Rhand Credit Union Loan Application Form

What is the Rhand Credit Union Loan Application Form

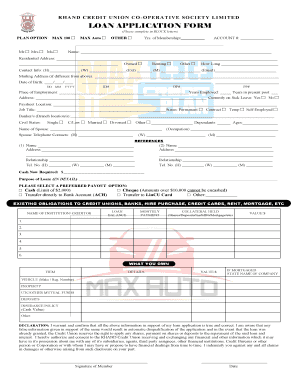

The Rhand Credit Union Loan Application Form is a crucial document used by individuals seeking to apply for a loan through Rhand Credit Union. This form collects essential information about the applicant's financial status, employment details, and the purpose of the loan. It serves as the foundation for the credit union to assess eligibility and determine loan terms. Completing this form accurately is vital for a smooth application process, as it directly influences the approval decision.

How to use the Rhand Credit Union Loan Application Form

Using the Rhand Credit Union Loan Application Form involves several straightforward steps. First, ensure you have all necessary personal and financial information readily available. This includes identification details, income sources, and any existing debts. Next, fill out the form carefully, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions before submitting it. This attention to detail can help expedite the approval process and reduce the likelihood of delays.

Steps to complete the Rhand Credit Union Loan Application Form

Completing the Rhand Credit Union Loan Application Form requires a systematic approach. Follow these steps for effective completion:

- Gather necessary documents, such as proof of income, identification, and any existing loan information.

- Begin filling out the form by entering your personal details, including your name, address, and contact information.

- Provide financial information, including your income, expenses, and any outstanding debts.

- Specify the loan amount you are requesting and the intended use of the funds.

- Review the completed form for accuracy and completeness.

- Submit the form through the preferred method, whether online, by mail, or in person.

Legal use of the Rhand Credit Union Loan Application Form

The Rhand Credit Union Loan Application Form is legally binding once submitted. It is essential that all information provided is truthful and accurate, as any discrepancies can lead to legal repercussions or denial of the loan. The form must comply with applicable federal and state laws governing lending practices, ensuring that both the lender and borrower are protected. Understanding these legal implications can help applicants navigate the process with confidence.

Eligibility Criteria

Eligibility for a loan through the Rhand Credit Union is determined by several factors outlined in the loan application form. Applicants typically need to meet specific criteria, such as:

- Being a member of Rhand Credit Union.

- Demonstrating a stable income source.

- Maintaining a good credit history.

- Providing necessary documentation to support the application.

Meeting these criteria is essential for increasing the chances of loan approval.

Form Submission Methods

The Rhand Credit Union Loan Application Form can be submitted through various methods to accommodate different preferences. Applicants can choose to:

- Submit the form online via the Rhand Credit Union website.

- Mail the completed form to the designated address.

- Deliver the form in person at a local branch.

Each submission method has its own timeline for processing, so applicants should consider their urgency when choosing how to submit the form.

Quick guide on how to complete rhand credit union loan application form

Effortlessly Prepare rhand credit union loan application form on Any Device

The management of online documents has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to swiftly create, edit, and eSign your documents without delays. Handle rhand credit union loan application form on any device with the airSlate SignNow apps for Android or iOS and enhance any document-centric operation today.

Edit and eSign rhand credit union loan application form with Ease

- Find rhand credit union loan application form and select Get Form to begin.

- Make use of the tools available to complete your document.

- Emphasize important sections of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Design your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate the hassle of lost or misfiled documents, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign rhand credit union loan application form to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to rhand credit union loan application form

Create this form in 5 minutes!

How to create an eSignature for the rhand credit union loan application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask rhand credit union loan application form

-

What is the rhand credit union loan application form?

The rhand credit union loan application form is a streamlined digital document that allows users to apply for loans quickly and easily. This form is designed to simplify the application process, making it accessible from anywhere, at any time, ensuring a seamless experience for applicants.

-

How can I access the rhand credit union loan application form?

You can access the rhand credit union loan application form directly on the airSlate SignNow platform. Simply navigate to our website, and you'll find the form ready for you to fill out and submit electronically, enhancing your application experience.

-

What are the benefits of using the rhand credit union loan application form?

Using the rhand credit union loan application form provides several benefits, including convenience and speed. Applicants can complete the form online, saving time on manual processes, while also ensuring that their information is securely transmitted and stored.

-

Is there a cost associated with the rhand credit union loan application form?

The rhand credit union loan application form is part of our services at airSlate SignNow, which offers a cost-effective solution for document management. While the basic features are accessible at no cost, premium services may involve a subscription fee that provides additional functionalities.

-

What features are included in the rhand credit union loan application form?

The rhand credit union loan application form includes user-friendly features such as electronic signatures, document sharing, and real-time tracking. These functionalities protect your application information while also allowing for a collaborative and transparent process.

-

Are there any integrations available with the rhand credit union loan application form?

Yes, the rhand credit union loan application form can be integrated with various third-party applications to enhance your document workflow. These integrations allow for data synchronization and seamless management of your loan applications alongside other business operations.

-

How secure is the information submitted through the rhand credit union loan application form?

Security is a top priority at airSlate SignNow. All information submitted through the rhand credit union loan application form is encrypted and complies with industry standards, ensuring that your personal and financial data remains protected throughout the application process.

Get more for rhand credit union loan application form

Find out other rhand credit union loan application form

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online