Virginia Form 760py Schedule of Income

What is the Virginia Form 760py Schedule Of Income

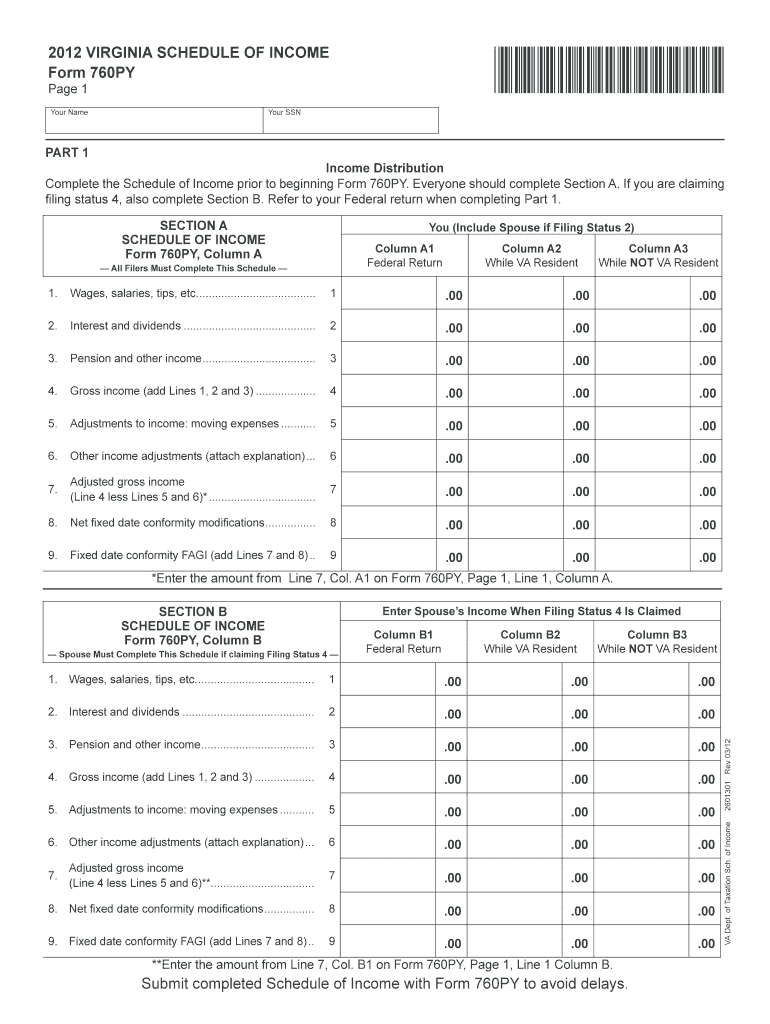

The Virginia Form 760py, also known as the Virginia Schedule of Income, is a tax form used by part-year residents of Virginia to report their income earned during the time they lived in the state. This form is essential for accurately calculating state tax obligations and ensuring compliance with Virginia tax laws. It is specifically designed for individuals who have moved into or out of Virginia during the tax year, allowing them to report only the income earned while they were residents.

How to use the Virginia Form 760py Schedule Of Income

To use the Virginia Form 760py effectively, taxpayers must first gather all relevant income documentation, including W-2s, 1099s, and any other income statements. After completing the form, individuals should ensure that they accurately report only the income earned during their residency in Virginia. This involves determining the portion of income that was earned while living in the state and applying any applicable deductions or credits. Once completed, the form must be submitted along with the main Virginia tax return, Form 760.

Steps to complete the Virginia Form 760py Schedule Of Income

Completing the Virginia Form 760py involves several key steps:

- Gather all necessary income documents, including W-2 and 1099 forms.

- Determine the period of residency in Virginia and calculate the income earned during that time.

- Fill out the form by entering the relevant income amounts, deductions, and credits.

- Review the completed form for accuracy and ensure all required information is included.

- Submit the form along with your main tax return by the designated filing deadline.

Legal use of the Virginia Form 760py Schedule Of Income

The Virginia Form 760py is legally recognized for tax reporting purposes when completed accurately and submitted on time. To ensure legal compliance, taxpayers must follow all guidelines set by the Virginia Department of Taxation. This includes reporting only the income earned during the period of residency and adhering to any specific instructions related to deductions and credits. Failure to comply with these regulations may result in penalties or additional taxes owed.

Filing Deadlines / Important Dates

Taxpayers should be aware of the important deadlines associated with the Virginia Form 760py. Typically, the filing deadline aligns with the federal tax deadline, which is usually April 15. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is crucial for taxpayers to submit their forms on time to avoid late fees and penalties.

Required Documents

To complete the Virginia Form 760py, taxpayers need to gather several key documents, including:

- W-2 forms from employers for income earned.

- 1099 forms for any additional income sources.

- Records of any deductions or credits applicable to their situation.

- Proof of residency in Virginia during the tax year.

Who Issues the Form

The Virginia Form 760py is issued by the Virginia Department of Taxation. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. Individuals can obtain the form directly from the department's website or through authorized tax preparation services.

Quick guide on how to complete virginia form 760py schedule of income

Effortlessly Complete Virginia Form 760py Schedule Of Income on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Virginia Form 760py Schedule Of Income on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Virginia Form 760py Schedule Of Income with Ease

- Obtain Virginia Form 760py Schedule Of Income and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which only takes a few seconds and holds the same legal standing as a conventional wet ink signature.

- Review the details and then select the Done button to save your modifications.

- Decide how you want to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, time-consuming form searches, or the need to print new copies due to errors. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Alter and electronically sign Virginia Form 760py Schedule Of Income and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I schedule a US visa interview of two people together after filling out a DS160 form?

Here is a link that might help answer your question >> DS-160: Frequently Asked QuestionsFor more information on this and similar matters, please call me direct: 650.424.1902Email: heller@hellerimmigration.comHeller Immigration Law Group | Silicon Valley Immigration Attorneys

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the virginia form 760py schedule of income

How to create an electronic signature for the Virginia Form 760py Schedule Of Income in the online mode

How to generate an eSignature for the Virginia Form 760py Schedule Of Income in Chrome

How to make an electronic signature for signing the Virginia Form 760py Schedule Of Income in Gmail

How to generate an eSignature for the Virginia Form 760py Schedule Of Income straight from your smart phone

How to generate an eSignature for the Virginia Form 760py Schedule Of Income on iOS

How to generate an electronic signature for the Virginia Form 760py Schedule Of Income on Android

People also ask

-

What is the form 760py, and who needs it?

The form 760py is a state tax form required by taxpayers in Virginia. It is designed for individuals who have income from multiple jurisdictions. If you are a Virginia resident or a part-year resident who earned income in another state, completing the form 760py is essential for proper tax filing.

-

How does airSlate SignNow assist with the form 760py?

airSlate SignNow streamlines the process of completing and eSigning the form 760py. Our platform provides templates and automation features that simplify the documentation process, ensuring that your form is filled out accurately and efficiently. This can save you valuable time during tax season.

-

Is there a cost to use airSlate SignNow for form 760py?

Yes, airSlate SignNow offers a range of pricing plans suitable for individuals and businesses. Each plan provides access to features that can enhance your experience with the form 760py, including document storage and customizable templates. We also offer a free trial to help you evaluate our services.

-

What features does airSlate SignNow offer for the form 760py?

Our platform offers a variety of features for the form 760py, including eSigning capabilities, document tracking, and cloud storage. You can also integrate the form with other applications for seamless workflows. These features ensure that your tax documents are handled securely and efficiently.

-

Can I integrate airSlate SignNow with other software for form 760py?

Yes, airSlate SignNow easily integrates with popular software applications, facilitating the completion and management of the form 760py. Whether you use accounting software or CRMs, our integrations simplify your tax processes. This connectivity helps ensure all your necessary documentation is readily available.

-

How secure is my information when using airSlate SignNow for the form 760py?

Security is a top priority for airSlate SignNow. We utilize advanced encryption and authentication measures to protect your personal information and the details of your form 760py. You can confidently use our platform knowing that your data is kept safe from unauthorized access.

-

Can multiple users collaborate on the form 760py within airSlate SignNow?

Absolutely! airSlate SignNow enables multiple users to collaborate on the form 760py. Whether you’re working with tax professionals or team members, our platform allows for easy sharing and collective editing. This collaborative feature ensures everyone can contribute to the final document.

Get more for Virginia Form 760py Schedule Of Income

- Georgia form 500ez printable

- Donation request form the salt lake bees proudly support charitable organizations and fundraisers through donations of tickets

- Fridge temperature record sheet pharmacy form

- Medical consultation form pdf

- Tribal exemption form az

- Da form 2063

- Eyemed reimbursement form pdf

- Established under section 91a of the constitution form

Find out other Virginia Form 760py Schedule Of Income

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself