions are essential for ensuring compliance with Texas tax laws and avoiding penalties. By following the Texas franchise tax instructions 2024, businesses can accurately determine their tax obligations.

-

How can airSlate SignNow assist with Texas franchise tax documentation?

airSlate SignNow streamlines the eSigning and document management process for Texas franchise tax documentation. It enables businesses to send, sign, and store important tax-related documents securely and efficiently. Using airSlate SignNow can simplify compliance with the Texas franchise tax instructions 2024.

-

What features does airSlate SignNow offer for tax compliance?

airSlate SignNow offers features such as secure e-signatures, document templates, and automation tools. These features help businesses meet the requirements set by the Texas franchise tax instructions 2024 with ease and efficiency. The platform’s user-friendly interface ensures that businesses can manage their documents without hassle.

-

Are there any costs associated with using airSlate SignNow for Texas franchise tax processes?

Yes, while airSlate SignNow provides a cost-effective solution for eSigning documents, pricing can vary based on the features you choose. Whether you're a small business or a large enterprise, airSlate SignNow offers various pricing plans to accommodate different needs. It's a worthwhile investment for simplifying compliance with texas franchise tax instructions 2024.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security to protect sensitive tax documents. It employs advanced security measures, such as encryption and audit trails, ensuring that your documents comply with the Texas franchise tax instructions 2024 without compromising confidentiality. You can trust that your data is safe with airSlate SignNow.

-

Can airSlate SignNow integrate with accounting software for better tax management?

Yes, airSlate SignNow offers integrations with various accounting and tax software to enhance tax management. By connecting with tools like QuickBooks and Xero, businesses can streamline their workflows and ensure they meet the Texas franchise tax instructions 2024 seamlessly. This integration can save time and reduce errors.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management simplifies the eSigning process, saves time, and enhances collaboration among teams. It ensures that all parties involved in tax documentation can access and sign documents anytime, anywhere. This efficiency aligns perfectly with the requirements outlined in the Texas franchise tax instructions 2024.

Get more for 05 139 Final Corporation Franchise Tax Report Texas Comptroller Window State Tx

Find out other 05 139 Final Corporation Franchise Tax Report Texas Comptroller Window State Tx

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy