Oklahoma Annual Information Return

What is the Oklahoma Annual Information Return

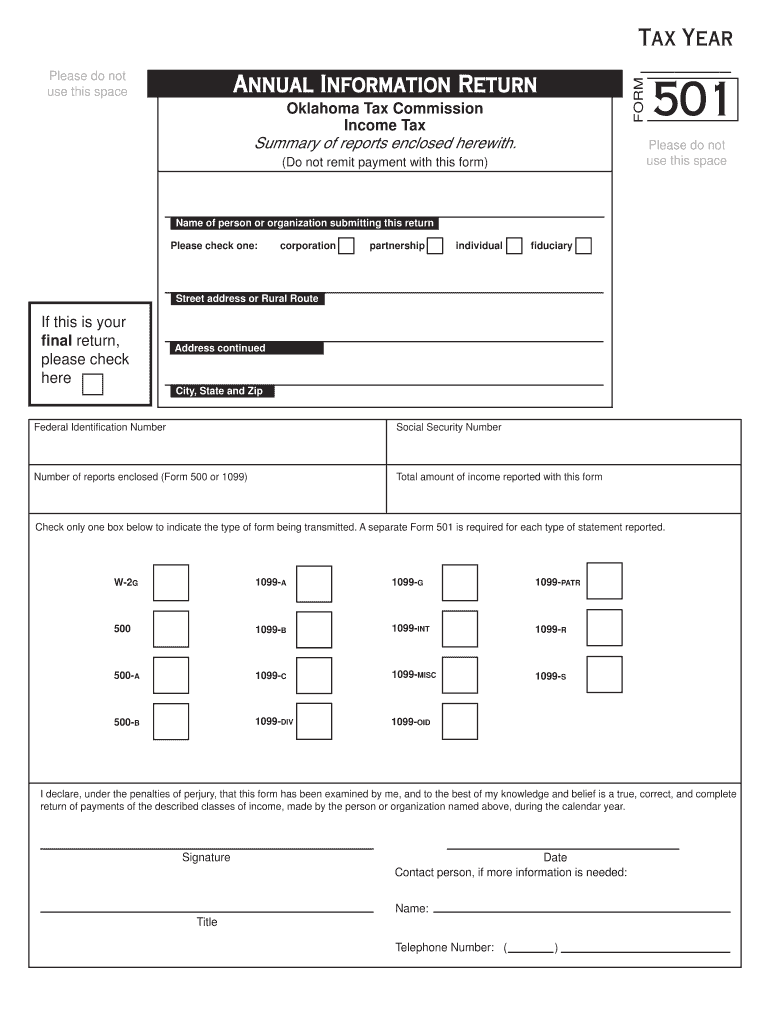

The Oklahoma Annual Information Return is a crucial document that organizations must file to report specific financial information to the state. This form is typically required for various entities, including corporations, partnerships, and limited liability companies (LLCs). It provides essential data about the organization’s income, deductions, and other financial activities throughout the year. Filing this return helps ensure compliance with state tax regulations and contributes to maintaining good standing with the state authorities.

Steps to complete the Oklahoma Annual Information Return

Completing the Oklahoma Annual Information Return involves several important steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary documents: Collect financial statements, income records, and any other relevant information needed to complete the form.

- Fill out the form: Carefully enter all required information, ensuring accuracy in reporting income, expenses, and deductions.

- Review for errors: Double-check all entries for completeness and correctness to avoid potential issues.

- Sign and date the form: Ensure that the appropriate individuals sign the return, as required by law.

- Submit the form: File the completed return either online, by mail, or in person, depending on the submission methods available.

Legal use of the Oklahoma Annual Information Return

The Oklahoma Annual Information Return serves a legal purpose by providing the state with essential data regarding an entity’s financial activities. When completed accurately and submitted on time, it fulfills the legal obligations of the organization under Oklahoma tax laws. The return must adhere to specific guidelines to be considered valid, ensuring that all reported information is truthful and complete. Failure to comply with these legal requirements can result in penalties or other consequences.

Filing Deadlines / Important Dates

Timely filing of the Oklahoma Annual Information Return is essential to avoid penalties. The typical deadline for submission is the fifteenth day of the fourth month following the end of the entity’s fiscal year. For entities operating on a calendar year, this means the deadline is April 15. It is important to keep track of these dates and any potential extensions that may apply to ensure compliance.

Required Documents

To successfully complete the Oklahoma Annual Information Return, organizations must gather several key documents. These typically include:

- Financial statements, including balance sheets and income statements

- Records of income and expenses for the reporting period

- Any supporting documentation for deductions claimed

- Previous year’s tax returns, if applicable

Having these documents ready will streamline the process and help ensure accurate reporting.

Form Submission Methods (Online / Mail / In-Person)

Organizations have multiple options for submitting the Oklahoma Annual Information Return. These methods include:

- Online submission: Many entities opt to file electronically through the state’s tax portal, which can expedite processing.

- Mail: Completed forms can be mailed to the appropriate state tax office. Ensure that sufficient postage is applied and consider using a tracking method.

- In-person: Some organizations may choose to deliver their returns directly to the tax office, allowing for immediate confirmation of receipt.

Quick guide on how to complete oklahoma annual information return

Complete Oklahoma Annual Information Return effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely preserve it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without interruptions. Handle Oklahoma Annual Information Return on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to modify and eSign Oklahoma Annual Information Return seamlessly

- Locate Oklahoma Annual Information Return and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements with just a few clicks from any device you choose. Modify and eSign Oklahoma Annual Information Return and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Can anyone share a link on how to fill out the GST and GST annual return?

The deadline for filing GST Return for the year 17–18 is fast approaching .To file the GST annual return you need to reconcile the data appearing in your returns with the data in your financial books.You can watch the below video to have a basic idea about filing GST annual returnEnglish :Hindi :

-

When I fill out my tax information for a new employer, what do I put for max withholding, to get the biggest possible tax return?

It sounds like you wish to get a large tax return. In that case when filling out your W-4 form you should claim S-0 (that’s single with zero exemptions). This means that your employer will take out the maximum amount. For those people who insist upon the government having use of their money all year there is also an option to have additional funds taken out and held and then returned when your annual return is filed. For that matter you could allow the government to keep it all during the year and then when you file your return instead of taking a refund just tell them to keep it toward next years return. Seriously, I know the large tax return seems nice and for some people that is how they save for vacations and other things, but a tax return is not a gift from the USA. It is your money and receiving a large tax return means that you allowed someone else to have your money for a year without paying you interest for the privilege of keeping your money.

-

How come my tax return was rejected when I filled out all the information correctly, have the correct pin, and did not file them last year?

Are we talking about an individual form 1040? If so are you attempting to electronically file with software like TurboTax or did you paper file? You are a US person with a Social Security number correct? Also, were you provided with a rejection code?In truth, there could be many reasons why your filing didn't go through. If you can give me the answer to the questions I asked above I can better direct you.I would not and no one on quora should charge you or take money from you to answer a question like this.

-

How do I submit income tax returns online?

Here is a step by step guide to e-file your income tax return using ClearTax. It is simple, easy and quick.From 1st July onwards, it is mandatory to link your PAN with Aadhaar and mention it in your IT returns. If you have applied for Aadhaar, you can mention the enrollment number in your returns.Read our Guide on how to link your PAN with Aadhaar.Step 1.Get startedLogin to your ClearTax account.Click on ‘Upload Form 16 PDF’ if you have your Form 16 in PDF format.If you do not have Form 16 in PDF format click on ‘Continue Here’Get an expert & supportive CA to manage your taxes. Plans start @ Rs.799/-ContinueWhat are you looking for?Account & Book KeepingCompany RegistrationGST RegistrationGST Return FilingIncome Tax FilingTrademark RegistrationOtherStep 2.Enter personal infoEnter your Name, PAN, DOB and Bank account details.Step 3.Enter salary detailsFill in your salary, employee details (Name and TAN) and TDS.Tip: Want to claim HRA? Read the guide.Step 4.Enter deduction detailsEnter investment details under Section 80C(eg. LIC, PPF etc., and claim other tax benefits here.Tip: Do you have kids?Claim benefits on their tuition fees under Section 80CStep 5.Add details of taxes paidIf you have non-salary income,eg. interest income or freelance income, then add tax payments that are already made. You can also add these details by uploading Form 26ASStep 6.E-file your returnIf you see “Refund” or “No Tax Due” here, Click on proceed to E-Filing.You will get an acknowledgement number on the next screen.Tip: See a “Tax Due” message? Read this guide to know how to pay your tax dues.Step 7: E-VerifyOnce your return is file E-Verify your income tax return

-

How can I add my business location on instagram"s suggested locations?

Making a custom location on Instagram is actually quite easy and gives you an advantage to other businesses because it allows you to drive traffic via location.First off, Facebook owns Instagram; therefore, any location listed on Facebook also appears on Instagram. So you are going to need to create a business location on Facebook.So let’s dive into how to create a business location on Instagram.Make sure that you have enabled location services through the Facebook App or in your phone settings. If you are using an iPhone, select “Settings” → “Account Settings” → “Location” → “While Using The App”You need to create a Facebook check-in status. You do this by making a status and type the name of what you want your location to be called. For example “Growth Hustlers HQ”. Scroll to the bottom of the options and select “Add Custom Location” then tap on it!Now that you’ve created a custom location you need to describe it. It will ask you to choose which category describes your location, which you will answer “Business”.After choosing a category Facebook will ask you to choose a location. You can either choose “I’m currently here” or you can search for a location that you want to create for your business.Finally, publish your status. Congratulations! You have just created a custom location to be used on Facebook and Instagram.Now you are able to tag your business or a custom location on Instagram.If you have any questions about Social Media Marketing for businesses feel free to check out GrowthHustlers.com where you can find tons of resources about growing your Instagram following.

-

Are there any websites to get statements (annual return) / informations / financial datas about companies in USA?

SEC.GOV…….this is for publically traded entities only. Private companies (with some exceptions) are not required to file financial information.

Create this form in 5 minutes!

How to create an eSignature for the oklahoma annual information return

How to make an electronic signature for the Oklahoma Annual Information Return in the online mode

How to generate an eSignature for the Oklahoma Annual Information Return in Chrome

How to make an eSignature for signing the Oklahoma Annual Information Return in Gmail

How to generate an eSignature for the Oklahoma Annual Information Return right from your mobile device

How to generate an eSignature for the Oklahoma Annual Information Return on iOS devices

How to make an eSignature for the Oklahoma Annual Information Return on Android OS

People also ask

-

What is an annual information return?

An annual information return is a tax form used by organizations to report their income, expenses, and other financial information to the relevant tax authority. Using airSlate SignNow can simplify the process of collecting, signing, and submitting these forms electronically, ensuring timely compliance.

-

How can airSlate SignNow help with the annual information return process?

airSlate SignNow streamlines the creation and submission of your annual information return by providing a user-friendly platform for preparing documents. With its electronic signature capabilities, you can gather necessary approvals without the hassle of paper forms, making the entire process faster and more efficient.

-

What features does airSlate SignNow offer for managing annual information returns?

airSlate SignNow offers a range of features including customizable templates for annual information returns, secure electronic signatures, and real-time tracking of document status. These tools ensure that your returns are filed accurately and on time, minimizing the risk of errors.

-

What pricing plans does airSlate SignNow have for businesses needing annual information return services?

airSlate SignNow offers flexible pricing plans tailored to various business needs, including features specific to managing annual information returns. Whether you are a small business or a large organization, you can find a plan that fits your budget and helps facilitate seamless document management.

-

Can airSlate SignNow integrate with my existing accounting software for annual information returns?

Yes, airSlate SignNow integrates with various accounting and financial software, allowing you to streamline the preparation of your annual information return. These integrations eliminate duplicate data entry and ensure that all your financial records are synchronized, improving accuracy.

-

What benefits does eSigning provide for annual information return filings?

eSigning through airSlate SignNow saves time and reduces paperwork by allowing you to get documents signed quickly and securely online. This is particularly beneficial for annual information returns, ensuring that your filings are completed promptly to avoid penalties from tax authorities.

-

Is airSlate SignNow suitable for both small and large organizations for their annual information return needs?

Absolutely! airSlate SignNow is designed to cater to organizations of all sizes for managing their annual information returns. Its scalable features allow small businesses to use it efficiently, while larger organizations benefit from advanced functionalities and integrations.

Get more for Oklahoma Annual Information Return

- Dc confidential statement form

- Realtors association of new mexico commercial form

- Realtor association of the fox valley rental application form

- Immunizaton date report maricopa county form

- Yardi dispute process form

- Commercial property inspection checklist john dixon amp associates 47316048 form

- Tamale order form 484715330

- Parent teen driving contract form

Find out other Oklahoma Annual Information Return

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple