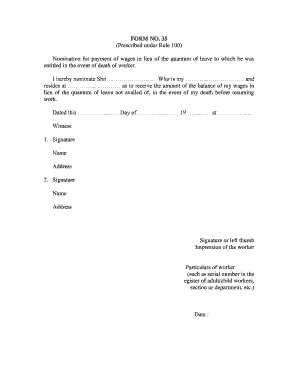

Form No 35 Prescribed under Rule 100

What is the Form No 35 Prescribed Under Rule 100

The form no 35 prescribed under rule 100 is a specific document used in various legal and administrative processes. It serves as a formal request or declaration, often required by governmental or regulatory bodies. Understanding its purpose is crucial for compliance and effective communication with these entities. This form may be utilized in contexts such as tax filings, legal applications, or other official submissions where detailed information is necessary.

How to Use the Form No 35 Prescribed Under Rule 100

Using the form no 35 prescribed under rule 100 involves several steps to ensure accuracy and compliance. First, gather all necessary information that pertains to the form’s requirements. This may include personal identification details, financial information, or specific declarations relevant to the submission. Next, fill out the form carefully, ensuring that all fields are completed as instructed. After completing the form, review it for any errors or omissions before submitting it to the appropriate authority.

Steps to Complete the Form No 35 Prescribed Under Rule 100

Completing the form no 35 prescribed under rule 100 requires attention to detail. Follow these steps for a smooth process:

- Read the instructions provided with the form to understand the requirements.

- Gather all necessary documents and information needed to fill out the form.

- Complete each section of the form, ensuring clarity and accuracy.

- Double-check all entries for correctness before finalizing.

- Sign and date the form as required.

- Submit the form according to the specified method, whether online, by mail, or in person.

Legal Use of the Form No 35 Prescribed Under Rule 100

The legal use of the form no 35 prescribed under rule 100 is established by compliance with relevant regulations and laws. When filled out correctly, this form can serve as a legally binding document. It is essential to adhere to all guidelines set forth by the issuing authority to ensure that the form is accepted and recognized legally. This includes understanding the implications of the information provided and the responsibilities that come with submitting the form.

Key Elements of the Form No 35 Prescribed Under Rule 100

Several key elements are crucial when dealing with the form no 35 prescribed under rule 100. These elements typically include:

- Personal identification information of the individual or entity submitting the form.

- Specific details related to the purpose of the form, such as financial data or legal declarations.

- Signature and date fields to validate the authenticity of the submission.

- Instructions for submission, including any deadlines or additional documentation required.

Form Submission Methods

The form no 35 prescribed under rule 100 can be submitted through various methods, depending on the requirements of the issuing authority. Common submission methods include:

- Online Submission: Many authorities allow for electronic submission through their official websites, providing a quick and efficient way to file.

- Mail: The form can often be printed and mailed to the appropriate office, ensuring that it is sent to the correct address.

- In-Person: Some situations may require or allow for personal delivery of the form, which can facilitate immediate confirmation of receipt.

Quick guide on how to complete form no 35 prescribed under rule 100

Complete Form No 35 Prescribed Under Rule 100 effortlessly on any device

Online document management has become widely adopted by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and efficiently. Manage Form No 35 Prescribed Under Rule 100 on any device with the airSlate SignNow applications for Android or iOS and enhance any document-centered operation today.

The easiest way to edit and eSign Form No 35 Prescribed Under Rule 100 without hassle

- Obtain Form No 35 Prescribed Under Rule 100 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your adjustments.

- Select your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form No 35 Prescribed Under Rule 100 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 35 prescribed under rule 100

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form No 35 prescribed under rule 100 and why is it important?

Form No 35 prescribed under rule 100 is a crucial document for tax assessment in India, enabling taxpayers to submit requests for revisions of their tax assessments. Understanding this form is essential for compliance and ensuring that tax obligations are met correctly.

-

How can airSlate SignNow help with Form No 35 prescribed under rule 100?

airSlate SignNow streamlines the process of creating, signing, and managing Form No 35 prescribed under rule 100. With our eSignature solution, businesses can ensure that their forms are accurately filled out and quickly executed, reducing processing time.

-

Is there a specific pricing plan for handling Form No 35 prescribed under rule 100?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes needing to manage Form No 35 prescribed under rule 100. Our plans are designed to provide cost-effective solutions without compromising on features, making it accessible for everyone.

-

What features does airSlate SignNow provide for Form No 35 prescribed under rule 100?

With airSlate SignNow, users can benefit from templates, electronic signing, and document tracking for Form No 35 prescribed under rule 100. These features facilitate easier management and compliance of tax-related documents, ensuring everything is handled efficiently.

-

Can I integrate airSlate SignNow with other software for easier handling of Form No 35 prescribed under rule 100?

Absolutely! airSlate SignNow offers seamless integrations with popular software which can assist in managing Form No 35 prescribed under rule 100. This ensures that you can streamline your workflow and enhance productivity with existing systems.

-

What are the benefits of using airSlate SignNow for Form No 35 prescribed under rule 100?

Using airSlate SignNow for Form No 35 prescribed under rule 100 provides businesses with a simplified signing process, enhanced security, and quicker turnaround times. These benefits contribute to a more efficient administrative process, saving both time and resources.

-

How secure is airSlate SignNow when handling Form No 35 prescribed under rule 100?

Security is paramount at airSlate SignNow, especially when managing sensitive documents like Form No 35 prescribed under rule 100. We implement industry-standard encryption and security protocols to ensure that your documents are protected at all times.

Get more for Form No 35 Prescribed Under Rule 100

- Ive been to the mountaintop speech pdf form

- Affidavit of intent arkansas public service commission website form

- Comeg registration form pdf download

- Student inclusion log for teachers form

- Bake off judging sheet form

- Zkn ausbildungsvertrag pdf form

- Worksheet on dna rna and protein synthesis answer key pdf form

- Aims scale 84039034 form

Find out other Form No 35 Prescribed Under Rule 100

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document