Form 8821 Instructions

What is the Form 8821 Instructions

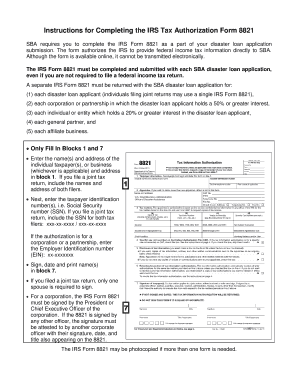

The Form 8821, also known as the Tax Information Authorization, is a document used by taxpayers to authorize another individual or organization to receive and inspect their tax information from the IRS. The instructions for Form 8821 provide detailed guidance on how to properly complete this form, ensuring that the taxpayer's intent is clear and that the designated individual can act on their behalf regarding tax matters.

Steps to complete the Form 8821 Instructions

Completing the Form 8821 involves several key steps:

- Enter the taxpayer's name and address at the top of the form.

- Provide the taxpayer's Social Security number or Employer Identification Number.

- Fill in the name and address of the individual or organization being authorized to receive tax information.

- Specify the tax matters for which the authorization applies, including the type of tax and the years or periods involved.

- Sign and date the form to validate the authorization.

It is essential to ensure that all information is accurate and that the form is signed by the taxpayer to avoid delays or issues with the IRS.

Legal use of the Form 8821 Instructions

The Form 8821 is legally binding when filled out correctly, allowing the designated individual or organization to access the taxpayer's confidential tax information. To ensure legal compliance, it is crucial that the form is signed by the taxpayer and that the authorized party is clearly identified. This form does not grant the authorized individual the ability to make decisions or file returns on behalf of the taxpayer; it strictly allows for information access.

How to obtain the Form 8821 Instructions

The instructions for Form 8821 can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. Many tax professionals also provide copies of the form along with the necessary instructions. It is advisable to use the most recent version of the form to ensure compliance with current IRS regulations.

Filing Deadlines / Important Dates

While there is no specific deadline for submitting Form 8821, it is recommended that the form be filed as soon as the taxpayer wishes to authorize someone to access their tax information. This ensures that the authorized individual can act promptly when needed, especially during tax season or when dealing with IRS inquiries. Keeping track of relevant tax deadlines is essential for maintaining compliance and avoiding penalties.

Required Documents

When completing Form 8821, the taxpayer should have the following documents ready:

- Personal identification, such as a driver's license or Social Security card.

- Tax returns for the years being authorized, if applicable.

- Any previous correspondence with the IRS that may be relevant.

Having these documents on hand can streamline the process and ensure that the form is filled out accurately.

Quick guide on how to complete form 8821 instructions

Effortlessly Prepare Form 8821 Instructions on Any Device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary format and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Form 8821 Instructions on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Modify and eSign Form 8821 Instructions with Ease

- Find Form 8821 Instructions and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Mark important sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Form 8821 Instructions and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8821 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form 8821 instructions?

The form 8821 instructions provide a detailed guide on how to fill out the IRS Form 8821, which allows taxpayers to authorize third parties to receive their confidential tax information. Understanding these instructions ensures that you correctly complete the form and avoid common pitfalls.

-

How can airSlate SignNow help with form 8821 instructions?

airSlate SignNow streamlines the process of completing and submitting Form 8821 by providing a secure platform for electronic signatures and document management. Utilizing our service ensures you follow the form 8821 instructions effectively, minimizing errors.

-

Is there a cost associated with using airSlate SignNow for form 8821?

Yes, airSlate SignNow offers various pricing plans that are designed to be cost-effective for businesses of all sizes. We believe that ease of use in following the form 8821 instructions shouldn't break the bank, so our plans are competitively priced.

-

What features does airSlate SignNow offer for managing form 8821?

Our platform includes features such as document templates, electronic signatures, and secure sharing capabilities. These features greatly assist you in adhering to the form 8821 instructions while also enhancing your overall document workflow.

-

Can I integrate airSlate SignNow with other software when following form 8821 instructions?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, including CRM systems and cloud storage services. This integration allows you to manage your documents, including Form 8821, and follow the provided instructions more efficiently.

-

How secure is airSlate SignNow when handling form 8821 documents?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption protocols to ensure that your Form 8821 and other sensitive documents are protected while you follow the form 8821 instructions.

-

What benefits does airSlate SignNow provide for using form 8821 instructions?

Using airSlate SignNow not only simplifies the process of completing Form 8821 but also enhances your workflow efficiency. With our easy-to-use tools, you can confidently follow the form 8821 instructions while reducing the time spent on document management.

Get more for Form 8821 Instructions

- Hdb contra form

- Lasik plus retreatment form

- Petition to establish paternity tennessee form

- Phoenix life change of address form

- After school meal program sponsor facility monitoring form schools utah

- Application for noise variance permit alexandriava form

- Prom permission form

- Special event application request form city of hopewell virginia hopewellva

Find out other Form 8821 Instructions

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter