Otc 904 Schedule 3 2012-2026

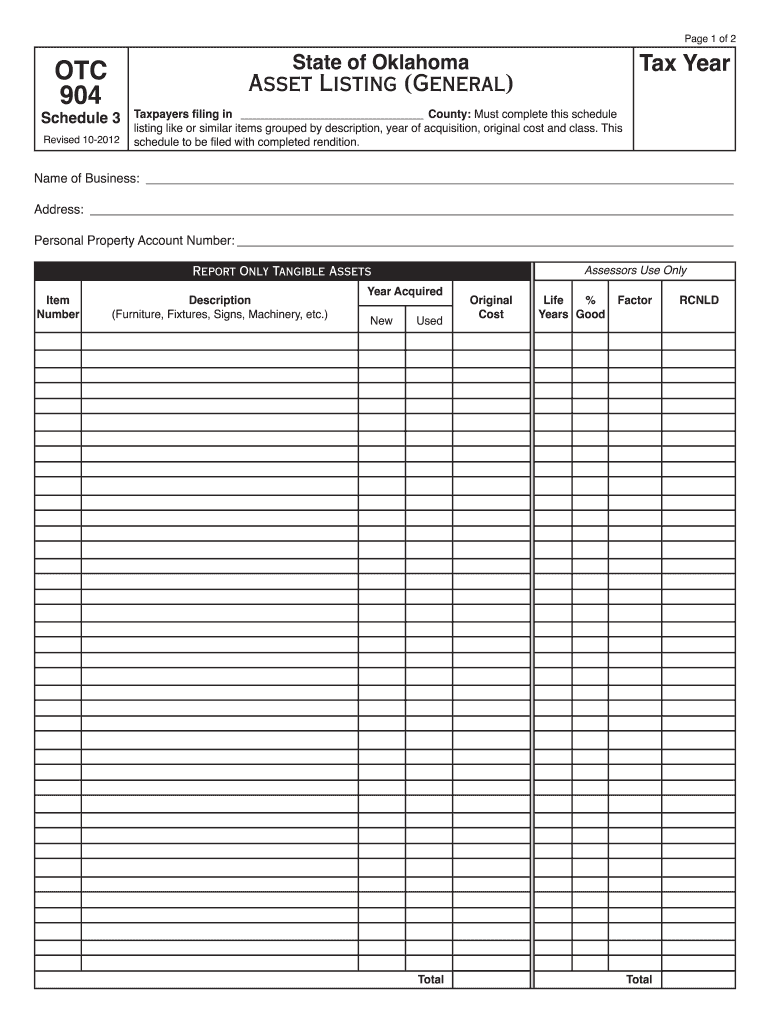

What is the OTC 904 Schedule 3?

The OTC 904 Schedule 3 is a specific tax form used in Oklahoma for reporting certain income and deductions related to business operations. This form is essential for taxpayers who need to detail their financial activities accurately to comply with state tax regulations. It provides a structured format for individuals and businesses to report their earnings, expenses, and other relevant financial information.

How to use the OTC 904 Schedule 3

Using the OTC 904 Schedule 3 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and receipts for deductible expenses. Next, fill out the form by entering the required information in the designated fields, ensuring that all entries are accurate and complete. Once filled, review the form for any errors before submitting it to the appropriate state tax authority. It is crucial to keep a copy for your records.

Steps to complete the OTC 904 Schedule 3

Completing the OTC 904 Schedule 3 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the OTC 904 Schedule 3 from the Oklahoma Tax Commission.

- Gather all relevant financial documents, including income records and expense receipts.

- Fill in your personal information at the top of the form.

- Report your total income in the designated section.

- List all deductible expenses accurately, ensuring to categorize them appropriately.

- Calculate your net income by subtracting total expenses from total income.

- Sign and date the form before submission.

Legal use of the OTC 904 Schedule 3

The OTC 904 Schedule 3 is legally recognized for reporting income and expenses in Oklahoma. It must be filled out accurately to comply with state tax laws. Failure to use the form correctly can lead to penalties or audits by the Oklahoma Tax Commission. It is essential for taxpayers to understand the legal implications of their submissions and ensure that all reported information is truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the OTC 904 Schedule 3 are crucial for compliance. Typically, the form must be submitted by April 15 of the following year for individual taxpayers. However, specific deadlines may vary based on the taxpayer's situation, such as extensions or special circumstances. It is advisable to check the Oklahoma Tax Commission's website for the most current deadlines and any updates that may affect filing dates.

Required Documents

To complete the OTC 904 Schedule 3, certain documents are necessary. These include:

- Income statements, such as W-2s or 1099s.

- Receipts for all deductible expenses.

- Previous year’s tax returns for reference.

- Any additional documentation that supports claims made on the form.

Form Submission Methods

The OTC 904 Schedule 3 can be submitted through various methods. Taxpayers have the option to file online, which is often the fastest and most efficient method. Alternatively, the form can be mailed to the Oklahoma Tax Commission or submitted in person at their offices. Each method has its own processing times, so it is important to choose the one that best fits your needs and timeline.

Quick guide on how to complete oklahoma form 904 schedule 3

Your assistance manual on how to prepare your Otc 904 Schedule 3

If you wish to understand how to finalize and transmit your Otc 904 Schedule 3, here are a few brief guidelines to simplify tax submission.

First, you must set up your airSlate SignNow account to change how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, draft, and finalize your tax documents seamlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and return to modify answers when necessary. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to finalize your Otc 904 Schedule 3 in moments:

- Create your account and start managing PDFs in moments.

- Utilize our directory to locate any IRS tax document; browse through variations and schedules.

- Click Obtain form to access your Otc 904 Schedule 3 in our editor.

- Complete the mandatory fillable fields with your information (text, numbers, check marks).

- Use the Signature Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper may lead to return errors and delay refunds. Of course, before e-filing your taxes, check the IRS website for filing guidelines specific to your state.

Create this form in 5 minutes or less

FAQs

-

How do I schedule a US visa interview of two people together after filling out a DS160 form?

Here is a link that might help answer your question >> DS-160: Frequently Asked QuestionsFor more information on this and similar matters, please call me direct: 650.424.1902Email: heller@hellerimmigration.comHeller Immigration Law Group | Silicon Valley Immigration Attorneys

-

How do I fill out Form 30 for ownership transfer?

Form 30 for ownership transfer is a very simple self-explanatory document that can filled out easily. You can download this form from the official website of the Regional Transport Office of a concerned state. Once you have downloaded this, you can take a printout of this form and fill out the request details.Part I: This section can be used by the transferor to declare about the sale of his/her vehicle to another party. This section must have details about the transferor’s name, residential address, and the time and date of the ownership transfer. This section must be signed by the transferor.Part II: This section is for the transferee to acknowledge the receipt of the vehicle on the concerned date and time. A section for hypothecation is also provided alongside in case a financier is involved in this transaction.Official Endorsement: This section will be filled by the RTO acknowledging the transfer of vehicle ownership. The transfer of ownership will be registered at the RTO and copies will be provided to the seller as well as the buyer.Once the vehicle ownership transfer is complete, the seller will be free of any responsibilities with regard to the vehicle.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

In Oklahoma if I revoke my probation is there a form that I can fill out and filed to the court that will let me pay my fines and be off probation?

I'm not from Oklahoma but I'm sure that you can't revoke your own probation. If that were possible no one would be on probation. You have no say in your probation. It is all told to you by the Judge and your PO.

Create this form in 5 minutes!

How to create an eSignature for the oklahoma form 904 schedule 3

How to generate an electronic signature for your Oklahoma Form 904 Schedule 3 online

How to create an electronic signature for the Oklahoma Form 904 Schedule 3 in Chrome

How to make an eSignature for signing the Oklahoma Form 904 Schedule 3 in Gmail

How to make an electronic signature for the Oklahoma Form 904 Schedule 3 straight from your smartphone

How to generate an electronic signature for the Oklahoma Form 904 Schedule 3 on iOS

How to create an eSignature for the Oklahoma Form 904 Schedule 3 on Android OS

People also ask

-

What is Otc 904 Schedule 3 and how does it relate to airSlate SignNow?

Otc 904 Schedule 3 refers to a classification of prescription medications that can be managed electronically using airSlate SignNow. The platform allows healthcare professionals and businesses to securely send and eSign documents related to these medications, ensuring compliance and efficiency in document management.

-

How does airSlate SignNow help with Otc 904 Schedule 3 documentation?

airSlate SignNow simplifies the documentation process for Otc 904 Schedule 3 by providing an intuitive interface for eSigning and sending necessary files. This helps businesses streamline their operations and maintain accurate records while adhering to regulatory requirements.

-

What are the pricing plans for using airSlate SignNow for Otc 904 Schedule 3?

AirSlate SignNow offers various pricing plans tailored to different business needs, including those specifically handling Otc 904 Schedule 3. Each plan provides access to essential features such as document templates and integrations, ensuring you find a cost-effective solution that fits your budget.

-

Can airSlate SignNow integrate with other software for managing Otc 904 Schedule 3?

Yes, airSlate SignNow seamlessly integrates with various software solutions, enhancing your ability to manage Otc 904 Schedule 3 documentation. Whether you're using CRM systems or other healthcare software, these integrations help streamline workflows and improve efficiency.

-

What features of airSlate SignNow are beneficial for Otc 904 Schedule 3 users?

Key features of airSlate SignNow beneficial for Otc 904 Schedule 3 users include customizable templates, secure cloud storage, and real-time tracking of document status. These features ensure that users can efficiently manage their documentation while maintaining compliance with healthcare regulations.

-

Is airSlate SignNow compliant with regulations for Otc 904 Schedule 3?

Absolutely, airSlate SignNow is designed with compliance in mind, especially for sensitive documents like those related to Otc 904 Schedule 3. The platform employs advanced security measures and adheres to industry standards to protect your data, ensuring that you stay compliant with regulations.

-

How does eSigning with airSlate SignNow work for Otc 904 Schedule 3 documents?

eSigning with airSlate SignNow for Otc 904 Schedule 3 documents is straightforward and user-friendly. Users can upload documents, add signature fields, and send them for electronic signature, all while ensuring the process is legally binding and secure.

Get more for Otc 904 Schedule 3

- Crt 61 example form

- Asthma control test pdf form

- Application for 65 plus licenses arkansas game and fish form

- Prescription form pdf

- Dd form 2866 instructions

- Sce owner authorization agreement form

- Financial assistance application baycare baycare form

- Custody statutes are included after the complaint form

Find out other Otc 904 Schedule 3

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter