Form 1120 W Estimated Tax for Corporations for Calendar Year , or Tax Year Beginning , , and Ending , 20 OMB No

What is the Form 1120 W Estimated Tax For Corporations For Calendar Year, Or Tax Year Beginning, And Ending, 20 OMB No

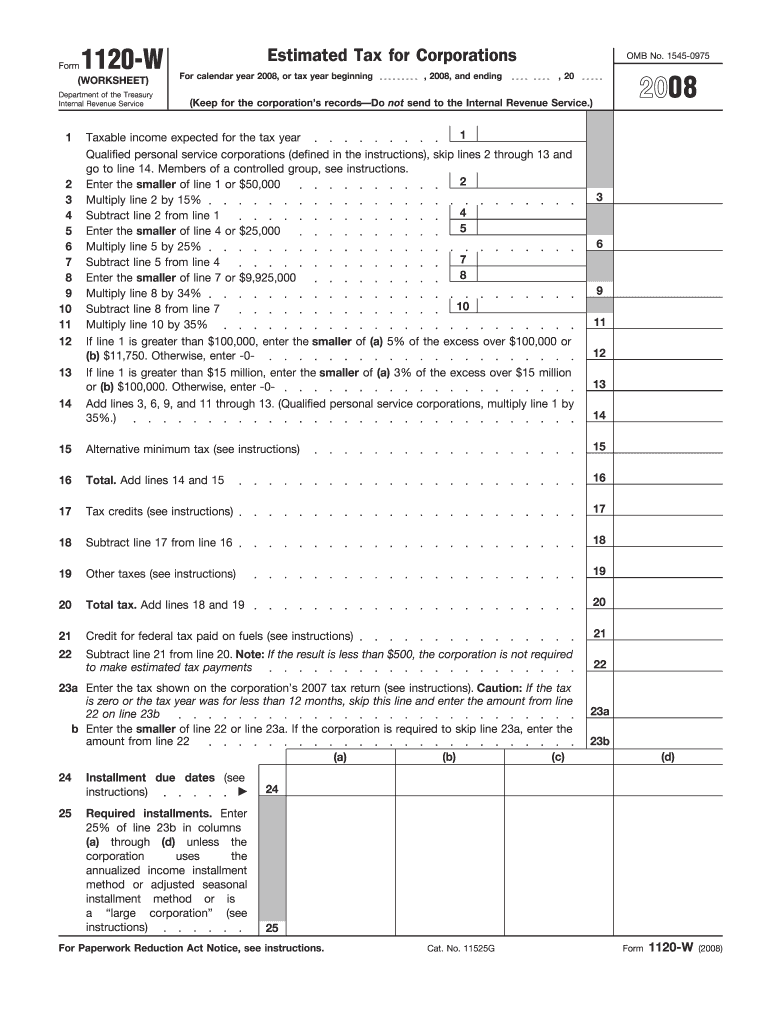

The Form 1120 W is used by corporations to calculate and report their estimated tax payments for a specified calendar year or tax year. This form is essential for corporations to ensure they meet their tax obligations throughout the year, rather than paying a lump sum at the end of the tax year. By using this form, corporations can estimate their tax liability based on their expected income, deductions, and credits, allowing for more manageable cash flow and compliance with IRS regulations.

How to use the Form 1120 W Estimated Tax For Corporations For Calendar Year, Or Tax Year Beginning, And Ending, 20 OMB No

To effectively use Form 1120 W, corporations should first gather necessary financial information, including projected income, deductions, and credits for the year. The form requires inputting this data to calculate the estimated tax liability. Corporations must then determine the payment schedule, which typically involves making quarterly payments. It is important to keep accurate records of these payments and any changes in projected income throughout the year, as this may affect future payments.

Steps to complete the Form 1120 W Estimated Tax For Corporations For Calendar Year, Or Tax Year Beginning, And Ending, 20 OMB No

Completing Form 1120 W involves several key steps:

- Gather financial data, including income projections and allowable deductions.

- Fill out the form by entering the estimated income, deductions, and credits in the appropriate sections.

- Calculate the estimated tax liability based on the information provided.

- Determine the payment schedule, typically divided into four quarterly payments.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing Form 1120 W. Generally, the first estimated tax payment is due on the fifteenth day of the fourth month of the tax year. Subsequent payments are typically due on the fifteenth day of the sixth, ninth, and twelfth months. It is crucial for corporations to mark these dates on their calendars to avoid penalties for late payments.

IRS Guidelines

The IRS provides detailed guidelines for completing and submitting Form 1120 W. Corporations should refer to the IRS instructions accompanying the form for specific requirements regarding income calculations, allowable deductions, and credits. Adhering to these guidelines helps ensure compliance and minimizes the risk of audits or penalties.

Penalties for Non-Compliance

Failure to file Form 1120 W or make timely estimated tax payments can result in significant penalties. The IRS may impose a penalty for underpayment of estimated taxes, which is calculated based on the amount of tax owed and the duration of the underpayment. Additionally, late filing can lead to interest charges on the unpaid tax amount. Corporations should prioritize compliance to avoid these financial repercussions.

Quick guide on how to complete form 1120 w estimated tax for corporations for calendar year or tax year beginning and ending 20 omb no

Effortlessly Prepare [SKS] on Any Device

The management of online documents has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed materials, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and without delays. Handle [SKS] on any device using airSlate SignNow’s Android or iOS applications and simplify any document-based workflow today.

The easiest method to modify and electronically sign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Produce your electronic signature with the Sign tool, which takes just moments and carries the same legal validity as a traditional wet signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1120 W Estimated Tax For Corporations For Calendar Year , Or Tax Year Beginning , , And Ending , 20 OMB No

Create this form in 5 minutes!

How to create an eSignature for the form 1120 w estimated tax for corporations for calendar year or tax year beginning and ending 20 omb no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1120 W Estimated Tax For Corporations For Calendar Year , Or Tax Year Beginning , , And Ending , 20 OMB No.?

Form 1120 W is an IRS form used by corporations to calculate their estimated tax liability for the calendar year or tax year specified. This form helps corporations determine their quarterly tax payments, ensuring compliance with IRS regulations. By understanding how to complete this form accurately, businesses can avoid potential penalties.

-

How can airSlate SignNow help me with Form 1120 W Estimated Tax For Corporations?

airSlate SignNow provides a seamless solution to eSign and send Form 1120 W Estimated Tax For Corporations for its users. By using our user-friendly interface, businesses can obtain necessary signatures on the form efficiently. This not only speeds up the process but also ensures that all relevant stakeholders are involved before submission.

-

Is there a cost associated with using airSlate SignNow for Form 1120 W?

Yes, airSlate SignNow offers competitive pricing plans that are designed to fit various business needs. These plans include features for managing and eSigning documents, including Form 1120 W Estimated Tax For Corporations. Investing in our platform can streamline your tax processes, ultimately saving your business time and reducing administrative burdens.

-

What features does airSlate SignNow offer for tax documents like Form 1120 W?

airSlate SignNow offers numerous features tailored for tax documents such as Form 1120 W, including customizable templates, audit trails, and real-time tracking. These features enhance the overall document management experience and ensure compliance with IRS requirements. Additionally, our platform ensures that your sensitive information remains secure throughout the signing process.

-

Can airSlate SignNow integrate with my accounting software for Form 1120 W?

Yes, airSlate SignNow offers integrations with various accounting software, making it easy to import and manage tax-related forms including Form 1120 W Estimated Tax For Corporations. This capability allows businesses to streamline their workflows and reduce the risk of errors by maintaining consistent records across all platforms.

-

Why is it important to file Form 1120 W Estimated Tax For Corporations timely?

Filing Form 1120 W Estimated Tax For Corporations on time is crucial to avoid penalties and interest imposed by the IRS. Timely filing ensures that your corporation meets its estimated tax obligations, helping maintain a good standing with the tax authorities. Additionally, submitting this form punctually aids in effective financial planning for your business.

-

How does airSlate SignNow ensure the security of Form 1120 W submissions?

airSlate SignNow prioritizes security by implementing advanced encryption techniques and secure servers to protect all document submissions, including Form 1120 W Estimated Tax For Corporations. Our platform complies with industry standards to safeguard sensitive data, giving users peace of mind while handling important tax documents.

Get more for Form 1120 W Estimated Tax For Corporations For Calendar Year , Or Tax Year Beginning , , And Ending , 20 OMB No

Find out other Form 1120 W Estimated Tax For Corporations For Calendar Year , Or Tax Year Beginning , , And Ending , 20 OMB No

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement