Loss Mitigation First Bank Form

What is the Loss Mitigation First Bank

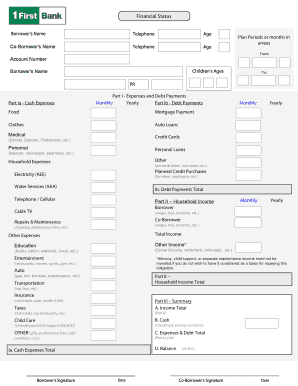

The Loss Mitigation First Bank is a formal process designed to assist borrowers who are struggling to meet their mortgage obligations. This program aims to provide alternatives to foreclosure by exploring various options such as loan modifications, repayment plans, or forbearance agreements. It is essential for borrowers to understand the specifics of this program, as it can significantly impact their financial stability and home ownership status.

How to Use the Loss Mitigation First Bank

Utilizing the Loss Mitigation First Bank involves several key steps. First, borrowers must contact their bank to express their intent to participate in the loss mitigation process. This typically requires submitting a request along with necessary documentation that outlines their financial situation. The bank will then review the application and communicate available options tailored to the borrower's needs.

Steps to Complete the Loss Mitigation First Bank

Completing the Loss Mitigation First Bank process involves a series of steps:

- Gather all relevant financial documents, including income statements, tax returns, and mortgage statements.

- Contact the bank to initiate the loss mitigation process.

- Submit the required documents along with a written request for assistance.

- Await the bank's review and response regarding available options.

- Follow up with the bank to ensure timely processing of your application.

Legal Use of the Loss Mitigation First Bank

The legal use of the Loss Mitigation First Bank is governed by federal and state regulations that ensure fair treatment of borrowers. It is crucial for borrowers to understand their rights under these laws, which protect them from unfair practices during the loss mitigation process. This includes the right to receive clear communication from the bank and the right to appeal decisions made regarding their application.

Required Documents

To successfully navigate the Loss Mitigation First Bank process, borrowers must prepare several key documents. These typically include:

- Proof of income, such as pay stubs or bank statements.

- Tax returns for the previous two years.

- A hardship letter explaining the circumstances that led to financial difficulties.

- Current mortgage statement.

Eligibility Criteria

Eligibility for the Loss Mitigation First Bank program varies based on specific criteria set by the bank. Generally, borrowers must demonstrate financial hardship, which may include job loss, medical expenses, or other significant financial burdens. Additionally, the borrower must be the primary resident of the property in question and must be in good standing with their mortgage payments prior to the hardship.

Quick guide on how to complete loss mitigation first bank

Complete Loss Mitigation First Bank effortlessly on any device

Online document management has become a favored choice for organizations and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to locate the right form and safely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Loss Mitigation First Bank on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and electronically sign Loss Mitigation First Bank effortlessly

- Access Loss Mitigation First Bank and click on Get Form to begin.

- Make use of the tools provided to fill out your document.

- Emphasize pertinent parts of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it directly to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow meets your document management needs within a few clicks from any device of your preference. Revise and electronically sign Loss Mitigation First Bank and ensure impeccable communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loss mitigation first bank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is loss mitigation first bank and how does it work?

Loss mitigation first bank refers to strategies used by financial institutions to reduce losses from defaulted loans. At first bank, these services involve negotiation and restructuring options that benefit both the borrower and the lender. Understanding this process can help borrowers find a viable solution to manage their debts effectively.

-

What are the key features of loss mitigation first bank?

The key features of loss mitigation first bank include personalized consultation services, flexible repayment options, and comprehensive guidance throughout the mitigation process. These features are designed to provide tailored solutions based on individual financial situations. By leveraging these features, borrowers can navigate their loss mitigation journey with ease.

-

How do I apply for loss mitigation first bank services?

To apply for loss mitigation first bank services, you typically need to contact your bank's loss mitigation department directly. They will guide you through the application process, which often includes providing financial documentation. This ensures that they can assess your situation accurately and offer the most suitable options.

-

Are there any costs associated with loss mitigation first bank?

Costs for loss mitigation first bank services can vary, but many offer free consultations to discuss your options. Depending on the solutions provided, there might be fees related to processing or restructuring your loan. It's important to clarify any potential costs upfront to avoid unexpected expenses.

-

What are the benefits of using loss mitigation first bank?

The benefits of using loss mitigation first bank include the potential for loan modification and a reduced risk of foreclosure. Additionally, it offers borrowers the chance to stay in their homes while managing their debt responsibly. This approach can ultimately lead to a more stable financial future.

-

Can loss mitigation first bank help with different types of loans?

Yes, loss mitigation first bank services can assist with various types of loans, including mortgages, personal loans, and vehicle loans. Each case is reviewed based on individual circumstances, allowing for customized solutions tailored to specific loan types. This flexibility is crucial in addressing a borrower’s unique needs.

-

How long does the loss mitigation process take at first bank?

The duration of the loss mitigation process at first bank can vary depending on the complexity of your financial situation and the type of negotiation involved. Generally, it can take anywhere from a few weeks to several months. Staying proactive in communication with the bank can help expedite the process.

Get more for Loss Mitigation First Bank

Find out other Loss Mitigation First Bank

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself