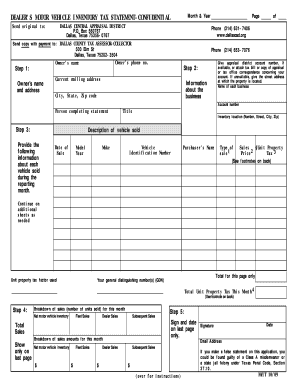

Dealer's Motor Vehicle Inventory Declaration Confidential Form

What is the Dealer's Motor Vehicle Inventory Declaration Confidential

The Dealer's Motor Vehicle Inventory Declaration Confidential is a formal document used by vehicle dealers to report their inventory for tax purposes. This declaration is essential for determining the value of the dealer's inventory in relation to state taxes. It ensures compliance with local tax regulations and provides transparency in the valuation process. The information contained within this declaration is typically confidential, protecting the dealer's business interests while allowing tax authorities to assess the appropriate tax obligations.

Steps to Complete the Dealer's Motor Vehicle Inventory Declaration Confidential

Completing the Dealer's Motor Vehicle Inventory Declaration involves several key steps:

- Gather necessary documentation, including inventory lists, purchase receipts, and any prior tax statements.

- Accurately assess the value of each vehicle in your inventory, ensuring that all details are current and precise.

- Fill out the declaration form, providing all required information such as dealer identification, inventory details, and valuation.

- Review the completed form for accuracy and completeness before submission.

- Submit the declaration to the appropriate state tax authority by the specified deadline.

Legal Use of the Dealer's Motor Vehicle Inventory Declaration Confidential

The legal use of the Dealer's Motor Vehicle Inventory Declaration is crucial for maintaining compliance with state tax laws. This document serves as a formal declaration of the dealer's inventory and is used to calculate tax liabilities accurately. Failure to submit this declaration can lead to penalties, including fines or additional tax assessments. It is important for dealers to understand their legal obligations regarding this declaration to avoid potential legal issues.

Required Documents for the Dealer's Motor Vehicle Inventory Declaration Confidential

To successfully complete the Dealer's Motor Vehicle Inventory Declaration, several documents are typically required:

- Current inventory list detailing all vehicles held for sale.

- Purchase invoices or receipts for each vehicle.

- Previous tax statements or declarations, if applicable.

- Dealer identification number and business registration documents.

Filing Deadlines for the Dealer's Motor Vehicle Inventory Declaration Confidential

Filing deadlines for the Dealer's Motor Vehicle Inventory Declaration vary by state. It is essential for dealers to be aware of these deadlines to ensure timely submission. Missing a deadline can result in penalties or additional scrutiny from tax authorities. Typically, these deadlines align with the annual tax filing period, but specific dates should be confirmed with local tax offices.

Examples of Using the Dealer's Motor Vehicle Inventory Declaration Confidential

Examples of when a Dealer's Motor Vehicle Inventory Declaration may be used include:

- Annual tax assessments where dealers report their inventory to determine tax liabilities.

- During audits by state tax authorities to verify compliance with tax regulations.

- When applying for financing or loans, where accurate inventory valuation is required.

Quick guide on how to complete dealers motor vehicle inventory declaration confidential

Prepare Dealer's Motor Vehicle Inventory Declaration Confidential effortlessly on any device

Online document management has gained popularity among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents quickly without delays. Handle Dealer's Motor Vehicle Inventory Declaration Confidential on any platform using airSlate SignNow Android or iOS applications and enhance your document-centric task today.

The simplest way to alter and eSign Dealer's Motor Vehicle Inventory Declaration Confidential without exertion

- Obtain Dealer's Motor Vehicle Inventory Declaration Confidential and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Dealer's Motor Vehicle Inventory Declaration Confidential to guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dealers motor vehicle inventory declaration confidential

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a dealer motor vehicle inventory tax statement?

A dealer motor vehicle inventory tax statement is a document that provides detailed information about the vehicles in a dealer's inventory. It outlines the value of these vehicles for tax purposes, helping dealerships comply with local tax regulations. Understanding this statement is crucial for accurate tax reporting and can impact the profitability of a dealership.

-

How can airSlate SignNow help with managing dealer motor vehicle inventory tax statements?

airSlate SignNow allows dealerships to digitally create, send, and eSign dealer motor vehicle inventory tax statements efficiently. This streamlines the process and reduces the time spent on paperwork, allowing dealers to focus more on their sales. Its user-friendly platform helps ensure accurate completion and timely submission.

-

Is airSlate SignNow cost-effective for handling dealer motor vehicle inventory tax statements?

Yes, airSlate SignNow is a cost-effective solution for managing dealer motor vehicle inventory tax statements. By eliminating the need for expensive paper processes and reducing administrative workloads, it can save dealers both time and money. The subscription plans are flexible, catering to various business sizes and needs.

-

What features does airSlate SignNow offer for electronic signing of dealer motor vehicle inventory tax statements?

airSlate SignNow provides robust features for electronic signing of dealer motor vehicle inventory tax statements, including secure eSignature options, document tracking, and templates. These features ensure that the signing process is quick, secure, and compliant with legal standards. Moreover, it enables multiple signers, facilitating collaborative approvals.

-

Can airSlate SignNow integrate with other software systems used in dealerships?

Absolutely! airSlate SignNow offers seamless integrations with various software systems commonly used in dealerships, such as CRM and inventory management software. This integration ensures that dealer motor vehicle inventory tax statements can be generated and managed within the ecosystem of tools dealerships are already using, enhancing workflow efficiency.

-

What are the benefits of using airSlate SignNow for dealership documentation?

Using airSlate SignNow for dealership documentation, including dealer motor vehicle inventory tax statements, enhances operational efficiency and accuracy. The platform reduces errors associated with manual paperwork, speeds up the signing process, and provides a secure environment for document management. This allows dealerships to maintain compliance and improve customer service.

-

How does airSlate SignNow ensure the security of dealer motor vehicle inventory tax statements?

airSlate SignNow prioritizes the security of documents like dealer motor vehicle inventory tax statements through advanced encryption and compliance with industry standards. Each document is stored securely, and access can be controlled to ensure only authorized personnel can view sensitive information. This level of security provides peace of mind for dealerships processing important financial documents.

Get more for Dealer's Motor Vehicle Inventory Declaration Confidential

- Safety performance history form

- Staybridge suites credit card authorization form 101253481

- Tag applied for printable form

- Warrick county fop form

- Medieval life information and activity worksheets answer key

- Florida serc form

- Periodic trends worksheet answers form

- Publication 972 child tax credit irs form

Find out other Dealer's Motor Vehicle Inventory Declaration Confidential

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe