Wv Ifta Form

What is the IFTA Mileage Sheet?

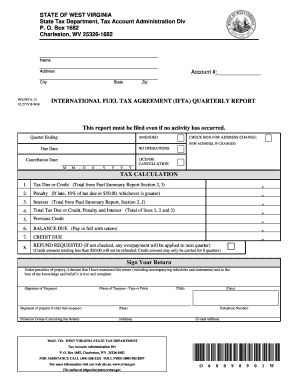

The International Fuel Tax Agreement (IFTA) mileage sheet is a crucial document for commercial vehicle operators who travel across multiple states and provinces in the United States and Canada. It serves as a record of the miles driven in each jurisdiction and the fuel purchased in those areas. This information is essential for calculating the taxes owed to each state based on the fuel consumed and the miles traveled. Accurate completion of the IFTA mileage sheet ensures compliance with tax regulations and helps avoid penalties.

Steps to Complete the IFTA Mileage Sheet

Completing the IFTA mileage sheet involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant data, including odometer readings, fuel purchases, and travel routes for the reporting period. Next, record the total miles driven in each jurisdiction and the gallons of fuel purchased. It is important to separate the data by state or province to facilitate accurate tax calculations. Finally, review the information for completeness and accuracy before submitting the form to the appropriate tax authority.

Legal Use of the IFTA Mileage Sheet

The IFTA mileage sheet is legally binding when filled out correctly and submitted to the appropriate authorities. To ensure its legal validity, the document must meet specific requirements, including accurate reporting of miles traveled and fuel purchased. It is also essential to keep supporting documentation, such as fuel receipts and trip logs, as these may be requested during audits. Compliance with IFTA regulations helps avoid legal issues and potential fines.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA mileage sheet are critical for maintaining compliance. Typically, the IFTA reporting period is quarterly, with deadlines falling on the last day of the month following the end of each quarter. For example, the deadlines for the first quarter are April 30, for the second quarter July 31, for the third quarter October 31, and for the fourth quarter January 31 of the following year. It is important to stay informed about these dates to avoid late filing penalties.

Required Documents

When completing the IFTA mileage sheet, certain documents are necessary to ensure accurate reporting. Required documents typically include odometer readings, fuel purchase receipts, and trip logs detailing the routes taken. Additionally, maintaining records of any exemptions or special circumstances related to fuel purchases is beneficial. Having these documents readily available can streamline the completion process and assist in any potential audits.

Penalties for Non-Compliance

Failure to comply with IFTA regulations can result in significant penalties for commercial vehicle operators. Common penalties include fines for late filing, inaccuracies in reporting, and failure to maintain proper records. In severe cases, repeated non-compliance may lead to the suspension of IFTA privileges, which can severely impact a business's operations. Understanding these penalties emphasizes the importance of accurate and timely submission of the IFTA mileage sheet.

Examples of Using the IFTA Mileage Sheet

Practical examples of using the IFTA mileage sheet can provide clarity on its application. For instance, a trucking company operating in multiple states must track miles driven and fuel purchased in each state to accurately report taxes owed. Another example includes a fleet manager who uses the mileage sheet to analyze fuel efficiency and operational costs across different routes. These examples illustrate how the IFTA mileage sheet is integral to maintaining compliance and optimizing business operations.

Quick guide on how to complete wv ifta

Effortlessly Prepare Wv Ifta on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, as you can easily access the right format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any delays. Work with Wv Ifta on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

Easily Modify and eSign Wv Ifta Without Effort

- Obtain Wv Ifta and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Wv Ifta and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wv ifta

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IFTA mileage sheet and why is it important?

An IFTA mileage sheet is a crucial document used by trucking businesses to report their miles driven in different jurisdictions for International Fuel Tax Agreement (IFTA) purposes. It helps ensure compliance with tax regulations and simplifies the process of calculating fuel tax obligations. Having a well-maintained IFTA mileage sheet can save time and reduce the risk of costly audits.

-

How can airSlate SignNow help with managing IFTA mileage sheets?

airSlate SignNow provides an efficient platform for creating, signing, and storing IFTA mileage sheets electronically. With its easy-to-use interface, you can quickly generate accurate mileage records and ensure they are securely signed and shared with the necessary parties. This streamlines the reporting process and helps you stay compliant with IFTA requirements.

-

Is there a cost associated with using airSlate SignNow for IFTA mileage sheets?

Yes, airSlate SignNow offers a variety of pricing plans tailored to your business needs, including options for managing IFTA mileage sheets. Depending on your selected plan, you can access features designed to simplify document management and eSignatures. It's a cost-effective solution that can enhance efficiency in your operations.

-

What features does airSlate SignNow offer for IFTA mileage sheet management?

airSlate SignNow provides a suite of features to streamline your IFTA mileage sheet management. These include customizable templates, real-time collaboration, automated workflows, and secure cloud storage. Together, these features enhance productivity and ensure that your IFTA mileage records are well-organized and easily accessible.

-

Can I integrate airSlate SignNow with other software for managing IFTA mileage sheets?

Yes, airSlate SignNow offers integrations with popular software applications, allowing you to streamline your workflow when managing IFTA mileage sheets. Whether you're using accounting software or fleet management tools, these integrations help centralize your data and improve overall efficiency. This means less time spent on manual entry and more accuracy in your reports.

-

What are the benefits of using airSlate SignNow for IFTA mileage sheets?

Using airSlate SignNow for your IFTA mileage sheets offers several benefits, including improved accuracy, faster processing times, and enhanced security for sensitive data. The ability to easily create, sign, and share documents electronically reduces the administrative burden on your team. Moreover, you can ensure compliance while saving time and resources.

-

How secure is the data in my IFTA mileage sheets with airSlate SignNow?

Data security is a top priority for airSlate SignNow, especially for sensitive documents like IFTA mileage sheets. The platform uses advanced encryption methods to protect your information and complies with industry standards for data privacy. You can rest assured that your IFTA mileage sheets are safe from unauthorized access.

Get more for Wv Ifta

- Commercial insurance declination form websitewelcomecom

- Opt out form

- Cancel transfer of names in ration card southgoa gov form

- Simclaim case 1 2 form

- Iht416 form

- City of daytona beach shores building permit application form

- Instructions for the clay ford scholarship application form

- Application for licensure of a blood bank form

Find out other Wv Ifta

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy