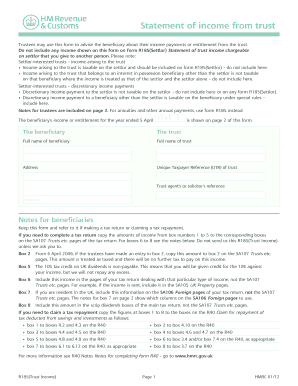

Statement of Income from Trust Fillable Form

What is the R185 Form for Estate?

The R185 form for estate is a tax document used in the United States to report income generated from an estate or trust. This form provides beneficiaries with essential information regarding their share of the income, which is necessary for their personal tax filings. The R185 form typically includes details about the income received, deductions, and the tax year in question. Understanding this form is crucial for beneficiaries to accurately report their income and comply with tax regulations.

Key Elements of the R185 Form for Estate

Several key elements are essential to understand when dealing with the R185 form for estate. These include:

- Beneficiary Information: This section identifies the beneficiaries receiving income from the estate or trust.

- Income Breakdown: The form details the various types of income generated, such as dividends, interest, and rental income.

- Deductions: Any applicable deductions that can reduce the taxable income for the beneficiaries are listed here.

- Tax Year: The form specifies the tax year for which the income is reported, ensuring clarity for tax filings.

Steps to Complete the R185 Form for Estate

Completing the R185 form for estate involves several straightforward steps:

- Gather Necessary Information: Collect all relevant financial documents related to the estate or trust.

- Fill Out Beneficiary Details: Enter the names and identification numbers of all beneficiaries receiving income.

- Report Income: Accurately report the total income generated by the estate or trust, categorizing it as necessary.

- Include Deductions: List any deductions that beneficiaries can claim to reduce their taxable income.

- Review for Accuracy: Double-check all entries for accuracy and completeness before submission.

Legal Use of the R185 Form for Estate

The R185 form for estate serves a legal purpose in the context of tax compliance. It ensures that beneficiaries report their income correctly, adhering to IRS regulations. Failure to accurately complete and file this form can lead to penalties or audits. Additionally, the form provides a clear record of income distribution from the estate, which can be important in legal disputes or estate settlements.

Examples of Using the R185 Form for Estate

Understanding how to use the R185 form for estate can be illustrated through practical examples:

- Example One: A beneficiary receives $5,000 in dividends from an estate. The R185 form will report this amount, allowing the beneficiary to include it in their personal tax return.

- Example Two: An estate generates rental income of $10,000. The R185 form will detail this income along with any deductible expenses, helping beneficiaries understand their tax obligations.

Who Issues the R185 Form for Estate?

The R185 form for estate is typically issued by the executor or administrator of the estate or trust. This individual is responsible for managing the estate's financial affairs and ensuring that all beneficiaries receive accurate information regarding their share of income. It is essential for the executor to complete and distribute the form in a timely manner to facilitate the beneficiaries' tax filings.

Quick guide on how to complete statement of income from trust fillable form

Submit Statement Of Income From Trust Fillable Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Statement Of Income From Trust Fillable Form on any device with airSlate SignNow Android or iOS applications and ease any document-centric procedure today.

The easiest way to modify and eSign Statement Of Income From Trust Fillable Form with ease

- Locate Statement Of Income From Trust Fillable Form and click Get Form to initiate.

- Utilize the tools we offer to finish your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet signature.

- Review all the details and then click the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Statement Of Income From Trust Fillable Form and ensure outstanding communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the statement of income from trust fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an example of completed r185 form?

An example of completed r185 form refers to a fully filled out document that illustrates how to correctly complete the form. This example helps users understand the necessary information and format, ensuring compliance with tax regulations. You can find various resources and templates that provide guidance on completing your R185 form effectively.

-

How can airSlate SignNow help with R185 form completion?

airSlate SignNow simplifies the process of completing legal documents such as the R185 form. With its intuitive interface, users can easily fill out the necessary fields and ensure accuracy. The platform also allows for electronic signatures, making the submission process more efficient.

-

Is airSlate SignNow suitable for small businesses filing R185 forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses needing to file R185 forms. With affordable pricing plans, it allows businesses to manage their document workflows without breaking the bank. Many small business owners have found it particularly useful for streamlining their paperwork.

-

Can I integrate airSlate SignNow with other tools to manage R185 forms?

Absolutely! airSlate SignNow offers integrations with popular tools such as Google Drive, Salesforce, and more. This allows you to manage your R185 forms alongside other documents and business processes seamlessly. Integrating these tools enhances productivity and ensures hassle-free management.

-

What security measures does airSlate SignNow offer for R185 forms?

airSlate SignNow prioritizes the security of your documents, including R185 forms, by using advanced encryption methods. This ensures that your information remains confidential and protected throughout the signing process. Compliance with industry standards also assures customers that their data is treated with the utmost care.

-

Can I access an example of completed r185 form on airSlate SignNow?

Yes, airSlate SignNow provides access to various templates, including an example of completed r185 form. This resource can guide you in completing your own form accurately. Users often find that these examples signNowly reduce errors in their submissions.

-

What features does airSlate SignNow offer for eSigning R185 forms?

airSlate SignNow offers a comprehensive set of features for eSigning, including customizable workflows, document tracking, and the ability to add multiple signers. This makes the process of signing R185 forms quick and efficient. Users especially appreciate the real-time updates and notifications during the signing process.

Get more for Statement Of Income From Trust Fillable Form

- Wdr 1 texas form

- To whom it may concern letter form

- Dennis uniforms returns

- My denver card application form

- Ol 29 i application for occupational license personal apps dmv ca form

- Forensic odontology webquest answer key form

- Senior night information sheet return to the high school

- Fishing derby sign up template form

Find out other Statement Of Income From Trust Fillable Form

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple