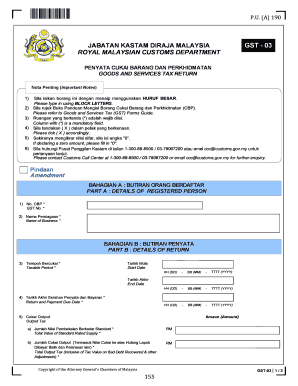

Gst03 Form

What is the Gst03

The Gst03 form is a specific document used in the United States for reporting and managing various tax-related matters. It is essential for individuals and businesses to understand its purpose and implications. The Gst03 serves as a declaration of certain financial activities and is often required by the Internal Revenue Service (IRS) to ensure compliance with federal tax regulations. Proper completion of this form is crucial for accurate tax reporting and to avoid potential penalties.

How to use the Gst03

Using the Gst03 form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents and data that pertain to the reporting period. Next, carefully fill out the form, ensuring that each section is completed according to the instructions provided. It is important to double-check for accuracy before submission, as errors can lead to delays or penalties. Once the form is completed, it can be submitted electronically or via traditional mail, depending on the specific requirements outlined by the IRS.

Steps to complete the Gst03

Completing the Gst03 form requires a systematic approach to ensure accuracy and compliance. Here are the key steps:

- Gather Information: Collect all necessary financial records, including income statements, expense receipts, and any other relevant documentation.

- Fill Out the Form: Begin entering information into the Gst03 form, following the prompts and guidelines carefully.

- Review for Accuracy: Check each section for completeness and correctness to prevent any mistakes that could lead to issues later.

- Submit the Form: Choose the appropriate submission method, whether online or by mail, and ensure that it is sent by the required deadline.

Legal use of the Gst03

The Gst03 form is legally binding when completed correctly and submitted in accordance with IRS regulations. It is crucial to adhere to all legal requirements associated with the form, including accurate reporting of financial information. Failure to comply with these regulations can result in penalties or legal repercussions. Utilizing a reliable eSignature platform can enhance the legal standing of the completed form, ensuring that it meets all necessary compliance standards.

Filing Deadlines / Important Dates

Filing deadlines for the Gst03 form are critical to ensure compliance with tax regulations. Typically, the form must be submitted by a specific date each year, often coinciding with the overall tax filing deadline. It is advisable to stay informed about any changes in deadlines or requirements that may occur annually. Marking these dates on a calendar can help individuals and businesses avoid late submissions and potential penalties.

Required Documents

To complete the Gst03 form accurately, several documents are typically required. These may include:

- Income statements for the reporting period

- Expense receipts and records

- Previous year’s tax returns for reference

- Any additional documentation as specified by the IRS

Having these documents ready will streamline the process and ensure that all necessary information is available for accurate reporting.

Quick guide on how to complete gst03

Complete Gst03 effortlessly on any device

Managing documents online has become increasingly popular with companies and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can obtain the appropriate form and securely keep it online. airSlate SignNow provides you with all the resources you require to create, edit, and eSign your documents promptly and without hassle. Handle Gst03 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Gst03 painlessly

- Find Gst03 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark relevant sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Gst03 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gst03

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is gst03 and how does it work with airSlate SignNow?

The gst03 is an innovative electronic signature feature included in airSlate SignNow, enabling users to easily and securely sign documents online. It streamlines the signing process, ensuring compliance and authenticity through advanced encryption methods. With gst03, businesses can enhance their workflow efficiency and reduce turnaround times for document approvals.

-

How much does airSlate SignNow with gst03 cost?

AirSlate SignNow offers various pricing plans tailored for different business sizes, starting with a cost-effective option that includes gst03 functionality. Each plan provides a comprehensive set of features, ensuring that whether you are a small business or a large enterprise, you can find an affordable solution. Additionally, there is a free trial available so users can experience gst03 before committing.

-

What key features does gst03 offer?

The gst03 feature in airSlate SignNow includes customized templates, real-time tracking of document status, and multi-party signing options. It's designed to improve the user experience by making document management simple and intuitive. These features help businesses to finalize agreements faster and with greater accuracy.

-

Are there any benefits to using gst03 for document signing?

Using gst03 with airSlate SignNow provides signNow benefits such as enhanced security, improved efficiency, and reduced paper usage. The digital signing process ensures that documents are signed from anywhere, at any time, which greatly promotes productivity. Additionally, businesses can maintain a secure audit trail with gst03, offering peace of mind regarding document integrity.

-

Can gst03 be integrated with other software solutions?

Yes, airSlate SignNow's gst03 can seamlessly integrate with various third-party software applications, including CRM and project management tools. This integration capability allows users to streamline workflows and manage document signing directly within their preferred platforms. Such compatibility enhances overall productivity and collaboration within teams.

-

Is gst03 compliant with legal standards for electronic signatures?

Absolutely, gs03 complies with key legal standards such as ESIGN and UETA, making it a reliable choice for electronic signatures. This compliance ensures that all signed documents are legally binding, providing users with the confidence they need when using airSlate SignNow. Businesses can trust that their use of gst03 will meet necessary regulatory requirements.

-

How can businesses maximize their use of gst03?

To maximize the effectiveness of gst03, businesses should utilize its customizable templates and automated workflows to tailor the document signing process. Additionally, training team members on how to leverage the full capabilities of airSlate SignNow will ensure optimal usage. Regularly analyzing usage statistics also helps in refining processes and improving overall efficiency.

Get more for Gst03

- Deponent verbs latin worksheet form

- Pdffiller huntington university physical form

- Pbgcg92f 101612 form

- Probable cause affidavit indiana form

- Floyd county government services form

- Fillable online srlsys bookmark contest bformbpdf satilla

- Transcript of esthetician apprentice training it is form

- Everything you need to know about the early payment form

Find out other Gst03

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template