Non Borrower Authorization Form Chase

Understanding the Non Borrower Credit Authorization Form

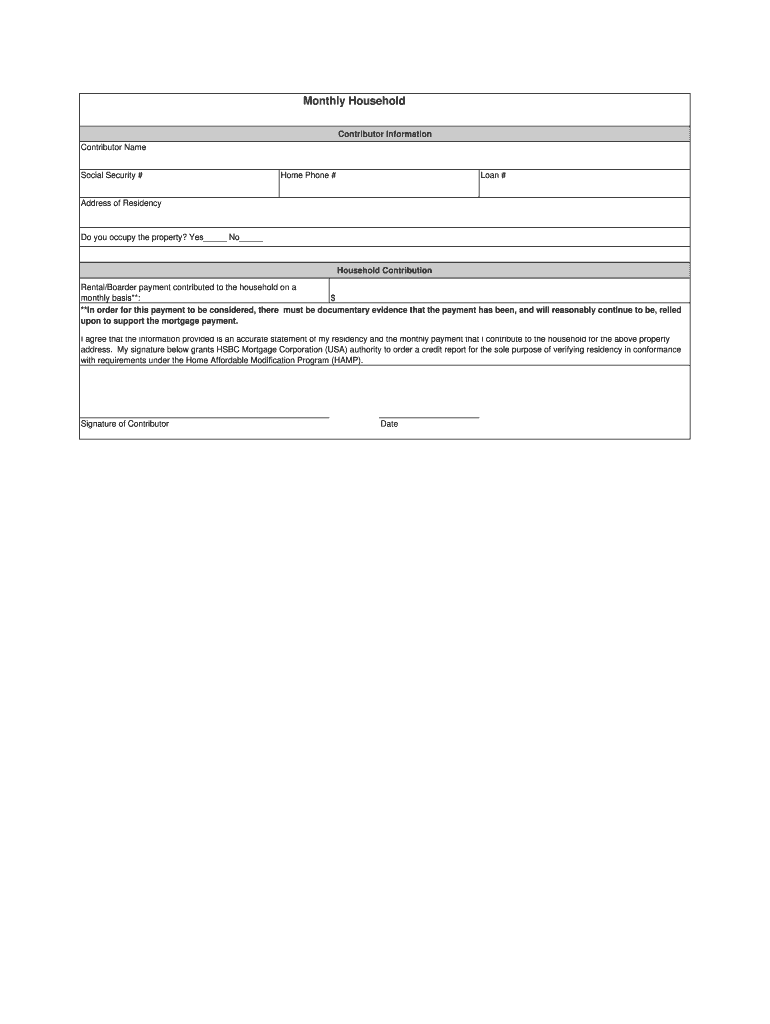

The non borrower credit authorization form is a crucial document used primarily in financial transactions where a non borrower needs to authorize a lender to access their credit information. This form is often required by lenders to evaluate the creditworthiness of a borrower when the borrower is not the sole individual applying for credit. It ensures that the lender has the necessary permissions to pull credit reports and assess financial histories, which is vital for making informed lending decisions.

Steps to Complete the Non Borrower Credit Authorization Form

Completing the non borrower credit authorization form involves several key steps to ensure accuracy and compliance. Follow these guidelines:

- Gather Required Information: Collect personal details such as full name, address, Social Security number, and date of birth.

- Provide Lender Information: Include the name and contact details of the lender requesting the authorization.

- Sign and Date: The non borrower must sign and date the form to validate the authorization.

- Submit the Form: Send the completed form to the lender as per their submission guidelines.

Legal Use of the Non Borrower Credit Authorization Form

The non borrower credit authorization form is legally binding when completed correctly. It must comply with relevant regulations, including the Fair Credit Reporting Act (FCRA), which governs the access and use of consumer credit information. By signing this form, the non borrower grants permission for their credit history to be reviewed, which can impact their credit score and financial standing. It is essential to understand the implications of signing this document, as it allows lenders to obtain sensitive financial information.

Key Elements of the Non Borrower Credit Authorization Form

Several key elements are essential for the non borrower credit authorization form to be effective:

- Identification Information: Accurate details of the non borrower, including full name and Social Security number.

- Lender Information: Clear identification of the lender or financial institution requesting the authorization.

- Authorization Statement: A clear statement that indicates the non borrower consents to the lender accessing their credit information.

- Signature and Date: The non borrower's signature and the date of signing are critical for validation.

Obtaining the Non Borrower Credit Authorization Form

The non borrower credit authorization form can typically be obtained directly from the lender or financial institution requiring it. Many lenders provide this form on their websites for easy access. Alternatively, it may be available through financial advisors or legal professionals who assist with loan applications. It is important to ensure that the correct version of the form is used, as different lenders may have specific requirements.

Examples of Using the Non Borrower Credit Authorization Form

This form is commonly utilized in various scenarios, such as:

- When a spouse is applying for a mortgage and the other spouse's credit is needed for approval.

- In situations where a business partner's credit history is required for a joint loan application.

- When a family member co-signs a loan, and their credit information is necessary for the lender's assessment.

Quick guide on how to complete non borrower credit authorization form

Complete Non Borrower Authorization Form Chase effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can easily find the right template and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Non Borrower Authorization Form Chase on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and electronically sign Non Borrower Authorization Form Chase with ease

- Obtain Non Borrower Authorization Form Chase and then click Get Form to begin.

- Use the tools provided to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Non Borrower Authorization Form Chase and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I fill out the authorization form in Wipro's synergy?

By authorisation form I assume that you mean LOA. Just download the pdf and sign it with stylus or get a printout,sign it and scan the copy.Now upload it!If I my assumption is wrong please provide little clear picture!Thank you!Allah maalik!

-

Is it safe to give all my details: name, address, credit card number and CVV, when filling in a credit card authorization form?

Safety is relative.Ecommerce is safe as long as you know what to look for. If the site doesn't feel safe, go with your gut. Here are reasons why you have to fill out all of the information requested like name, address, CVV and full card number.1. When you are purchasing goods from a merchant, that merchant needs certain information to verify you are the valid cardholder. The merchant is assuming the real risk in assuming you aren't a fraudster using a stolen card. Put yourself in the merchant's position. Would you just take a card number and expiration date from some random cardholder and hope it's not a stolen card?2. Information such as Address and ZIP and CVV/CVC (Visa/MC) or CID (Amex/Disc) are tools to verify the card is valid. They mitigate risk for the merchant. Address and ZIP in a Card Not Present (CNP) situation also allow the merchant to get the best possible processing rates for that transaction. 3. A legitimate merchant will have a secure website (if this is the scenario to which you're referring). Look for 2 things when entering your payment information on the site.Secure Connection in the URL Address denoted by HTTPS:A Privacy and Security Statement that includes their Compliance and Security Assessor:4. Credit card numbers are created by a sophisticated algorithm which is why you can't simply input the last 4 digits into a form. There are sites that will allow you to enter the lat 4 digits once you have already registered with them to verify the choice of card, but this is after they have your card on file. There are billions of debit/credit cards in the world with different expiration dates, CVV values and different 11/12 beginning digits so the chances that your card is the only one with a unique 4 digit ending are pretty slim.What is not safe 1. Filling out a paper form with this same data and mailing it to someone. Imagine if it got lost and someone got this info. Shopping spree on the internet for them. It still amazes me that my water bill allows this info to be paid in this manner. I would never fill out a form with my credit card data an mail or fax it. A big no-no. 2. Never email you credit card data to anyone. This communication can be easily intercepted and go into the wrong hands. Email is a safe mode of transmitting sensitive card data..

-

What does the authorization form in Wipro’s Synergy need to be filled out?

I don't exactly remember how the form was looking like in synergy portal. But I hope it is Authorizing Wipro to do background verification on all the details provided by candidate. It needs your name and signature with date.

Create this form in 5 minutes!

How to create an eSignature for the non borrower credit authorization form

How to generate an eSignature for the Non Borrower Credit Authorization Form online

How to make an eSignature for the Non Borrower Credit Authorization Form in Google Chrome

How to create an electronic signature for putting it on the Non Borrower Credit Authorization Form in Gmail

How to generate an eSignature for the Non Borrower Credit Authorization Form straight from your mobile device

How to generate an eSignature for the Non Borrower Credit Authorization Form on iOS

How to make an electronic signature for the Non Borrower Credit Authorization Form on Android OS

People also ask

-

What is the Non Borrower Authorization Form Chase and why is it important?

The Non Borrower Authorization Form Chase is a vital document that allows parties to authorize transactions and access information without being the primary borrower. This form is crucial for ensuring compliance with regulations and protecting the interests of all parties involved. By utilizing the Non Borrower Authorization Form Chase, you can streamline processes and enhance communication.

-

How can I obtain the Non Borrower Authorization Form Chase?

You can easily access the Non Borrower Authorization Form Chase through airSlate SignNow's platform. Simply log in or sign up to our service, and you will find templates available for download and customization. This convenience allows you to get the necessary form quickly and efficiently.

-

Is there a fee associated with using the Non Borrower Authorization Form Chase?

airSlate SignNow offers a cost-effective solution for managing documents, including the Non Borrower Authorization Form Chase. While there may be subscription fees depending on the plan you choose, the overall savings from using our platform can signNowly reduce your document management costs.

-

Can I eSign the Non Borrower Authorization Form Chase using airSlate SignNow?

Absolutely! airSlate SignNow provides an easy-to-use platform that allows you to eSign the Non Borrower Authorization Form Chase seamlessly. Our electronic signature feature ensures that your documents are signed quickly and securely, making it convenient for all parties involved.

-

What features does airSlate SignNow offer for managing the Non Borrower Authorization Form Chase?

With airSlate SignNow, you can easily create, send, and manage the Non Borrower Authorization Form Chase. Key features include customizable templates, secure eSigning, document tracking, and integration with various applications to streamline your workflow. These features enhance your efficiency and ensure compliance.

-

How does airSlate SignNow ensure the security of the Non Borrower Authorization Form Chase?

Security is a top priority for airSlate SignNow. We implement advanced encryption and authentication protocols to protect the Non Borrower Authorization Form Chase and other sensitive documents. This commitment to security ensures that your information remains confidential and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other software to manage the Non Borrower Authorization Form Chase?

Yes, airSlate SignNow offers a range of integrations with popular software and applications that can enhance your document management, including the Non Borrower Authorization Form Chase. These integrations allow for a seamless workflow, helping you to manage your documents more effectively across various platforms.

Get more for Non Borrower Authorization Form Chase

Find out other Non Borrower Authorization Form Chase

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast