Property Tax Bill Template Form

What is the Property Tax Bill Template

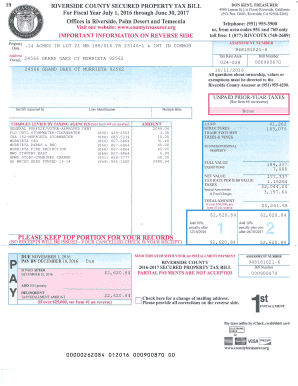

The property tax bill template is a standardized document used to assess and communicate the property taxes owed by property owners in Riverside County. This template typically includes essential information such as the property owner's name, property address, assessed value, tax rate, and total tax due. Understanding this template is crucial for property owners to ensure they are aware of their tax obligations and can manage their finances accordingly.

How to use the Property Tax Bill Template

Using the property tax bill template involves filling out the necessary information accurately. Property owners should start by entering their personal details, including their name and address, followed by the specifics of the property in question. It is important to ensure that the assessed value and tax rates are correctly reflected. Once completed, the template can be printed or saved for electronic submission, depending on the requirements set forth by Riverside County.

Steps to complete the Property Tax Bill Template

Completing the property tax bill template involves several key steps:

- Gather necessary documentation, including previous tax bills and property assessment notices.

- Fill in your personal information, such as your name and address.

- Input the property details, including the assessed value and tax rate.

- Review the completed template for accuracy.

- Submit the form electronically or print it for mailing, as per the county's guidelines.

Legal use of the Property Tax Bill Template

The legal use of the property tax bill template is governed by regulations set forth by Riverside County. This document must be filled out accurately to ensure compliance with local tax laws. An improperly completed form may lead to penalties or disputes regarding tax obligations. Utilizing a reliable digital solution, such as eSignature services, can enhance the legal standing of the completed document by providing a secure and verifiable signature.

Key elements of the Property Tax Bill Template

Key elements of the property tax bill template include:

- Property Owner Information: Name and address of the property owner.

- Property Details: Address and description of the property.

- Assessed Value: The value assigned to the property for tax purposes.

- Tax Rate: The percentage used to calculate the tax owed.

- Total Tax Due: The final amount owed by the property owner.

State-specific rules for the Property Tax Bill Template

Riverside County adheres to specific state rules regarding property tax assessments and billing. These rules dictate how property values are assessed, how tax rates are determined, and the deadlines for payment. Property owners should familiarize themselves with these regulations to avoid any compliance issues and ensure they are taking advantage of any available exemptions or deductions.

Quick guide on how to complete property tax bill template

Complete Property Tax Bill Template effortlessly on any gadget

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Property Tax Bill Template on any gadget using airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The easiest method to edit and eSign Property Tax Bill Template seamlessly

- Locate Property Tax Bill Template and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or mistakes that necessitate printing out new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign Property Tax Bill Template and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the property tax bill template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for accessing my property tax bill in Riverside County?

To access your property tax bill in Riverside County, you can visit the county's official tax assessor website. There, you can enter your property information to view and download your property tax bill Riverside County. Additionally, airSlate SignNow can help you securely sign and send any related documents required.

-

How can I pay my property tax bill in Riverside County?

You can pay your property tax bill Riverside County online through the official county tax payment portal. Alternatively, payments can be made by mail or in person at your local tax collector's office. Using airSlate SignNow allows you to easily manage and sign documents related to your property taxes.

-

What are the penalties for late payment of property tax bills in Riverside County?

If you fail to pay your property tax bill Riverside County by the due date, you may incur penalties and interest on the unpaid amount. Familiarizing yourself with these deadlines is essential to avoid additional costs. Using airSlate SignNow, you can promptly sign and send necessary payment documents.

-

Are there any exemptions or discounts available for property tax bills in Riverside County?

Yes, residents may qualify for various exemptions that can reduce their property tax bill in Riverside County, including homeowner's exemptions and programs for seniors or veterans. It's important to research eligibility requirements and file applications on time. With airSlate SignNow, you can quickly submit and sign application documents.

-

How can I contest my property tax bill in Riverside County?

If you believe your property tax bill Riverside County is incorrect, you can file an appeal with the Riverside County Assessment Appeals Board. This process involves providing evidence to support your claim, which can be facilitated by using airSlate SignNow to gather and sign necessary documentation.

-

What is the average property tax rate in Riverside County?

The average property tax rate in Riverside County typically ranges around 1% of the assessed value of the property. However, various factors can influence the final amount. To better understand your specific liability, refer to your property tax bill Riverside County and consider consulting with a tax professional.

-

Can I receive my property tax bill electronically in Riverside County?

Yes, Riverside County offers options to receive your property tax bill electronically. By registering online through the county's tax office website, you can choose digital delivery, which saves time and ensures timely access. Using airSlate SignNow, you can also electronically sign any related documents efficiently.

Get more for Property Tax Bill Template

- Parish registration form bilingual pub st vincent de paul catholic

- Forward health prior authorization form

- General liability insurance certificate form

- Balance due letter form

- Hazardous waste weekly inspection checklist form

- Post office document form

- Identix identification services form

- Irs form 8854 beginners guide to the tax expatriation

Find out other Property Tax Bill Template

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form