Ctuir Loan Application Form

What is the Ctuir Loan Application

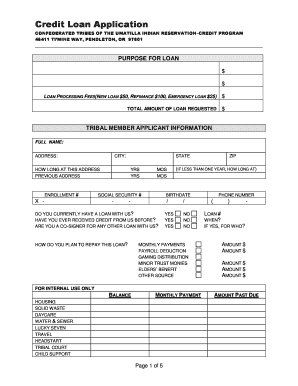

The Ctuir loan application is a formal document used by individuals seeking financial assistance from the Confederated Tribes of the Umatilla Indian Reservation. This application is part of the Ctuir credit program, which aims to support community members in accessing funds for various needs, including education, home improvement, and business ventures. Understanding the purpose and requirements of the application is essential for applicants to ensure a smooth process.

How to Use the Ctuir Loan Application

Using the Ctuir loan application involves several straightforward steps. First, individuals must obtain the application form, which can typically be found through the Ctuir loan department. Once the form is acquired, applicants should carefully read the instructions provided. Completing the application requires accurate personal information, financial details, and any necessary supporting documents. After filling out the form, applicants can submit it online or through other specified methods.

Steps to Complete the Ctuir Loan Application

Completing the Ctuir loan application involves a systematic approach to ensure all necessary information is provided. The steps include:

- Gather required documents, such as identification and financial statements.

- Fill out the application form, ensuring all fields are accurately completed.

- Review the application for any errors or omissions.

- Submit the application through the designated method, whether online or by mail.

Following these steps carefully can enhance the likelihood of a successful application outcome.

Legal Use of the Ctuir Loan Application

The Ctuir loan application must comply with relevant legal standards to be considered valid. This includes adherence to eSignature laws, which ensure that electronically signed documents are legally binding. Utilizing a secure platform for submission, such as airSlate SignNow, can help maintain compliance with these laws, providing applicants with a digital certificate that verifies their submission. Understanding these legal requirements is crucial for applicants to protect their rights and ensure the legitimacy of their application.

Required Documents

To successfully complete the Ctuir loan application, applicants need to prepare specific documents. Commonly required documents include:

- Proof of identity, such as a government-issued ID.

- Recent financial statements or pay stubs to demonstrate income.

- Any additional documentation that supports the purpose of the loan, such as estimates for home repairs or business plans.

Having these documents ready can streamline the application process and improve the chances of approval.

Eligibility Criteria

Eligibility for the Ctuir loan application is determined by several factors. Applicants typically must be members of the Confederated Tribes of the Umatilla Indian Reservation. Additionally, they may need to demonstrate financial need and the ability to repay the loan. Specific criteria can vary based on the type of loan sought, so it is advisable for applicants to review the requirements outlined by the Ctuir loan department before applying.

Application Process & Approval Time

The application process for the Ctuir loan can vary in duration depending on several factors, including the volume of applications received and the completeness of submitted information. Generally, applicants can expect the following timeline:

- Initial review of the application upon submission.

- Potential follow-up for additional information or clarification.

- Notification of approval or denial, typically within a few weeks.

Understanding this timeline can help applicants manage their expectations and plan accordingly.

Quick guide on how to complete ctuir loan application

Effortlessly Prepare Ctuir Loan Application on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without any delays. Manage Ctuir Loan Application on any device using the airSlate SignNow applications for Android or iOS and enhance any document-based workflow today.

How to Edit and eSign Ctuir Loan Application with Ease

- Find Ctuir Loan Application and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which is done in seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you'd like to send your form, either via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign Ctuir Loan Application to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ctuir loan application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a ctuir loan application?

A ctuir loan application is a streamlined process designed for businesses seeking quick funding. It helps applicants submit required information efficiently, allowing for a faster review and approval process. Utilizing airSlate SignNow can enhance this experience by simplifying document management.

-

How does airSlate SignNow support the ctuir loan application process?

airSlate SignNow provides a user-friendly platform to create, send, and eSign documents related to the ctuir loan application. Its intuitive interface makes it easy for both lenders and applicants to navigate necessary paperwork. This speeds up the loan processing time signNowly.

-

What features does airSlate SignNow offer for processing ctuir loan applications?

AirSlate SignNow offers features such as templates, real-time tracking, and secure eSignature capabilities for ctuir loan applications. These features ensure a seamless workflow and enhance collaboration between all parties involved. This streamlines the collection of necessary documents and approvals.

-

Is airSlate SignNow a cost-effective solution for ctuir loan applications?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing ctuir loan applications. With flexible pricing plans, businesses can choose a package that suits their needs without compromising on functionality. This affordability allows even small businesses to access professional document management tools.

-

Can I integrate airSlate SignNow with other tools for my ctuir loan application process?

Absolutely! airSlate SignNow offers integrations with various CRM and productivity tools, enhancing the ctuir loan application process. This integration ensures seamless data flow and improves efficiency, helping your team stay organized and productive.

-

What are the benefits of using airSlate SignNow for a ctuir loan application?

The benefits of using airSlate SignNow for a ctuir loan application include faster processing times, enhanced security, and improved document accuracy. By reducing the chances of errors and miscommunication, it allows businesses to focus on what matters most: securing funding quickly and effectively.

-

How can I ensure the security of my ctuir loan application documents with airSlate SignNow?

airSlate SignNow prioritizes the security of your ctuir loan application documents with robust encryption and compliance measures. These features ensure that all sensitive data is protected throughout the submission and approval process. You can trust that your information is safe with our advanced security protocols.

Get more for Ctuir Loan Application

Find out other Ctuir Loan Application

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement