Crt 61 Example Form

What is the CRT 61 Example

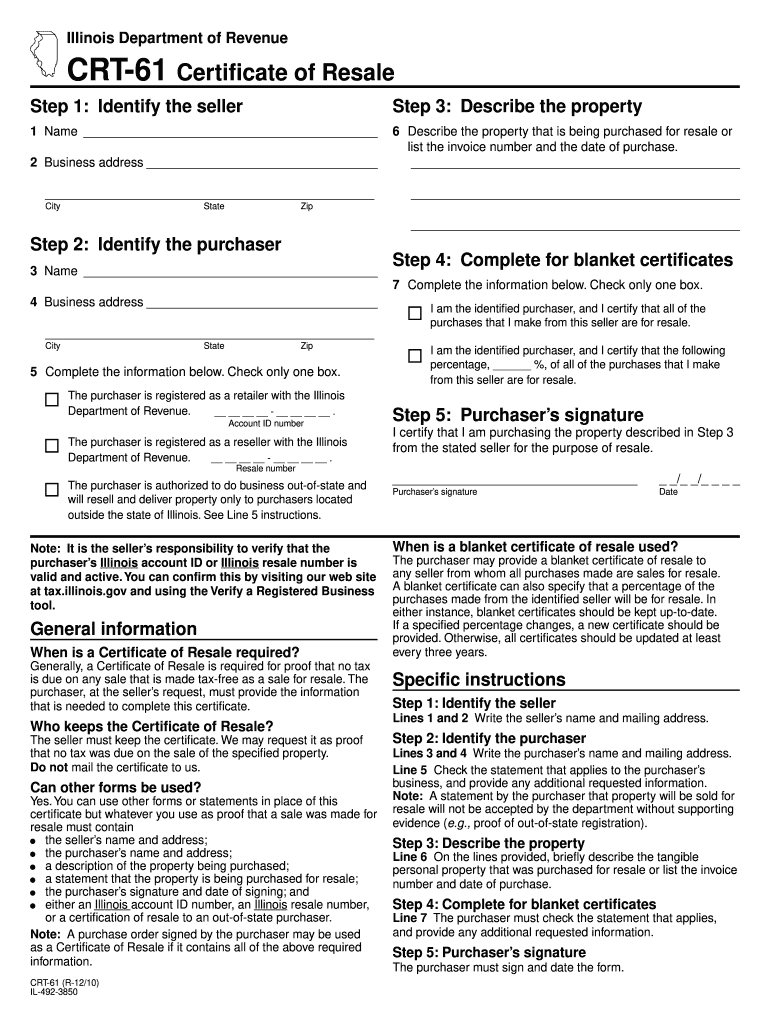

The CRT 61 form is a resale certificate used in Illinois, allowing businesses to purchase goods tax-free when they intend to resell them. This certificate is crucial for retailers and wholesalers who want to avoid paying sales tax on items they will sell to end consumers. By using the CRT 61 example, businesses can ensure compliance with state tax regulations while facilitating smoother transactions with suppliers.

Steps to Complete the CRT 61 Example

Completing the CRT 61 form involves several key steps to ensure accuracy and compliance. First, gather necessary information, including your business name, address, and the seller's details. Next, clearly indicate the type of goods being purchased for resale. It is important to provide your Illinois Department of Revenue registration number, as this verifies your status as a retailer. Finally, sign and date the form to validate it. Ensure that all information is accurate to prevent issues with tax authorities.

Legal Use of the CRT 61 Example

The CRT 61 form is legally binding when filled out correctly. It serves as a declaration that the purchaser intends to resell the goods, thereby exempting them from sales tax. To maintain legal validity, the form must be presented to the seller at the time of purchase. Both parties should retain copies for their records, as they may need to provide proof of the transaction in case of an audit by the Illinois Department of Revenue.

Who Issues the Form

The CRT 61 form is issued by the Illinois Department of Revenue. This state agency oversees the collection of sales tax and ensures compliance with tax regulations in Illinois. Businesses must ensure they are registered with the Department of Revenue to obtain a valid CRT 61 form and to use it correctly during transactions.

Required Documents

To complete the CRT 61 form, several documents may be required. These typically include your business registration documents, proof of your Illinois sales tax registration number, and any relevant identification that confirms your business status. Having these documents on hand will streamline the process and help ensure that the form is filled out accurately.

Examples of Using the CRT 61 Example

Businesses can use the CRT 61 form in various scenarios. For instance, a clothing retailer purchasing inventory from a wholesaler would present the CRT 61 to avoid paying sales tax on those items. Similarly, a furniture store acquiring products for resale can utilize the form to facilitate tax-exempt purchases. These examples illustrate how the CRT 61 form is essential for maintaining compliance while managing operational costs.

Quick guide on how to complete crt 61 example

Easily Prepare Crt 61 Example on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without any holdups. Handle Crt 61 Example on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The Easiest Way to Modify and eSign Crt 61 Example Effortlessly

- Find Crt 61 Example and click Get Form to begin.

- Utilize the tools available to complete your document.

- Select important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Craft your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether through email, text message (SMS), invite link, or by downloading it to your computer.

Eliminate the hassle of lost or misplaced documents, tiring searches for forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs within just a few clicks from any device you choose. Modify and eSign Crt 61 Example while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the crt 61 example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CRT 61 example in airSlate SignNow?

A CRT 61 example refers to a specific document format supported by airSlate SignNow for electronic signatures. This example illustrates how businesses can streamline their signing processes using templates tailored to their needs, ensuring efficiency and compliance with industry standards.

-

How does airSlate SignNow handle pricing for CRT 61 examples?

airSlate SignNow offers competitive pricing plans to access features associated with CRT 61 examples. By choosing the plan that best fits your business size and requirements, you can take advantage of unlimited document sends and eSignatures at an affordable rate.

-

What features are included in the CRT 61 example templates?

The CRT 61 example templates within airSlate SignNow include various features such as drag-and-drop document creation, customizable fields, and automatic reminders for signers. These features enhance document management and ensure that your contracts are executed promptly.

-

What are the benefits of using CRT 61 examples in airSlate SignNow?

Using CRT 61 examples in airSlate SignNow can boost productivity, as they simplify the eSigning process and eliminate paper waste. Additionally, these examples ensure compliance with legal standards, providing peace of mind while managing important documents.

-

Can I integrate CRT 61 examples with other applications?

Yes, airSlate SignNow allows integration of CRT 61 examples with various applications such as Google Drive, Salesforce, and Dropbox. This capability ensures a seamless workflow, allowing you to manage documents efficiently across different platforms.

-

Is it easy to create a CRT 61 example document?

Absolutely! airSlate SignNow features an intuitive interface that makes creating a CRT 61 example document quick and straightforward. Users can simply select the template, customize it to their needs, and share it for signing with just a few clicks.

-

Are CRT 61 examples secure in airSlate SignNow?

Security is a top priority for airSlate SignNow, and CRT 61 examples are protected by robust encryption protocols. This means your sensitive information and signed documents are safe, giving businesses the confidence they need when handling important paperwork.

Get more for Crt 61 Example

- Form 26 5 seller financing addendum ccimtech support

- Trec contract form

- West virginia crash form

- Lifetime climbing climbing waiver form

- The function of form pdf

- Discipline fill of blank form

- Application moeamp39s fppub moeamp39s southwest grill form

- Anskan om godknnande av andrahandsuthyrning hn1c form

Find out other Crt 61 Example

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile