Fac Sefaz Ce Form

What is the Fac Sefaz Ce

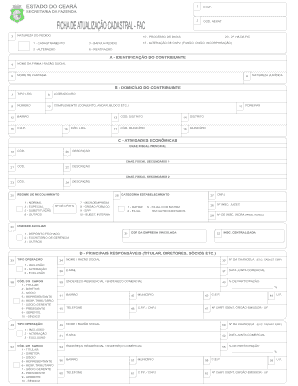

The Fac Sefaz Ce is a specific form utilized for electronic invoicing and tax purposes within the Brazilian state of Ceará. It is primarily designed for businesses to facilitate the issuance of electronic invoices, ensuring compliance with state regulations. This form plays a crucial role in the tax reporting process, allowing companies to document transactions accurately and maintain transparency with tax authorities.

How to use the Fac Sefaz Ce

Using the Fac Sefaz Ce involves several steps to ensure that all required information is accurately captured. First, gather all necessary data related to the transaction, including buyer and seller details, product descriptions, and pricing. Next, access the digital platform that supports the completion of the Fac Sefaz Ce form. Input the collected data into the designated fields, ensuring accuracy to avoid compliance issues. Finally, review the information for correctness before submitting the form electronically.

Steps to complete the Fac Sefaz Ce

Completing the Fac Sefaz Ce involves a systematic approach:

- Collect all relevant transaction information, including buyer and seller details.

- Access the digital platform designated for the Fac Sefaz Ce form.

- Fill in the required fields with accurate and complete information.

- Review the form for any errors or omissions.

- Submit the form electronically to ensure compliance with state regulations.

Legal use of the Fac Sefaz Ce

The legal use of the Fac Sefaz Ce is governed by state tax laws and regulations. It is essential for businesses to adhere to these guidelines to ensure that their electronic invoices are recognized as valid for tax purposes. Compliance with the legal framework helps prevent penalties and ensures that transactions are documented correctly, thereby fostering trust between businesses and tax authorities.

Key elements of the Fac Sefaz Ce

Key elements of the Fac Sefaz Ce include:

- Identification of the seller and buyer, including their tax identification numbers.

- Details of the products or services being invoiced, including descriptions and quantities.

- Pricing information, including applicable taxes and total amounts.

- Digital signatures to validate the authenticity of the invoice.

- Compliance with state-specific regulations and requirements.

Form Submission Methods (Online / Mail / In-Person)

The Fac Sefaz Ce form is primarily submitted online through designated electronic platforms. This method ensures that submissions are processed quickly and efficiently. While electronic submission is the preferred method, it is important to check if alternative submission methods, such as mail or in-person delivery, are accepted in specific circumstances, particularly for corrections or appeals.

Quick guide on how to complete fac sefaz ce

Complete Fac Sefaz Ce effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the appropriate form and securely store it online. airSlate SignNow provides you with all the features necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Fac Sefaz Ce on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The optimal way to modify and eSign Fac Sefaz Ce with ease

- Obtain Fac Sefaz Ce and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Disregard concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document administration requirements in just a few clicks from any device you prefer. Alter and eSign Fac Sefaz Ce and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fac sefaz ce

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is fac sefaz ce and how does it work with airSlate SignNow?

Fac sefaz ce refers to the digital document verification process that is crucial in many business transactions. With airSlate SignNow, you can seamlessly integrate this feature, ensuring that your documents are compliant and valid. This includes easy tracking and management of your signed documents using electronic signatures.

-

How much does it cost to use airSlate SignNow for fac sefaz ce?

airSlate SignNow offers various pricing plans to accommodate different business needs, and these plans include access to features like fac sefaz ce. You can choose from our flexible subscription options, allowing you to find a plan that fits your budget while benefiting from our comprehensive eSigning solutions.

-

What features does airSlate SignNow provide for fac sefaz ce?

airSlate SignNow provides a robust suite of features designed for fac sefaz ce, including customizable templates, advanced security measures, and real-time collaboration tools. These features facilitate a smoother document signing process while ensuring compliance with legal standards.

-

Can airSlate SignNow integrate with other software for fac sefaz ce?

Yes, airSlate SignNow supports integrations with various software applications, making it easy to implement fac sefaz ce in your existing workflows. Whether you use CRM, ERP systems, or other document management tools, our platform can be seamlessly integrated for enhanced efficiency.

-

What industries can benefit from using fac sefaz ce with airSlate SignNow?

Various industries can leverage fac sefaz ce with airSlate SignNow, including finance, healthcare, education, and legal sectors. Any business that requires secure, efficient document signing and verification processes will find signNow advantages in using our platform.

-

How secure is airSlate SignNow when handling fac sefaz ce?

Security is a top priority for airSlate SignNow, especially when it comes to fac sefaz ce. We employ industry-standard encryption and compliance protocols to protect your documents and sensitive information throughout the signing process.

-

Is there customer support available for fac sefaz ce issues?

Yes, airSlate SignNow offers dedicated customer support to assist you with any questions or concerns regarding fac sefaz ce. Our team is available via various channels, ensuring you can receive timely assistance whenever needed.

Get more for Fac Sefaz Ce

Find out other Fac Sefaz Ce

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe