L 1040 Form

What is the L 1040

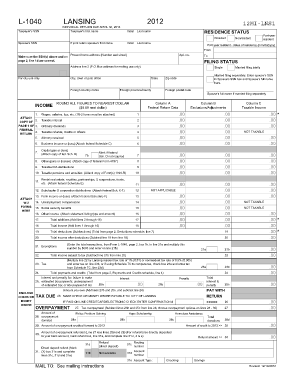

The L 1040 form is a tax return document used by individuals in the United States to report their annual income to the Internal Revenue Service (IRS). This form is essential for taxpayers as it determines their tax liability, allowing them to calculate the amount of tax owed or the refund due. The L 1040 form includes various sections for reporting income, deductions, and credits, making it a comprehensive tool for tax filing.

Steps to complete the L 1040

Completing the L 1040 form involves several key steps to ensure accuracy and compliance with IRS regulations. Here are the main steps:

- Gather necessary documents, such as W-2s, 1099s, and records of other income.

- Determine your filing status, which affects your tax rates and deductions.

- Report all sources of income in the appropriate sections of the form.

- Claim deductions and credits to reduce your taxable income.

- Calculate your total tax liability based on the information provided.

- Sign and date the form to validate your submission.

How to obtain the L 1040

The L 1040 form can be obtained through various methods to accommodate different preferences. Taxpayers can download the form directly from the IRS website in a printable format. Alternatively, many tax preparation software programs include the L 1040 form as part of their services, allowing for electronic completion and submission. Additionally, physical copies are available at local IRS offices and select libraries.

Legal use of the L 1040

The L 1040 form is legally binding when completed and submitted according to IRS guidelines. To ensure its legal validity, taxpayers must provide accurate information and sign the form. Electronic signatures are acceptable if the form is filed online, provided that the eSignature complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act. This legal framework ensures that electronic submissions hold the same weight as traditional paper filings.

Filing Deadlines / Important Dates

Filing deadlines for the L 1040 form are crucial for taxpayers to meet to avoid penalties. Typically, the deadline for submitting the L 1040 form is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also request an extension to file, usually extending the deadline to October 15, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Examples of using the L 1040

There are various scenarios where the L 1040 form is applicable. For instance, a full-time employee receiving a salary would report their income using the L 1040, including any additional income from side jobs. Similarly, self-employed individuals must complete the L 1040 to report their business income and expenses. Each taxpayer's situation may vary, but the L 1040 serves as a foundational document for reporting income and calculating taxes owed.

Quick guide on how to complete l 1040

Complete L 1040 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage L 1040 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign L 1040 without effort

- Locate L 1040 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information, then click on the Done button to save your changes.

- Select how you wish to share your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign L 1040 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the l 1040

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the l 1040 form and why is it important?

The l 1040 form is a vital document for individual income tax filing in the United States. It enables taxpayers to report their income, claim deductions, and calculate their tax obligations. Understanding the l 1040 is essential to ensure compliance and optimize tax returns.

-

How can airSlate SignNow assist with filling out the l 1040?

airSlate SignNow streamlines the process of filling out the l 1040 form by allowing users to fill, sign, and send documents electronically. This not only saves time but also reduces the risk of errors in tax submissions. With airSlate SignNow, your l 1040 form will be ready for submission in a few simple steps.

-

Is airSlate SignNow cost-effective for businesses needing to prepare the l 1040?

Yes, airSlate SignNow offers a cost-effective solution specifically tailored for businesses looking to prepare and eSign documents, including the l 1040 form. Its competitive pricing ensures that companies can efficiently handle their document workflows without breaking the bank. Investing in airSlate SignNow means investing in both efficiency and savings.

-

What features does airSlate SignNow offer for managing the l 1040?

airSlate SignNow includes features such as templates for l 1040 forms, real-time collaboration, and secure cloud storage. These functionalities make it easier to manage your tax documents and ensure that all stakeholders can access the necessary information. This user-friendly interface signNowly enhances the experience of working with the l 1040.

-

Are there any integrations available for the l 1040 with airSlate SignNow?

Absolutely! airSlate SignNow integrates with a variety of applications to improve efficiency when managing the l 1040 form. You can seamlessly connect with accounting software, CRM systems, and other productivity tools. This integration helps streamline your entire tax preparation process.

-

What are the benefits of using airSlate SignNow for the l 1040 process?

Using airSlate SignNow for the l 1040 process provides numerous benefits, including increased efficiency, enhanced security, and reduced paperwork. The platform simplifies the eSigning and document management, helping users to focus on what matters most. Businesses experience improved workflow and can ensure their tax forms are submitted correctly and on time.

-

Can airSlate SignNow help in preventing errors in the l 1040 submission?

Yes, airSlate SignNow signNowly reduces the chances of errors in l 1040 submissions by offering features like interactive document filling and automatic validations. By guiding users through each step, the platform ensures that all necessary information is accurately captured before submission. This minimizes the risk of costly mistakes in your tax filings.

Get more for L 1040

Find out other L 1040

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document