Ftb3519 Form

What is the Ftb3519

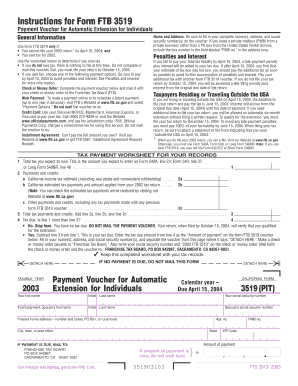

The Ftb3519 form, officially known as the California Nonresident or Part-Year Resident Income Tax Return, is a crucial document used by nonresidents and part-year residents of California to report their income earned within the state. This form is essential for ensuring compliance with California tax laws and accurately calculating the tax liability for individuals who do not reside in the state for the entire year.

How to use the Ftb3519

Using the Ftb3519 involves several steps to ensure accurate reporting of income. Taxpayers must gather all relevant income documentation, including W-2s and 1099s. The form requires detailed information about income earned in California, as well as deductions and credits applicable to nonresidents. It is important to follow the instructions carefully to complete the form correctly, as any errors may lead to delays or penalties.

Steps to complete the Ftb3519

Completing the Ftb3519 can be straightforward if you follow these steps:

- Gather all necessary documents, including income statements and any relevant tax forms.

- Fill out your personal information, including your name, address, and Social Security number.

- Report all income earned in California, ensuring to separate it from income earned outside the state.

- Calculate your deductions and credits, if applicable, to determine your taxable income.

- Review the completed form for accuracy before submission.

Legal use of the Ftb3519

The Ftb3519 must be used in accordance with California tax laws. It is legally binding when completed accurately and submitted on time. Compliance with the regulations set forth by the California Franchise Tax Board is essential to avoid potential penalties. Additionally, eSignatures can be utilized for electronic submissions, provided that all legal requirements for electronic signatures are met.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Ftb3519. Typically, the deadline for filing the form aligns with the federal tax return deadline, which is usually April 15. However, extensions may be available, and it is advisable to check the California Franchise Tax Board's website for the most current information regarding deadlines and any changes that may occur.

Form Submission Methods (Online / Mail / In-Person)

The Ftb3519 can be submitted through various methods to accommodate different preferences. Taxpayers may file online using the California Franchise Tax Board's e-filing system, which offers a secure and efficient way to submit the form. Alternatively, the form can be mailed to the appropriate address provided in the instructions, or it can be submitted in person at designated tax offices. Each method has its own processing times and requirements, so it is important to choose the one that best suits your needs.

Quick guide on how to complete ftb3519

Complete Ftb3519 effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, alter, and eSign your files swiftly without delays. Manage Ftb3519 on any device with airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The easiest way to modify and eSign Ftb3519 with ease

- Find Ftb3519 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or hide sensitive details with tools that airSlate SignNow provides specifically for that task.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements with just a few clicks from any device you prefer. Modify and eSign Ftb3519 while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftb3519

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ftb3519 and how does it relate to airSlate SignNow?

ftb3519 is a specific form related to California taxes that can be easily managed using airSlate SignNow. Our platform allows you to send, sign, and store this document securely, ensuring compliance with tax regulations. With airSlate SignNow, handling ftb3519 becomes a streamlined process for businesses.

-

How much does airSlate SignNow cost for ftb3519 document management?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those requiring ftb3519 handling. Our plans are designed to be cost-effective, allowing you to choose the features that best fit your organization’s requirements. Explore our pricing page to find the best option for managing your ftb3519.

-

What features does airSlate SignNow offer for managing ftb3519 documents?

airSlate SignNow provides a host of features that streamline the management of ftb3519 documents, including customizable templates, electronic signing, and status tracking. These features enhance efficiency by reducing the time spent on paperwork. Users can easily track their ftb3519 submissions and get reminders for deadlines through our intuitive platform.

-

Are there any integration options for using airSlate SignNow with ftb3519?

Yes, airSlate SignNow integrates seamlessly with various tools and software to enhance your workflow with ftb3519. Whether you’re using CRM systems or document management solutions, our integrations ensure that you can efficiently manage your documents without switching platforms. This makes it easier to handle your ftb3519 submissions along with other critical processes.

-

What benefits does airSlate SignNow provide for businesses handling ftb3519?

The primary benefit of using airSlate SignNow for ftb3519 management is the increased efficiency in document processing. It simplifies sending and signing the form, helping you meet compliance efficiently. Additionally, our user-friendly platform ensures that you spend less time on administrative tasks while maintaining accuracy in your ftb3519 submissions.

-

Is airSlate SignNow secure for sending ftb3519 and other sensitive documents?

Absolutely. airSlate SignNow prioritizes security, making it a safe choice for sending ftb3519 and other sensitive documents. We implement top-tier encryption standards and compliance measures to protect your data. You can trust that your information is safe with airSlate SignNow while managing your ftb3519.

-

Can I customize my ftb3519 forms using airSlate SignNow?

Yes, you can easily customize your ftb3519 forms within airSlate SignNow to fit your business needs. Our platform allows you to add your branding, adjust fields, and create workflows that streamline your document management. This flexibility ensures that your ftb3519 forms align with your organization's standards and processes.

Get more for Ftb3519

- Drill and ceremonies for dummies detachment 855 air force rotc form

- Filing proof of claim kansas bankruptcy court form

- Child care form unlicensed cuny home cuny

- Hermes claim form

- Chief complaint form 297068555

- Louisiana healthcare connection form

- Fillable online form np city of henderson po box 671

- Mil 015 declaration in support of petition for relief from financial courts ca form

Find out other Ftb3519

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form